FXCM Online Broker Review: Can This Early Innovator Continue to Impress?

Risk Warning: Your Capital is at Risk.

Contents

Overview

FXCM was one of the first brokerage firms to offer online forex trading to retail traders.

The two kinds of trading available at FXCM are contracts-for-difference (CFDs) and spreadbetting*. Products include forex, shares, indices, commodities, cryptocurrencies, and baskets.

The broker offers a variety of platforms to trade on, including MetaTrader 4, NinjaTrader, ZuluTrade, and the Trading Station Mobile App for iOS and Android users. FXCM provides customer support via live chat, phone, and e-mail, with free international dials.

This FXCM review gives an overview of the broker as a company, the FXCM platform, and the trading products offered to traders. Read on to find out find out if FXCM is available in .

*Spreadbetting is only available to UK and Ireland residents.

For a limited time, FXCM is offering deposit bonuses. Here are the required deposit amounts with the corresponding rewards:

| Deposit | Bonus |

| $50 -$999 | $25 |

| $1000 – $2499 | $100 |

| $2500 – $4999 | $200 |

| $5000+ | $300 |

Quick Compare

| What's Good About FXCM? | What Could FXCM Do Better? |

|---|---|

Key FXCM Takeaways

|

|

|---|---|

| Overview | One of the first online forex and CFD brokers |

| Founded | 1999 |

| Markets | CFDs, Spreadbetting (see all products) |

| Products | Forex, Shares, Indices, Commodities, Cryptocurrencies, Baskets |

| Countries Served | UK, Australia, France, India, Israel and many others |

| Minimum Deposit & Fees | $50 for retail and non-EU traders - (see all funding limits and fees) |

| Regulator(s) | UK Financial Conduct Authority (FCA), Australian Securities and Investment Commission (ASIC), Financial Sector Conduct Authority (FSCA) - (see all regulatory information here) |

| Customer Support | 24-hour support via phone, SMS, live chat, & email |

| Demo Account | Yes, with £50,000 demo credits for UK and EU traders |

Where Does FXCM Operate?

FXCM accepts traders from the UK, Australia, France, India, Israel and many other countries.

IMPORTANT: CFDs are not available in the USA due to local regulation, and regulated brokers do not accept US citizens or US residents as clients.

FXCM does not provide services to citizens to certain countries.

See all countries restricted from FXCM.

- Afghanistan

- Belarus

- Burundi

- Central African Republic

- Cuba

- Iran

- Ivory Coast

- Liberia

- Libya

- North Korea

- Russian Federation

- Singapore

- South Korea

- Sudan

- Syria

- Turkey

- Ukraine

- Vanuatu

- Zaire

- Zimbabwe

Website Languages

The FXCM website is available in 14 languages.

See all FXCM website languages

- Arabic

- Bahasa (Indonesia)

- Chinese

- English

- French

- German

- Greek

- Hebrew

- Italian

- Malay

- Phillipino

- Portuguese

- Spanish

- Tieng Viet (Vietnamese)

Subsidiary Branches and Offices of FXCM

FXCM provides brokerage services to customers through its partners and affiliates. The firm operates in the following three major international financial centers:

- London, UK: Forex Capital Markets Limited (“FXCM LTD”)

- Sydney, Australia: FXCM Australia PTY Limited (“FXCM Australia”)

- Paris, France: Forex Capital Markets Limited (“FXCM France”)

- Hong Kong: FXCM Bullion Limited (“FXCM Hong Kong”)

FXCM also provides brokerage services to other established and developing economic regions. The firm requires the following local partners in these regions to adhere to all local regulations:

- India: FXCM Markets

- South Africa: FXCM South Africa (PTY) LTD

Can I Trust FXCM?

As an international broker, FXCM is regulated by agencies in several jurisdictions.

The firm’s registration with the UK’s Financial Conduct Authority (FCA) allows it to do business in other EU member states including France, Germany, Greece, and Italy.

Here is the full list of regulatory bodies overseeing FXCM operations:

- Financial Conduct Authority (FCA) – Registration No. 217689

- Australian Securities and Investments Commission (ASIC) – Registration No. 309763

- South Africa’s Financial Sector Conduct Authority (FSCA) – Registration No. 46534

- Germany’s Federal Financial Supervisory Authority (BaFin)

- France’s Autorité de Contrôle Prudentiel (ACP)

- Italy’s Commissione Nazionale per le Società e la Borsa (CONSOB)

All of FXCM’s subsidiaries are regulated by local authorities in the regions where the firm operates. For instance, the ASIC regulates the firm’s Australian operations, while the FSCA oversees the firm in South Africa.

Background

Here is a brief overview of FXCM’s background and timeline:

- 1999 – Founded in New York and pioneered online FX trading for retail customers

- 2003 – FXCM expanded overseas, opened an office in London, and became regulated by the FCA

- 2007 – FXCM created a No Dealing Desk model. The firm executed its customer orders with independent market makers

- 2015 – Leucadia Investments becomes a majority owner of FXCM

- 2017 – FXCM decommissioned by the NFA and the CFTC

- 2018 – Re-launch of FXCM Pro website

- 2020 – FXCM launches commission-free equity trading

Previous Regulatory Issues with the NFA and CTFC

On February 6, 2017, the National Futures Association (NFA), a US regulatory agency, banned FXCM from membership citing “numerous deceptive and abusive execution activities that were designed to benefit FXCM, to the detriment of its customers.”

In summary, the NFA accused FXCM of sending its customers’ orders to an FXCM-owned subsidiary called Effex for execution. Effex, in turn, sent rebates for this order flow back to FXCM, and FXCM allegedly concealed these payments from NFA.

In addition, NFA alleges that Effex defrauded customers by executing their orders in a way that benefited FXCM egregiously at their expense.

On February 6, 2017, FXCM agreed to pay a $7 million penalty to settle a suit by the Commodity Futures Trading Commission (CFTC), another US regulatory agency. FXCM subsequently withdrew its registration with the CFTC as part of this agreement, which left it unable to operate in the US.

On November 10, 2017, Global Brokerage Inc., a publicly-traded company on the US NASDAQ exchange, announced a reorganization bankruptcy plan under Chapter 11. Global Brokerage Inc., through a subsidiary, owns a majority stake in FXCM.

Both Global Brokerage Inc. and FXCM assert that FXCM customers and their assets will not be affected by the reorganization.

Outcome: FXCM settled the case without admitting nor denying allegations. The company now serves traders from over 170 countries worldwide.

FXCM Products and Leverages

FXCM offers CFDs and spreadbetting in some countries.

There are five main products to trade as contracts for difference (“CFDs”). With CFDs, the traders buy and sell assets without actually holding or owning the instrument.

IMPORTANT: CFDs are not available in the USA due to local regulation, and regulated brokers do not accept US citizens or US residents as clients.

Here is an up-to-date list of leverages by FXCM:

- 30:1 for major currency pairs

- 10:1 for commodities (except gold and non-major equity indices)

- 20:1 for non-major currency pairs, gold and major indices

- 2:1 for cryptocurrencies

Forex Pairs

The FXCM platform offers trading in 39 different currency pairs.

FXCM also allows traders in the UK and Ireland tax-free, leveraged spread bets on the currency pairs.

See all Forex pairs

| AUD/CAD | EUR/CHF | GBP/CHF | USD/CHF |

| AUD/CHF | EUR/GBP | GBP/JPY | USD/CNH |

| AUD/JPY | EUR/JPY | GBP/NZD | USD/ILS* |

| AUD/NZD | EUR/NOK | GBP/USD | USD/JPY |

| AUD/USD | EUR/NZD | NZD/CAD | USD/MXN |

| CAD/CHF | EUR/SEK | NZD/CHF | USD/NOK |

| CAD/JPY | EUR/TRY | NZD/JPY | USD/SEK |

| CHF/JPY | EUR/USD | NZD/USD | USD/TRY |

| EUR/AUD | GBP/AUD | TRY/JPY | USD/ZAR |

| EUR/CAD | GBP/CAD | USD/CAD | ZAR/JPY |

Indices

Indices are indicators of how markets are performing by following the performance of a particular group of companies. With FXCM, traders can choose from 13 popular indices CFDs to trade:

| SYMBOL | INDEX | Currency | AVERAGE SPREAD (2020) |

|---|---|---|---|

| AUS200 | ASX SPI 200 Future | AU$ | 2.02 |

| CHN50 | SGX FTSE China A50 Future | US$ | 10.9 |

| ESP35 | IBEX35 Index Future | € | 7.66 |

| EUSTX50 | Euro Stoxx 50 Future | € | 1.14 |

| FRA40 | CAC40 Index Future | € | 1.31 |

| GER30 | DAX Index Future | € | 2.68 |

| HKG33 | Hang Seng Future | HK$ | 11.58 |

| INDIA50 | SGX NIFTY 50 Future | US$ | N/A |

| JPN225 | Nikkei 225 Dollar Future | ¥ | 9.32 |

| NAS100 | E-Mini Nasdaq 100 Future | US$ | 1.38 |

| SPX500 | E-Mini S&P 500 Future | US$ | 0.6 |

| UK100 | FTSE 100 Index Future | £ | 1.05 |

| US2000 | E-Mini Russell 2000 Future | US$ | 0.38 |

| US30 | E-Mini Dow Future | US$ | 3.09 |

Important: Spreads are variable and are subject to delay. Any spread figures shown are for informational purposes only.

Commodities

FXCM offers 11 commodity futures CFDs that traders can speculate on. These are:

- Natural Gas Future

- Brent Crude Future

- Brent Crude Future SPOT

- WTI Light Sweet Crude Oil Future

- WTI Light Sweet Crude Oil Future SPOT

- Copper Future

- Spot Silver

- Spot Gold

- Corn Future

- Soy Future

- Wheat Future

Cryptocurrencies

The major cryptocurrency markets are covered by FXCM, namely, Bitcoin, Ethereum, Litecoin, and Ripple. Here is the full list of eight cryptocurrency CFD products:

- BTC/USD

- ETH/USD

- LTC/USD

- XRP/USD

- BCH/USD

- EOS/USD

- XLM/USD

- CryptoMajor (a basket of Bitcoin, Ethereum, Litecoin, Ripple, and Bitcoin Cash — like an index)

Please Note: Availability subject to regulations. Cryptocurrency CFDs are not available to UK retail traders.

Other Baskets

FXCM baskets are like indices — a basket indicates the performance of a group of products on the market on which traders can bet on.

Alongside the CryptoMajor basket, there are two other types of baskets that allow traders to speculate on collective products’ performance in the market.

Forex Baskets

Forex baskets track the performance of a chosen major currency against a grouping of other world currencies, thus creating an index to speculate on.

- USDOLLAR (The Dow Jones FXCM Dollar Index Basket)

- Value of the USD against AUD, JPY, EUR, and GBP

- JPYBasket (Yen Index)

- Value of JPY against AUD, GBP, USD, EUR, and CAD

- EMBasket (Emerging Markets Index)

- Value of UD against minor world currencies

Stocks Baskets

Shares baskets are not very different from indices, except they are smaller groupings of companies’ stocks. As opposed to indices like the FTSE 100, FXCM offers shares baskets of only five or six companies.

FXCM offers the following stocks baskets:

- FAANG — Facebook Inc, Amazon.com Inc, Apple Inc, Netflix Inc, Alphabet Inc. Class C (Google)

- BIOTECH — AbbVie Inc, Amgen Inc, Gilead Sciences, Bristol-Myers Squibb Co, Vertex Pharmaceuticals Incorporated

- CANNABIS — Tilray Inc, GW Pharmaceuticals PLC, Canopy Growth Corp, Aurora Cannabis Inc, Cronos Group Inc, Innovative Industrial Properties Inc

- ESPORTS — Adv Micro Devices, Nvidia, Electronic Arts, Activision, Sony

- CHINA TECH — Baidu, NetEase, Weibo, iQIYI, Bilibili

- CHINA E-COMMERCE — Alibaba, Trip.com, JD.com Inc, Pinduoduo Inc, Tencent Music Entertainment Group

What About Spreads?

FXCM doesn’t offer fixed spreads, so traders need to visit FXCM.com to get up-to-date information on the current average spreads.

FXCM Account Types and Verification

For traders in , FXCM offers three different account options for traders – retail, active trader, and professional. All three account types are covered by FXCM’s 24/5 support and trading resources.

The retail account is standard, to which this review is primarily suited. The main differences between the active trader and professional accounts are outlined below.

Active Trader Account

Active trader account holders benefit from:

- Tighter spreads, resulting in cheaper trading

- A dedicated support team for active traders

- Eligibility to apply for eFXplus, an FXCM research tool

- ‘Market depth’ feature unlocked on the web trading platform

- 2% of deposited funds to spend in the FXCM app store

- Free access to FXCM APIs

Professional Account

The benefits of the professional trader account are not clarified on the FXCM website, although traders can expect better spreads and a less cluttered platform without warnings and support toggles.

Professional account holders do not have negative balance protection, leverage limits, and risk warnings.

In order to qualify for a professional account, traders must have:

- A portfolio exceeding €500,000 (or equivalent)

- Sufficient trading experience and activity in the past year

- At least one year of professional experience in the financial sector

FXCM also offers an API product under ‘FXCM Pro’ aimed at institutional clients wanting to exercise wholesale trading execution.

Demo Account

For UK and EU traders only, the FXCM demo account functions like the live trading platform, except that traders are given £50,000 practice credits to test out the functionalities of the platform.

No verification is necessary to try out the demo platform. Traders can upgrade to a live version directly from the demo platform’s dashboard.

Margin Requirements

The FXCM margin requirements for each type of account vary as market conditions, volatility, and currency rates fluctuate. Margin amounts are calculated as a percentage of the notional value of a currency pair and get adjusted as the price fluctuates.

Traders who use excessive leverage may be at risk of a margin call and having their positions closed prematurely by FXCM.

FXCM provides real-time information on usable margin and used margin so customers can track their FXCM margin requirements and adjust their trading accordingly.

The broker states that ‘all new accounts are defaulted to 400:1 leverage on FX and 200:1 leverage on CFDs.’

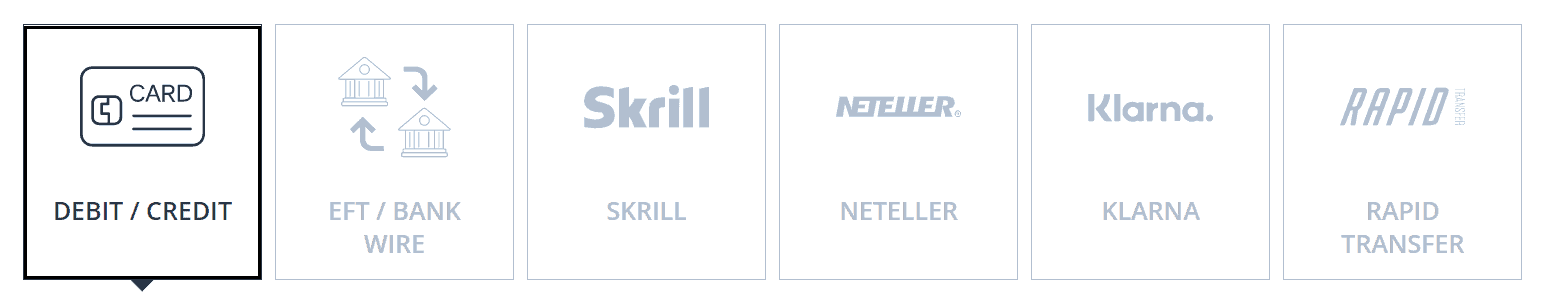

Deposits and Withdrawals

Traders can deposit and withdraw funds for no fee charged by FXCM. The only fees traders may incur are those by the payment providers.

The available deposit and withdrawal methods are:

- Credit/Debit card

- Wire Transfer

- E-Wallets:

- BPay

- Skrill

- Union Pay

- Neteller

- POLi

Processing times vary based on which method traders use. E-wallets and credit card transactions may take up to 24 hours, while wire transfers can take 3-to-5 working days.

FXCM only accepts funds from payment cards under the account holder’s name.

FXCM.com has a very clear step-by-step breakdown of each deposit method with screenshots to which traders can refer to when making their first deposits.

Fees and Spreads

FXCM has different fee structures depending on the account type. Retail account holders don’t pay commissions on most trades, while active trader accounts and professional accounts do.

FXCM primarily makes money through spreads. Since spreads are not fixed, they can be calculated for each instrument and trade using the following formula:

Spread x Pip Cost x Number of Contracts = Total Transaction Cost

FXCM may charge traders for instances of inactivity. See the table below for general fee details.

| Fees | Amount |

|---|---|

| Deposit Fee | $0 |

| Withdrawal Fee | $0 except for wire withdrawals which are $25 (for destinations inside the US/UK) or $40 (for destinations outside the US/UK) |

| Inactivity Fee | $50/year (after one year of inactivity) or JPY 5,000 for JPY denominated accounts |

| Spreads Formula | Spread x Pip Cost x Number of Contracts = Total Transaction Cost |

| Currency Conversion |

|

| Negative Balance Fee | 1.75% above the overnight fee, compounded and charged monthly |

| CFD Overnight/Rollover | If FXCM's liquidity providers charge a rollover fee, that fee will be passed on to the trader. |

| Rolling Spot Forex Commissions | Commission per 100k trade per side (open + closed) for accounts with base currency of:

|

FXCM Platform Review

The FXCM Trading Station platform is designed to appeal to many types of traders. Traders can access the platform via desktop, web, and mobile.

Following a simple sign-up using their personal details and a handful of questions, traders have full access to the platform.

Top Bar and Menu

Once logged in, the statistics bar at the top of the page shows the trading account number, account balance, account equity, profit/loss standing, gross profit/loss standing (excluding trading fees), and the used/remaining usable margins (also shown as a percentage.)

More, the top bar shows which trading server traders are connected to, as well as a customizable layout setting.

The main menu is located on the left of the screen as a sidebar where traders can access the:

- Main trading window actions

- Subscription list

- Widgets

- Platform settings

- Trading reports

- Language settings (choice of 10 languages)

- Research and educational resources

- Market data

Some of these options open in a new tab and are not built-in functionalities.

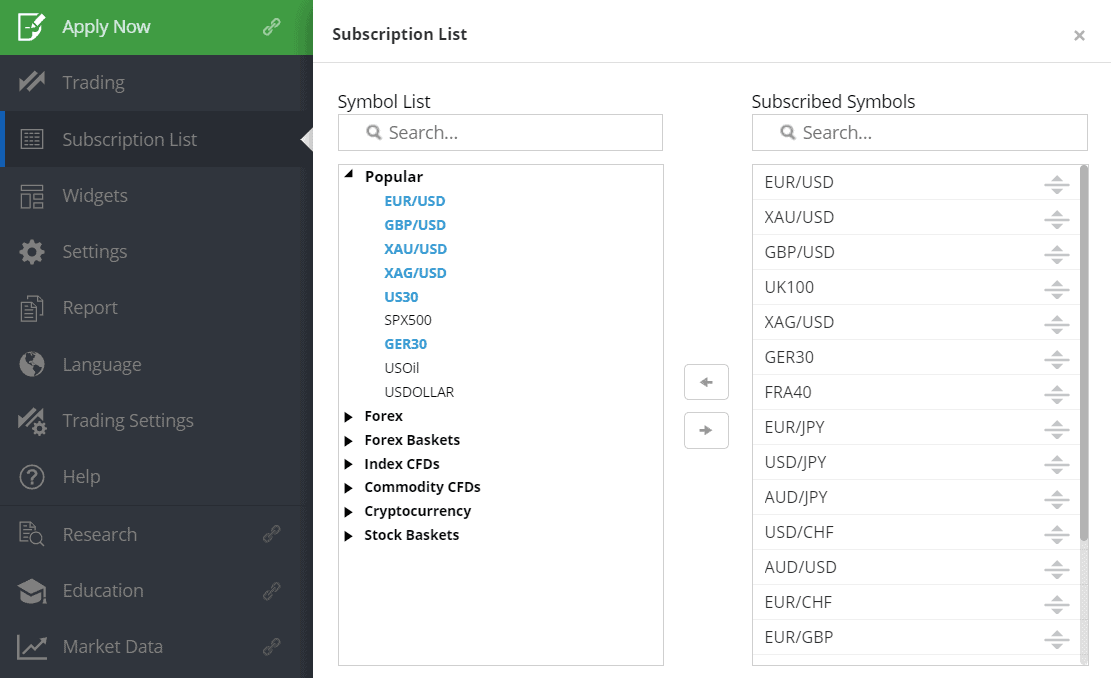

Asset Browsing

Traders can browse products through the ‘Subscription List’ tab that opens on the left of the main trading screen, where product categories are split into:

- Popular

- Forex

- Forex Baskets

- Index CFDs

- Commodity CFDs

- Cryptocurrencies

- Stock Baskets

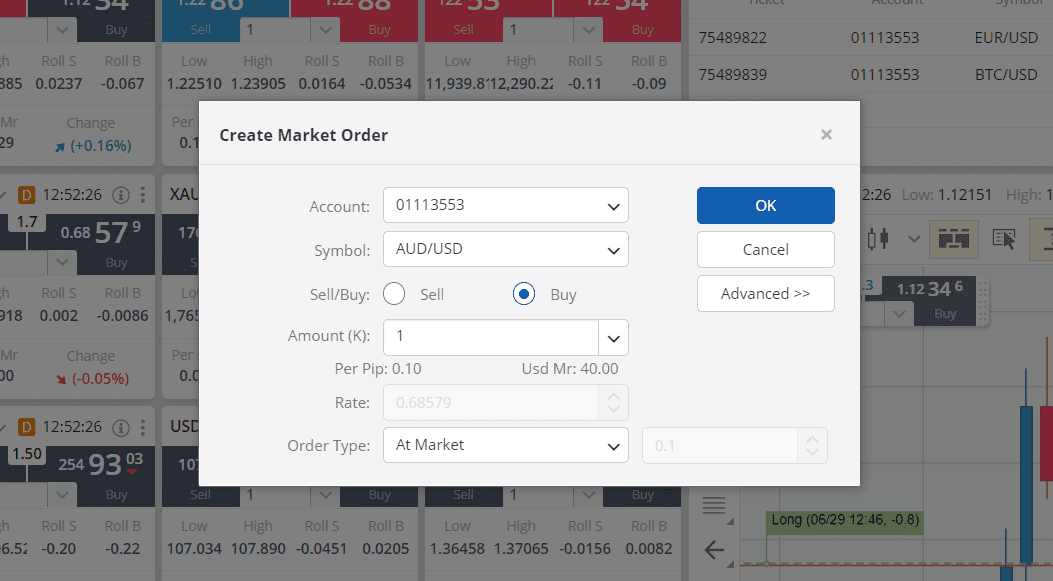

Executing Trades

The trading window requires all traders to select and confirm as to which account to trade with (multiple accounts can belong to one trader), the asset being traded, the amount, and the order type (at market rate, or within market range).

Even though products can be added to the trading dashboard to execute quick trades, it doesn’t matter which ‘buy’ or ‘sell’ button traders click, since all products and choices lead to the same market order window.

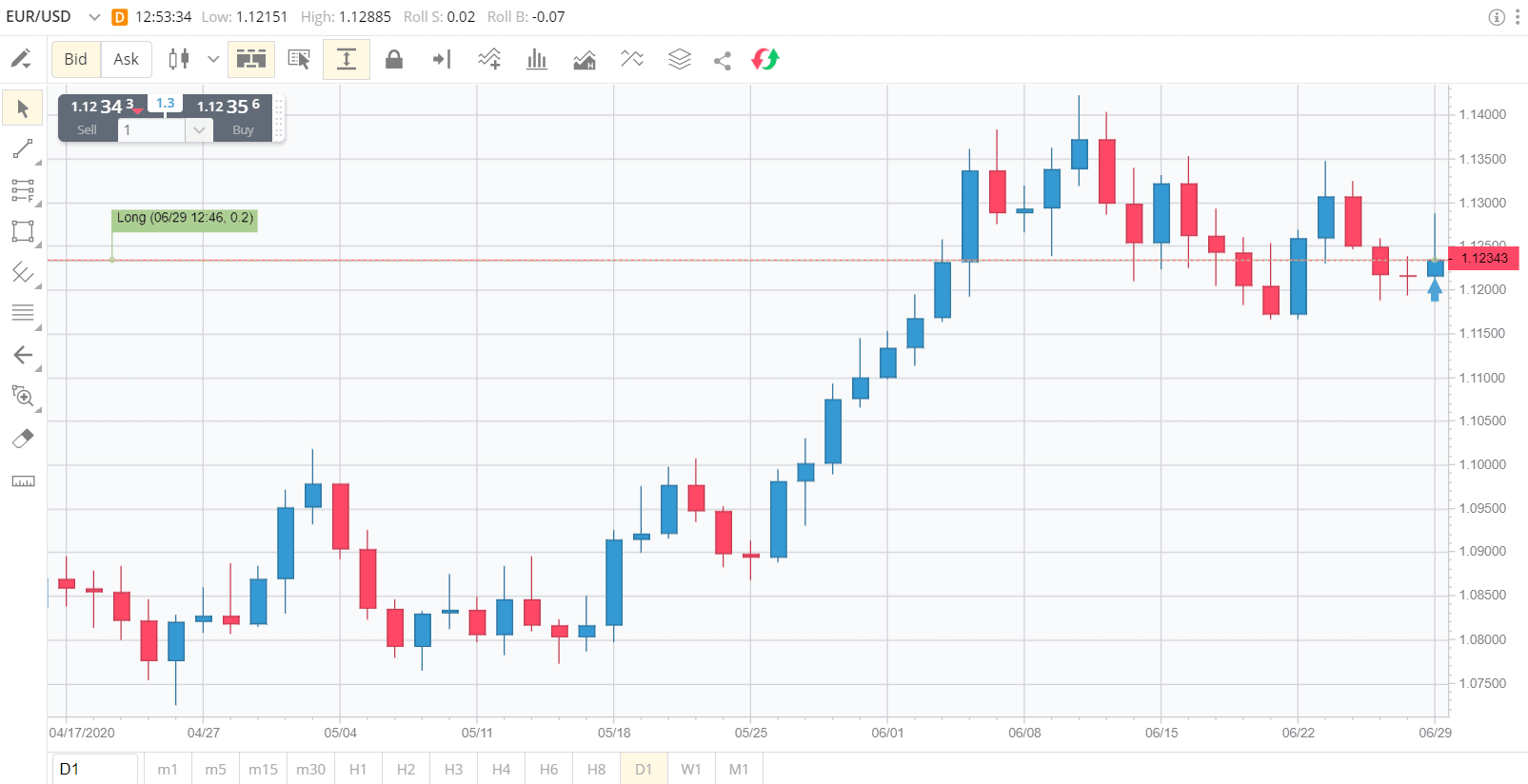

Charting Tool

The charting feature is familiar, as similar charting design and functionalities are used by other brokers.

Traders can use the following features while trading with FXCM:

- Fibonacci tools

- Shape tools

- Gann tools

- Arrow markers

- Pip ruler

- Switch between chart types (line, bar, table, candlestick)

- Price floater toggle

- Custom indicators

- Histograms

Other Notable Dashboard Features

- Dealing Rates Window: This window displays bid / ask levels for all currency pairs available for trading. When a trader clicks on one of the pairs in this window, a ticket opens for entering a trade.

- Accounts and Positions Window: This window shows the details of the account including equity, daily P&L, margin used, and margin available for use. Another tab of the same window also allows traders to track open and closed positions and a summary of their daily activity.

- Trading Central: All relevant news articles and updates related to assets that are added to the users’ trading screen as pop-up windows are present here.

- Customizability: Traders can customize and choose as to how the main screen is laid out. The customizability is done block to block, so it isn’t completely free to layout like with some other brokers.

If traders want further customization, they can develop their own tools. FXCM allows users with programming experience to build their own custom features using the firm’s API.

FXCM Marketplace

FXCM has created an online marketplace of apps to support its Trading Station platform. FXCM account holders can download these apps and customize their trading experience.

Apps cover all types of trading strategies and styles. The marketplace offers apps for fundamental traders, trend traders, and range traders among other categories. Both demo account and real account holders can access these apps.

The apps include:

- Custom indicators

- Add-ons

- Automated trading strategies

- Reporting tools

- Extensions for other FXCM-supported platforms (like MetaTrader 4)

Supported Trading Platforms

FXCM supports 3 other platforms, namely:

- MetaTrader 4: Advanced charting, pre-loaded trading strategies, automation, mobile-friendly, backtesting, and custom indicators

- NinjaTrader: Custom alerts, advanced charting, automation, pre-set strategies, and backtesting

- TradingView: The less feature-rich of the three, offering automated trading and pre-loaded strategies

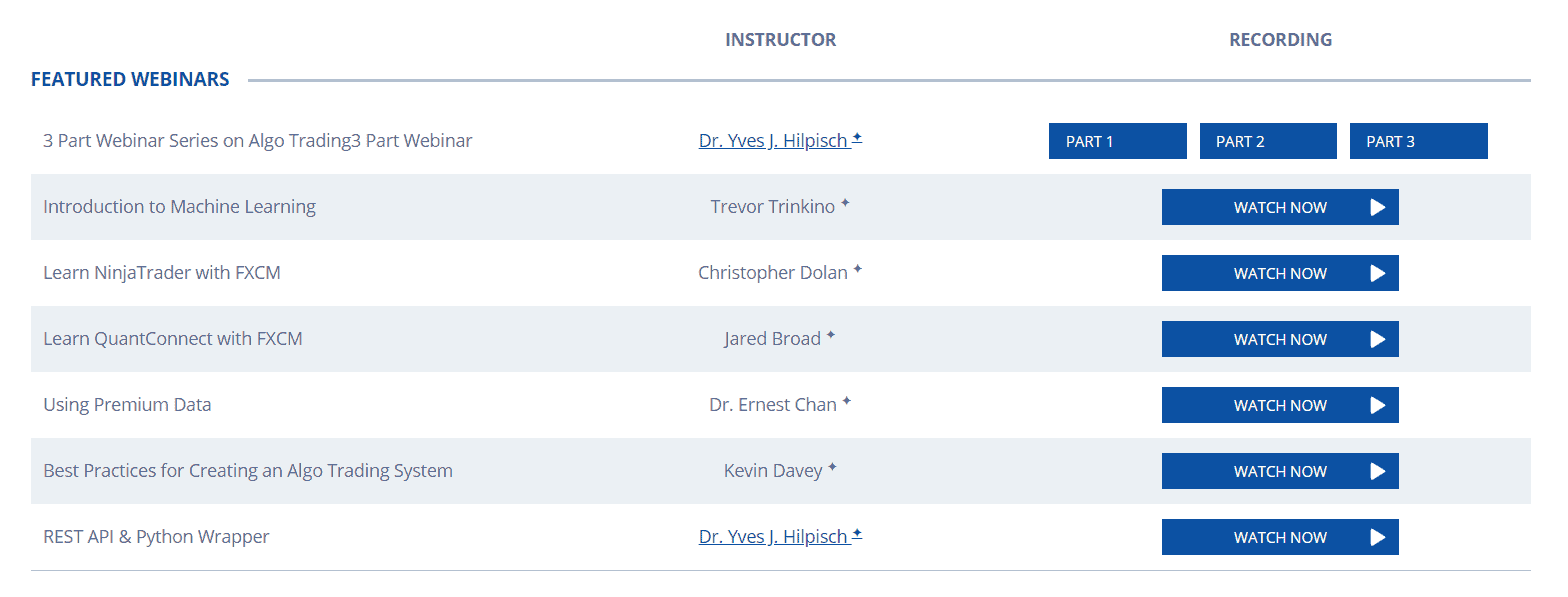

Educational Resources

FXCM offers a selection of learning resources to help get you started.

- FXCM University: This comprehensive Forex 101 online university course covers everything from explaining forex to chart reading to risk management. As with a university, the course is divided into freshman, sophomore, junior and senior years with increasingly more challenging content as the student progresses.

- Trading Guides: Free trading guides offering insights into trading.

- Video Library: This comprehensive library covers market educational topics through short and informative videos.

- Seminars: These sessions take place every Wednesday after 6 pm and alternate between beginner and advanced sessions. Every trader, including those with demo accounts, can participate, but attendance is limited to 10 per seminar.

- Live Classroom: Webinars that allow attendees to ask questions via chat to the moderators, who cover a variety of FX topics.

Mobile Trading With FXCM

FXCM’s mobile trading platform is far more impressive than the desktop version. The application is available both on iOS and Android.

While the interface seems dated, asset browsing is set as the default homepage and traders can execute contracts in just a few clicks.

Trade Execution and Management

Trades can be managed by switching between tabs presented at the bottom of the screen.

The mobile app also allows users to create entry orders, where traders have to define the amount, the rate, stop/loss limit, and trade type.

Mobile Features

More, the mobile app offers a top bar statistics toggle which users can tap to switch on or off — this is the simplified equivalent of the top bar on the desktop platform.

The mobile chart is far more basic than the desktop version — traders are free to change the time frame to view assets, but no actual charting features are available.

Frequently Asked Questions

Can FXCM be trusted?

FXCM is an internationally regulated broker, but you should make sure that it’s regulated in . You are encouraged to decide whether a broker is trustworthy or not based on the information available on the broker’s present regulatory status, history, and overall platform impression. Reliable customer support is also an essential part of broker good service.

What is the minimum deposit with FXCM?

FXCM’s minimum deposit for regular retail account holders and non-EU traders is $50, while regular EU account holders are required to make a minimum deposit of £300/€300. Both minimum deposits apply to other trading currencies in their equivalent sums.

How do I withdraw money from FXCM?

FXCM offers seven different payment methods which are also accepted as valid withdrawal methods. The full list of withdrawal options include Credit/Debit cards, wire transfer, e-wallets, BPay, Skrill, Union Pay, Neteller, and POLi.

How long does it take to withdraw money from FXCM?

The time it takes to withdraw your funds depends on the state of your account and the payment provider you use. Provided that your account is fully verified, withdrawals via wire transfer may take 3-5 days, while all other methods may take up to 24 hours.

Are there alternative CFD brokers to FXCM?

While FXCM is a regulated broker with plenty of products and a global presence, other brokers also offer hundreds of CFDs in different markets. Other popular CFD brokers that traders may consider include AvaTrade, Plus500, and Markets.com.

Credits: Original review written by Alison Quine. Updates by Marko Csokasi with contributions from the Commodity.com editorial team.