The National Debt Of Czech Republic

When economists talk about the national debt of a country, they really mean the government debt. The debts of individuals and companies are not counted in the calculation of national debt.

There are a number of different standards that dictate what figures to include and which items to exclude when calculating the national debt.

The Czech Republic is a member of the EU and so it has to follow the standards specified in the Maastricht Treaty when calculating its national debt even though it is not a member of the Eurozone.

EU membership also means that Czech economic statistics are tracked by Eurostat.

Who Manages Czech National Debt?

The Czech government’s Ministry of Finance is responsible for setting the national budget every year, which is where the national budget originates.

The government needs to get approval from the national parliament for its budget every year because the representatives of the people have the ultimate responsibility for the debts accumulated by the government.

A department of the Ministry of Finance called the Debt and Financial Management Section (Department 20) is specifically tasked with managing the national debt.

Department 20 doesn’t implement debt raising itself. That job is contracted out to the Czech National Bank.

Other Facts About Czech National Debt

What facts should you know about Czech Republic’s national debt?

- You could wrap $1 bills around the Earth 404 times with the debt amount.

- If you lay $1 bills on top of each other they would make a pile 11,344 km, or 7,049 miles high.

- That's equivalent to 0.03 trips to the Moon.

What Is Czechia’s Debt-To-GDP Ratio?

The IMF doesn’t include these obligations. The OECD does include obligations to EU institutions and also all other loan guarantees given by the government of the Czech Republic to other institutions within the country.

Different rule sets result in different debt to GDP figures for the Czech Republic. At the end of 2017 these were:

- IMF: 34.7%

- Eurostat: 34.6%

- OECD: 44%

There are other factors apart from debt category inclusion that create the differences between these evaluations.

What Does Czech Republic’s Dept-To-GDP Show?

When economists consider the national debt of a country, they are more interested in the debt in relation to the country’s national income, which is called Gross Domestic Product (GDP), rather than the absolute amount.

This metric is called the debt to GDP ratio and it is expressed as a percentage.

When looking at the debt to GDP ratio of the Czech Republic for a particular year, you may well encounter several different figures. This is because the international bodies that report on national debt all follow different rules.

Eurostat includes the obligations of the Czech Republic to EU institutions, such as the country’s guarantees to the European Financial Stability Fund.

National Debt Valuation Of Czechia

A variable to look out for when examining the national debt of the Czech Republic is the valuation method used in the calculation. The value of government bonds changes once they are traded.

Those bonds have a face value that specifies how much the government received in exchange for the bond.

However, traders will pay more for those instruments if they offer a high rate of interest. Index-linked government securities will increase in value over their lifetimes.

Ways To Count Czechia’s National Debt

So, there are three different ways to count the debt represented by those bonds:

- Face Value: In the case of fixed-value bonds, the face value and the nominal value are the same. However, index-linked securities increase in value over time and so their redemption cost is higher than the face value.

- Nominal Value: Eurostat and the government of the Czech Republic use nominal values when counting the bonds issued by the country for the purpose of calculating national debt.

- Market Value: The IMF and the OECD use market values of bonds in their national debt calculations.

The nominal value is higher than the face value. Market values are usually higher than nominal values.

What Is Czechia’s National Debt?

The general government debt that is reported as the national debt counts up the values of all the loans and outstanding debt instruments issued by all levels of government in the Czech Republic.

This is also known as “gross debt.” The IMF also publishes “net debt” figures for each of the countries that it monitors.

To calculate net debt, the IMF adds up the value of all of the financial assets that the Czech government holds and deducts that figure from the gross debt of the country.

In the case of the Czech Republic, the IMF calculated a gross debt to GDP ratio of 34.7% and a net debt to GDP ratio of 22.9%.

What Are The Czech Government’s Financial Assets Worth?

That means that the IMF judged the financial assets of the Czech government to be worth the equivalent of 11.8% of the country’s GDP.

That means that the Czech government could pay off about a third of the country’s national debt if it sold off all of its financial assets.

The assets included in this calculation are only shareholdings, currency holdings, and other liquid assets. Physical assets, such as government buildings, art collections, and military equipment are not included.

Is The Czech Republic’s National Debt Growing?

The Czech Republic joined the EU in 2004. Maastricht Treaty stipulations require that all EU members get their national debts down below 60% of GDP.

The governments of EU nations are also required to keep their annual budget deficits at no more than 3% of GDP.

The government of the Czech Republic had no need to alter its working practices in order to comply with the EU’s debt rules. The Czech debt to GDP ratio hit its lowest point of 11.6% in 1996.

Czechia’s Current & Historical Nation Debt Standing

The national debt had risen steadily since that date, but by the end of 2003, it was still only 28.3%, which is well below the EU membership national debt limit.

The country managed to keep its debt to GDP ratio between 27 and 29%.

The global financial crisis of 2008 didn’t have as extreme an effect on the economy of the Czech Republic as it did on many other EU members.

What Is Czechia’s Government Debt Deficit?

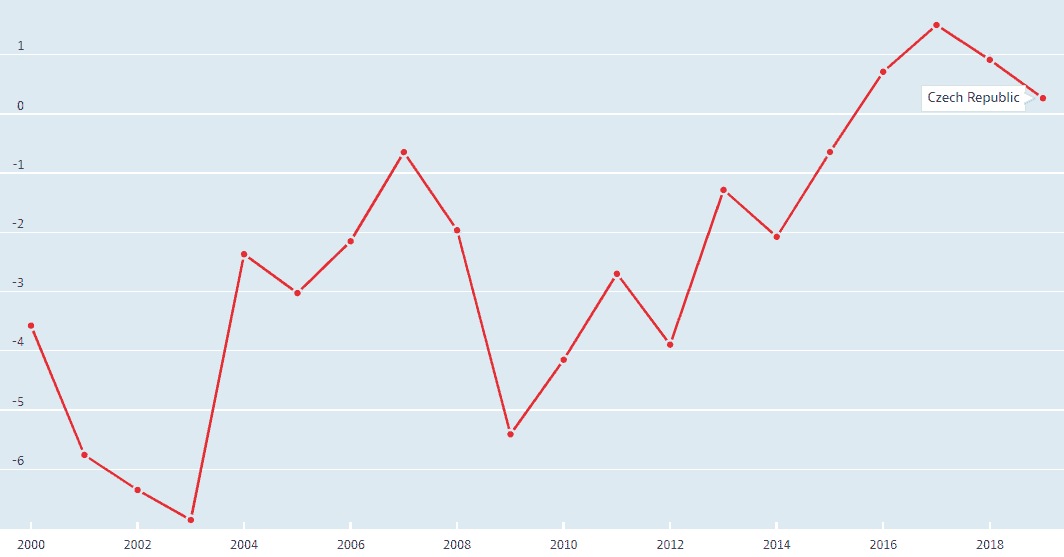

Nevertheless, the government still needed to provide liquidity to the economy and it ran a high-budget deficit for 2009, breaking the Maastricht requirements.

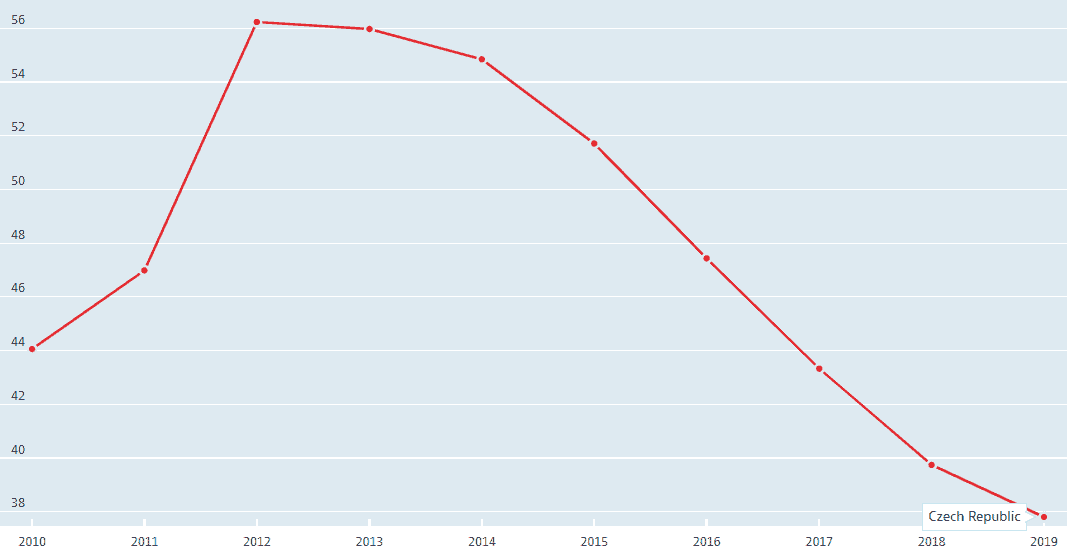

The Czech Republic’s debt to GDP ratio continued to grow until 2013, when it peaked at 44.9%. Since that date, the national debt has declined down to 34.6% by Eurostat measurements.

The government managed to bring its budget deficit above 3% of GDP in 2013 and continued to improve its saving. The Czech government posted budget surpluses for 2016 and 2017.

What Is Czechia’s Credit Rating?

The government of the Czech Republic’s debt management skills has earned it a good credit rating.

All of the major credit rating agencies give the country A-grade ratings both for foreign and domestic currency securities.

Agency Local Currency Long-term Issuer Rating Outlook Foreign Currency Long-term Issuer Rating Outlook Rated/confirmed

Moody’s A1 Positive A1 Positive 20.4.2018

Standard & Poor’s AA Stable AA- Stable 20.7.2018

Fitch Ratings A+ Positive A+ Positive 8.2.2018

JCR AA- Positive A+ Positive 27.9.2016

R&I AA- Stable A+ Stable 2.7.2017

Scope Ratings AA Stable AA Stable 26.1.2018

Dagong Global Credit Rating A+ Stable A+ Stable 8.2.2017

The country doesn’t have the very best credit rating, however, it is in the top division.

France and the United Kingdom are only one rung higher than the Czech Republic in the Standard & Poor’s league table.

How Does The Czech National Bank Raise Loans?

The Czech National Bank runs the primary market for Czech government securities and it also oversees the secondary market for those instruments, which is called MTS Czech Republic.

Government securities are sold only to primary dealers by auction. The primary dealers are pre-approved agencies that are expected to sell on their allocations by placing them on the secondary market.

What Securities Does The Czech Government Sell?

The Ministry of Finance, through the Czech National Bank sells Treasury bills to feed short-term financing needs and bonds to cover long-term finance.

The Treasury bills do not pay interest, but are sold at a discount and redeemed at face value. The government issues bills in maturities of 3, 6, 9, and 12 months.

The Czech government doesn’t issue index-linked bonds, which makes accounting a lot simpler because that makes the nominal and face values the same.

All bonds have either a fixed rate of interest or a floating rate. Floating-rate bonds represent 12% of all outstanding debt stock.

Interested in Trading Commodities?

Start your research with reviews of these regulated brokers available in .

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74%-89% of retail investor accounts lose money when trading CFDs. You should consider whether you can afford to take the high risk of losing your money.

Further Reading

Our team have put together live debt clocks for many other countries, including other European nations like Hungary, Austria, France, Switzerland, and Germany.

You can learn about the overall trade and economic health of these countries in our economic guides, along with which instruments you can trade the most imported and exported commodities with.

See our guides on CFDs, options, forex, cryptocurrencies, stocks, and bullion dealers.