Contents

Overview

Trading can be a minefield for new and experienced traders alike. Not only do beginners have to learn new financial instruments and trading lingo, but they also have to be on guard against the slew of scammers and fraudsters seeking to prey on novice investors.

Similarly experienced traders can become victims because their confidence becomes complacency.

This scam guide explains ways in which scams are structured and what traders are ought to pay attention to in order to avoid them.

The Multi-Billion Dollar Scam Business

In 2016, $16 billion was lost worldwide to various types of fraud, scams, and identity theft. This represents a 16% increase over 2015 and is the highest level of fraud recorded since Javelin Strategy & Research (the firm behind the report) began tracking this statistic in 2004.

In 2020, almost $20 billion was lost to phone scams in the U.S only. That’s a close to double the reported $10.5 billion a year prior in 2019.

Fraud affects every region of the globe and manifests in many different forms:

- The Securities Investor Protection Corporation (SIPC) estimates that investment fraud costs Americans somewhere between $10 billion – $40 billion a year. The range is so big because many scams go unreported by the victims for fear of embarrassment at falling a victim to fraud.

- Regulators around the world struggle to keep pace with fraudsters. To highlight this, FINRA (admittedly just one body that exists to protect Americans from investment scams) initiated over 800 disciplinary actions in 2019 against brokers and individuals resulting in $39.5 million in fines and $27.9 million in restitution to harmed investors. That figure is frankly a drop in the ocean if SIPC figures are accurate.

- According to UK Finance, more than £1 billion was lost to fraud in the UK in 2019.

- The National Fraud Intelligence Bureau, which is a division of the City of London Police, logged an average of 27 complaints relating to unregulated binary options brokers every month in 2016. When some are defrauded up to £1m and lose large chunks of their life savings, the scale of binary options scams is put into perspective.

- A report by the Australian Competition and Consumer Commission estimates that Australian consumers lost over $170 million to online scams in 2020. The report tracked over 200,000 incidents of online scams spanning 10 categories ranging from investment schemes to inheritance scams and hacking incidents.

Binary options are an instrument where traders are speculating on an outcome. Many binary options brokers leverage the simplicity of the instrument to encourage vulnerable adults, such as the elderly, to deposit money with them offering worthless “risk-free guarantees”, and disappearing with the money. Binary options are different from Vanilla Options Trading.

If we can take anything from these statistics, it is that as well-meaning as Governments, charities and regulators can be, the problem is too big for them to completely protect people.

As investors, we need to be responsible for protecting our money.

Types of Investment Scams

Virtually every investment scam involves unscrupulous actors convincing investors to put up money for investments that are risky, fraudulent, or, in some cases, don’t even exist.

Scammers successfully defraud through many different schemes, like:

- Bad brokers

- Boiler rooms

- Unregistered/offshore securities

- Pump & Dump

- Pyramid schemes

- Ponzi schemes

- Precious metal scams

- Alternative investment scams

- Investment seminars

Bad Brokers: Designed To Keep Your Money

Unscrupulous brokers, most of which are unregulated, perpetrate a variety of scams against individuals:

- Trading unfairly against customer orders – The broker may wait for the market to move significantly in the broker’s favor before executing the order.

- Charging egregious trading commissions, fees, or spreads

- Charging other hidden fees to customers for dubious or worthless services

- Freezing trading platforms or suspending trading during busy market hours. This prevents a customer from being able to cancel an order and allows an unscrupulous broker to fill the order at prices outside of the market.

- The broker may place onerous and unnecessary requirements on customers who want to withdraw funds. Examples include requiring excessive forms of identification, charging absurd withdrawal fees, and placing unnecessarily long hold times before releasing the customer’s funds.

Despite enforcement efforts, the problem of online scam brokers is global, pervasive, and ongoing.

Examples Of Past Broker Scams

- In 2017, FXCM, at a time the largest Forex trading broker in the USA, was shut down in the US and permanently banned from being a member of the National Futures Association for a variety of bad practices.

- In 2015, a US judge ordered IB Capital FX LLC to pay $35 million to clients it defrauded. The firm set up shop in the United States and solicited clients worldwide. IB Capital FX LCC never registered with the Commodity Futures Trading Commission (CFTC), which is a requirement for US-based commodity and forex brokers.

The Australian Securities Investments Commission (ASIC) regularly issue public warnings about illegal conduct of unregistered brokers.

The reality, however, is that while a few scammers face fines or cease-and-desist orders for their illegal activities, many go unnoticed or escape unscathed.

It is vital, therefore, for the public to understand how to spot and avoid fraudulent online brokerage firms and other scams.

Unfortunately, the internet allows anyone with a website to operate a business with near-total anonymity. It is not surprising, therefore, that criminals have used websites to prey on the online investing public.

What Promises Do Bad Brokers Make?

Generally, broker scams appear in one of several forms:

- Promises of easy profits in a short amount of time

- Offers of automated trading systems to make guaranteed profits

- Too-good-to-be-true signup bonuses in the form of free funds for new traders

Once traders deposit money, shady brokers have several ways of stealing their money. Some brokers trade against their customers’ orders and charge them unjustified spreads and commissions. Meanwhile, others make it impossible for traders to withdraw funds.

Still, others brazenly steal customer funds and then close up shop or rebrand under a new name. Investors should pay attention to how long a brokerage firm has operated.

Traders can avoid fraudulent online brokers by doing a little bit of homework and following the three Rs on this checklist:

Regulation: How To Ensure A Broker Is Regulated

Make sure your broker is registered with a legitimate international financial regulator.

A reputable broker should disclose which agencies regulate it. As an example, this page on the eToro website lists not only the agencies the company is regulated by but also the registration and license numbers under which it operates.

Traders should beware of claims of regulation by bogus agencies. If an agency lacks an operating history, independence, and the authority to fine or sanction offenders, then it probably offers no protections to investors.

If a broker has no agencies that regulate it, traders should avoid opening an account with it at all costs.

Reading Broker Reviews For Client Feedback

Traders can get a general idea about the reputation of a broker by reading online reviews.

If a brokerage firm has numerous customer complaints about egregiously high spreads and commissions, inability to withdraw funds, or costly trading systems and educational materials, then traders should look for another firm.

Does The Broker Have Any Recent Industry Recognition?

The most transparent and credible firms list on their websites awards and recognitions they have received. Traders should pay attention to whether the awards are recent (within the last two to three years), and whether they come from recognized and authoritative industry groups.

Traders can do searches on these industry groups to see how long they have been around and whom they honored in the past.

Of course, even reputable firms have occasional disgruntled customers, so traders should look for a pattern of excessive complaints and pay attention to the reasons for those complaints.

Research: Finding Information On A Broker

Traders can learn a lot about a broker by reading and researching the firm’s website before they open an account.

More transparent brokerage firms tend to provide detailed information about:

- Margin requirements

- Leverage

- Trading products offered

- Lot sizes

- Trading platforms

Such brokers are more likely to be reputable than firms that offer vague or scant information.

What Information Should You Look For?

In particular, traders should look for specific information segmented by product type.

If a firm is reputable, it should be willing to share detailed and transparent cost information so traders can compare it with other brokers.

Reputable firms also generally provide one or more physical addresses and several methods and times for contacting customer service. Of course, a detailed website is no substitute for regulation, but it offers another level of comfort to traders.

Use Common Sense to Avoid Broker Fraud

Avoiding fraudulent online brokers is ultimately about using common sense. If something doesn’t seem right, then it probably isn’t. Here are a few more tips that an online broker might not be legitimate:

- The website contains lots of typographical errors, confusing content, and poor graphics. Although some scam sites look as professional as legitimate sites, an amateurish-looking site is probably a scam.

- The broker makes outrageous and unsubstantiated claims about trader profits.

- The broker offers lucrative signup bonuses that seem too good to be true. Many reputable firms offer attractive signup bonuses and promotions for new traders. However, the best firms ultimately lure new customers with quality products and not with gimmicks.

Boiler Room Scams

In the UK alone it is estimated that £200m a year was lost to this type of scam in 2011.

As people become more information-savvy, the likes of boiler room scams become less successful. There is limited data on present boiler room scam amounts.

Criminals set up makeshift offices called boiler rooms and pitch bogus or very risky schemes to potential investors.

Sometimes the operators give themselves a formal-sounding name and set up a website to make their company seem legitimate.

How Do Boiler Room Scams Operate?

Boiler room operators usually have nothing more than a temporary office.

Their goal is to convince individuals to send them money. In some cases funds are used to buy a worthless stock which the boiler room operators get a commission on or in many cases no stocks are purchased at all.

Frequently the firm closes up shop and moves to a new location before the victims (or the authorities) discover the fraud.

Boiler room scams have featured in the following two films; The Wolf of Wall Street and Boiler Room. Both offer a glimpse into the real world of boiler rooms, albeit with a touch more glamour than reality.

Unregistered and Offshore Securities Scams

In most jurisdictions around the World, a company may not offer or sell securities unless the offering has been registered with the correct regulatory agency for example SEC.

If the offering is not registered, it is often referred to as a private placement or unregistered offering.

Generally speaking, unregistered offerings are not subject to many laws and regulations that exist to protect investors.

It is worth remembering that each year many legitimate companies engage in unregistered offerings to raise funds from investors. Scammers, however, use unregistered offerings to conduct investment fraud.

If you are presented with an opportunity to invest in an unregistered offering, thoroughly research the investment and the investment professional selling it.

Pump-and-Dump Schemes

This type of investment fraud can take two forms:

- Scammers purchase shares in an illiquid company prior to soliciting investors. The scammer, acting as a broker, then convinces other investors to buy shares and drive the price higher. After the shares rise in value, the “broker” dumps them for a large profit, and the price heads sharply lower.

- Bigger investors collude to buy shares in large volumes, driving up the price and encouraging hype around the stock before eventually dumping.

One of the more infamous pump and dump schemes is RCA in the late 1920s.

What Happened With RCA’s Dump?

It can be argued that RCA was the first ‘hot tech stock’ when it was leading the way with phonograph technology and it became widely lauded.

As can often happen with ‘hot’ stocks, the company struggled to live up to the hype. The reason we are talking about RCA though is because the bubble bursting was amplified by a group known as the Radio Pool which was a coordination between a number of investors to purchase shares and inflate the stock’s price.

They led the share price to an incredible $549 before it plummeted to less than $10 a share.

Thousands of average investors lost everything. The collusion of the Radio Pool led to much tighter legislation to protect investors in the future.

Pyramid Schemes: Compelling Earning Potential

The pyramid scheme is one of the most pervasive forms of investment scam.

At its core, it is a simple practice; the scammer recruits a number of individuals on the promise of some kind of return on their investment, an incentive is then usually offered to the first individuals to participate to encourage more people to invest e.g. a commission on people they refer.

These individuals then (often unknowingly) perpetuate the scam by recruiting a few more individuals each. The process then continues at the next level and so on.

How Are Pyramid Schemes Structured?

It is widely documented that if a pyramid scheme starts with a scammer recruiting 6 people and each of these recruits 6 people.

By the time you are 13 levels down on the pyramid, you’ve exceeded the total population of the world.

The problem though is that most pyramid schemes are “dressed up” so that they don’t necessarily have the outward appearance of a pyramid scheme.

Many multi-level marketing companies have been accused of operating pyramid schemes with front selling products or services but with emphasis placed on recruiting new members.

Ponzi Schemes: A Specialist Pyramid Scheme

A Ponzi scheme is a type of pyramid scheme named after Charles Ponzi, the now infamous Italian swindler who traveled to the US and generated over $20 million in the 1920s.

Although a type of pyramid scheme, it deserves its own mention because rather than relying on downstream individuals to do the recruiting, a Ponzi scheme usually involves the original scammer continuing the recruitment of new “investors”.

How Does A Ponzi Scheme Operate?

Here is how it works:

- In month 1, the scammer encourages 2 individuals to make an investment (usually on the promise of incredible returns)

- In month 2, the scammer encourages 4 individuals to make an investment meaning they can return some of the “profits” to those recruited in month 1 so as to keep the scam going because these early “believers” are important as they’ll often step in to defend the scammer should anyone question their legitimacy without realizing they are perpetuating a scam.

- In month 3, the scammer encourages 8 individuals and so on.

Probably the largest Ponzi scheme of all time was the Bernie Madoff investment scandal which prosecutors estimate cost victims nearly $65 billion.

Precious Metal Scams

Gold and other precious metals have long been an area attractive to fraudsters.

The safety and security of investing in a “hard asset” like gold or silver can be very enticing to victims. Scammers may pull one of the following tricks:

- No precious metals actually acquired – they just steal your money after a slick sales pitch.

- Precious metals of low purity are acquired – meaning your investment is immediately worth less than you are handing over.

- Unrealistic guarantees about increases in value or income potential.

- Excessive broker fees for helping you acquire precious metals. These convicted fraudsters were charging victims a sales commission of 50%.

How Rigorous Are Precious Metal Regulations?

In many countries, gold and precious metal dealers are lightly regulated.

That doesn’t automatically mean they aren’t legitimate but it is worth remembering you need to conduct extra due diligence and seek professional advice before parting with any money.

If you are looking to speculate on the price of gold or precious metal in a safe and regulated environment then you should review our list of regulated CFD brokers.

Other Alternative Investment Scams

There are a multitude of alternative investment opportunities out there; from fine wine and rare stamps to classic cars and carbon credits.

Many opportunities are completely legitimate but unfortunately these alternative and often unregulated areas of investment are a breeding ground for fraudsters.

Some masterminds may attempt to cash in on the interest in developing markets like carbon credits, cryptocurrencies, and popular hobbies like classic car ownership or stamp collecting.

Some warning signs of illegitimate alternative investments include:

- Claims of high returns with little or no risk

- Aggressive sales tactics

- Sham or virtual office

- Suspicious or unverifiable biographies of management

- Problems with sales documents – limited information published and typos in brochures.

Investment Seminars As Scams

To be clear, there are many completely legitimate investment training seminars out there.

However, fraudsters are increasingly selling victims phony or worthless education packages that will purportedly teach them to trade/get rich/invest in property/start an online business, and the like.

These seminars and education courses often cost thousands of pounds and will help victims do nothing more than empty their pockets.

How To Spot A Scam Investment Seminar

Here are some red flags to help you spot potential scams if you are considering investing in a seminar or training course:

- Flaunting of a luxurious lifestyle, with rented supercars, houses, and jets

- Testimonials that are too good to be true

- The trainer seems more focused on selling memberships to his/her course rather than honing his/her craft

- Claims of high profits at low risk

- Guaranteed results

- Very little or no warnings of potential losses

- Focus on targeting beginners

- The pressure to sign up now to lock in a discount

INVESTOR ALERT

The Financial Conduct Authority (FCA) in the UK has reported an increasing number of scammers purporting to be from legitimate firms on its register. This is achieved in a variety of ways;

- Stealing the identity of the firm on the FCA register by updating address and contact details. The FCA has initiated new security processes to avoid this happening but be vigilant and if something seems off then it is worth finding a second source of contact information to ensure they match.

- Fraudsters claiming to be from a registered firm but saying the contact details on the FCA register are out of date. This is unlikely because the FCA completes an update of their register daily.

- Fraudsters list a genuine Firm Registration Number (FRN) on their website and sales materials but the FRN relates to a completely different company. Always check the register.

- Cloning the website of a legitimate firm with subtle changes to contact details to allow them to draw in victims.

More recently, the FCA also warned consumers against high-return advertisements on cryptocurrency investment opportunities.

Beware of Market Bubbles

An asset bubble is when the price of an asset, such as gold, property or bitcoin becomes over-inflated. Prices rise sharply over a short period followed by an equally sharp decline.

It is important to remember that price rises in a bubble are not supported by underlying demand for the product itself.

Asset bubbles or investment frenzies aren’t actually a type of scam but it is worth mentioning in this guide because in the thick of a frenzy many otherwise sensible investors make bad decisions – investing in perhaps legitimate assets but for the wrong reasons.

Furthermore, bubbles make life easier for scammers because the aforementioned otherwise sensible investors may be more susceptible to scams in a bid to capitalize on the rise in an asset price.

Brief History Of Asset Bubbles

Asset bubbles have existed for centuries. From the Dutch tulip bulb craze of the 1600s to the dotcom bubble of the late 1990s, investors periodically bid up asset classes to inexplicably high levels.

Many see similar patterns developing with the price action in cryptocurrencies such as Bitcoin. Bitcoin and many other cryptocurrencies aren’t investment scams, but they offer fraudsters ripe opportunities to take advantage of gullible investors and to prey on greed.

Investors should proceed with caution and investigate cryptocurrency offers thoroughly before investing. If something seems too good to be true, then there is probably a scam behind it.

Bitcoin Ponzi schemes, fraudulent initial coin offerings (ICOs), and scam bitcoin trading systems are a few of the areas where investors may get burned.

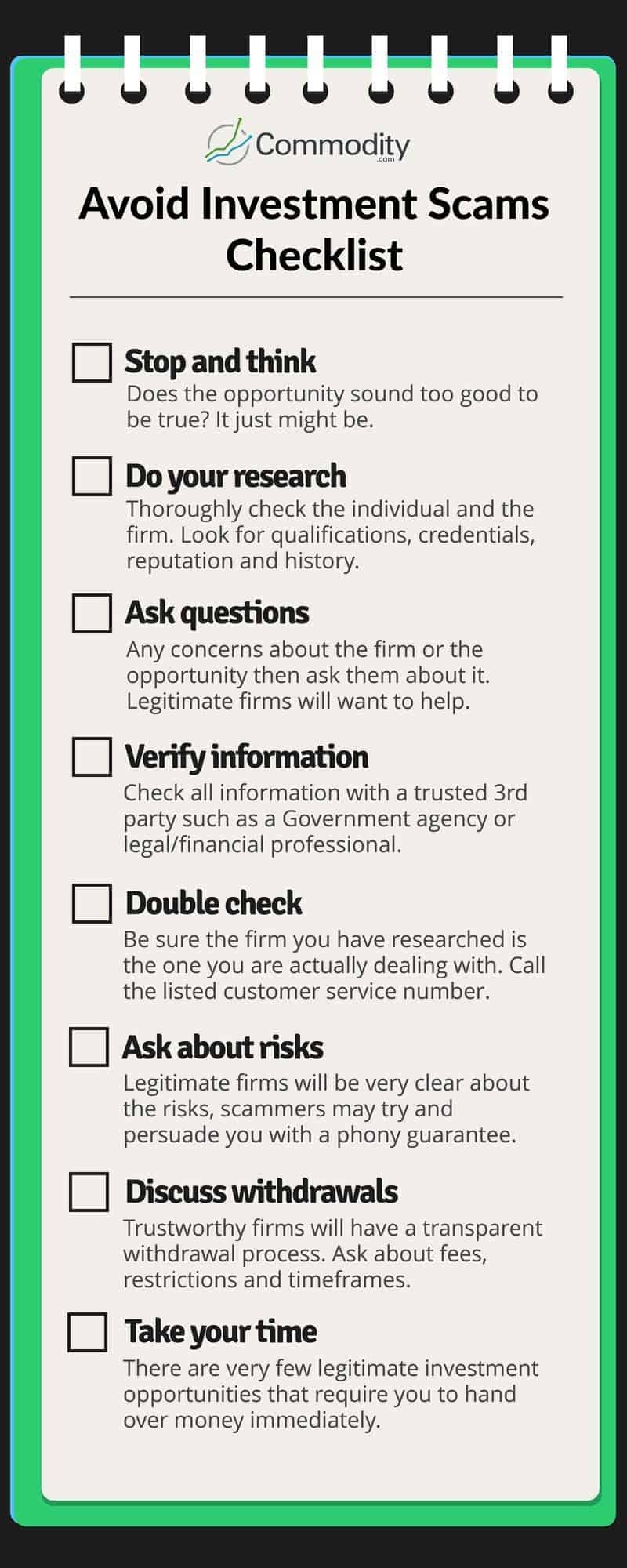

Avoid Investment Scams [Use This Checklist]

This checklist is intended as a guide. No responsibility will be taken for any investments made as a result of using this checklist, you should always seek the advice of a suitable qualified professional before making any investment decision.

How To Find A Regulated Broker

To find a regulated broker that you’re comfortable depositing your money with, you need to know what you’re looking for.

This Guide To Finding Regulated Brokers is a starting point for traders wanting to research a suitable platform.

If you already know how to choose a broker, here are some regulated online brokers in :

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74%-89% of retail investor accounts lose money when trading CFDs. You should consider whether you can afford to take the high risk of losing your money.