In this economic guide to Sweden we’ll give you an overview of the Swedish economy, including the country’s primary imports and exports of goods and services, as well as their primary destinations.

Contents

Economy of Sweden – Overview

Sweden is currently ranked the 32nd largest export economy in the world and its annual export total of $162 billion (less total imports of $160 billion) means that it has a positive trade balance of $2.37 billion.

Sweden’s annual exports have fallen $3 billion over the last five years from $165 billion to $162 billion.

Sweden’s GDP

GDP for Sweden is $556 billion, which equates to a GDP per capita of $54,608.

The country is ranked 22nd in the world by GDP and it has enjoyed an annual growth rate of over 7.9% in the last 10 years.

Sweden’s Top 5 Commodity Exports

- Refined Petroleum – $10.0 billion

- Sawn Wood – $3.4 billion

- Iron Ore – $2.4 billion

- Flat-Rolled Steel – $1.2 billion

- Refined Copper – $0.8 billion

Sweden’s Other Notable Exports

- Cars – $11.9 billion

- Packaged Medicaments – $6.9 billion

- Vehicle Parts – $5.6 billion

- Broadcasting Equipment – $3.7 billion

- Non-fillet Fresh Fish – $3.3 billion

Top export destinations of Sweden are Germany ($17.4 billion), Norway ($15.2 billion), Denmark ($11.2 billion), the United States ($11.1 billion), and the Netherlands ($9.4 billion).

Sweden’s Top 5 Commodity Imports

- Crude Petroleum – $8.7 billion

- Refined Petroleum – $6.9 billion

- Coated Flat-Rolled Iron – $877.5 million

- Petroleum Gas – $844.7 million

- Other Iron Products – $789.0 million

Sweden’s Other Notable Imports

- Cars – $8.8 billion

- Vehicle Parts – $6.4 billion

- Broadcasting Equipment – $5.2 billion

- Computers – $3.6 billion

- Packaged Medicaments – $2.5 billion

Sweden’s largest import partners are its EU neighbors Germany ($30 billion), Netherlands ($13.8 billion), Denmark ($11.2 billion), Norway ($9.8 billion).

Details About Sweden’s Imports/Exports

Here we provide more analysis of Sweden’s trading products.

Refined Petroleum

Sweden has a 1.3% share of a global export market that is worth $753 billion annually. Key destinations for the country’s refined petroleum exports are the Netherlands ($2 billion), the United Kingdom ($1.5 billion), Finland ($1.27), Norway ($1.19 billion), and Germany ($760 million).

Refined petroleum accounts for 6.17% of Sweden’s total annual exports.

Flat-Rolled Steel

Exports of large flat-rolled steel represent 0.76% of Sweden’s total annual exports and the country is ranked 9th in the world for exports of this product. This represents a 3.6% share of a market worth $34.4 billion per year.

China is a significant destination, accounting for 24.2% of all Sweden’s flat-rolled stainless steel exports.

Iron Ore

Sweden is the 6th largest exporter of iron ore and has a 2.5% share of an annual global market that is worth $95.1 billion.

Iron ore exports worldwide grew 2.34% over the last reported year, from $93 billion to $95.1 billion fallen. The largest growing importer of iron ore from Sweden was Finland which grew 21% to $3.2 million.

Refined Copper

The annual refined copper export market is worth $67 billion and Sweden has a 1.15% market share.

Germany imports 56% of Sweden’s refined copper exports and its total output is exported exclusively to European destinations.

Interesting Facts About Sweden

- Despite being a major weapons producer, Sweden has not participated in any war for nearly 200 hundred years.

- Swedes are one of the most highly taxed populations in the world with a total tax rate of 51.4%.

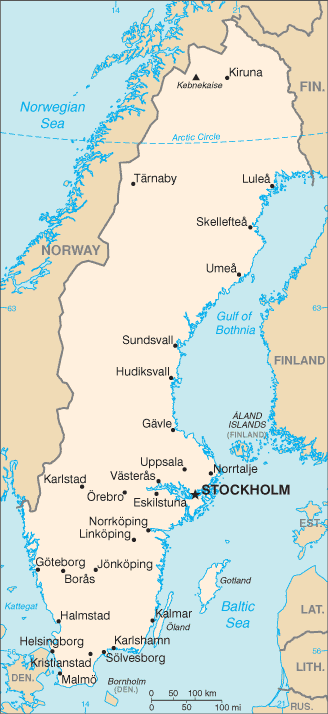

- Sweden is the third-largest country in the European Union but it has the second-lowest population density.

- The country has one of the highest life expectancies in the world, 74 for men and 80 for women.

All figures based on OEC/IMF 2018 calculations and projections unless otherwise stated.

Regulated Brokers: Where Can I Trade Commodities?

Start your research with reviews of these regulated brokers available in .

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74%-89% of retail investor accounts lose money when trading CFDs. You should consider whether you can afford to take the high risk of losing your money.

Further Reading

- Commodity.com Guide to Commodity Brokers

- Commodity.com Guide to CFD Brokers

- Guide to Trading Energy Commodities

- Guide to Trading Lumber