On this page, you’ll learn about the main uses of nickel, how and where it’s produced, nickel’s main price drivers, and some expert opinions on nickel as a commodity.

Interested in how nickel is traded? See our full guide, or if you want to get started trading right now, here are options available in to consider:

Disclaimer: Availability subject to regulations.

Between 74-89% of retail investor accounts lose money when trading CFDs.

Contents

What Is Nickel?

Nickel is a solid, lustrous, silvery-white metallic element that is strong, ductile, magnetic and resistant to corrosion. It also has a high melting point and catalytic properties.

Nickel’s favorable traits make it one of the most widely used industrial metals on earth.

Why is Nickel Valuable?

By the late 1800s, iron and steel manufacturers discovered they could strengthen traditional steel by creating alloys with nickel.

Discovery of new ore deposits in the early 20th century combined with strong demand for steel during World War I and World War II ushered in the modern nickel production industry.

Today mines worldwide extract more than 2.25 million tons of nickel annually.

In addition, recycling efforts account for additional supplies of the metal.

Over 300,000 products in the consumer, industrial, military, transport, aerospace, marine and architectural sectors use nickel. As a result, nickel has become an essential commodity in world markets.

Main Uses of Nickel

| Uses | Description |

|---|---|

| Stainless Steel | Nearly two-thirds of all nickel produced goes into stainless steel. A particular variety of stainless steel that contains significant quantities of nickel is austenitic steel. Many common products often contain austenitic steel: - Automotive trim - Cookware - Cutlery - Food and beverage equipment - Industrial equipment - Mining, chemical, cryogenic, and pharmaceutical equipment - Storage vessels and pipes for corrosive liquids - Sinks - Tanks |

Electronics  | Iron and nickel alloys are used in many electronics. |

| Plating | Electro nickel plating uses electrical current to cover conductive metals with a coating of nickel. |

Catalysts | Nickel is an important ingredient in many catalysts that facilitate chemical reactions. |

Rechargeable Batteries | Nickel is a key component in rechargeable battery systems used in electronics, power tools, transportation and emergency power supply. |

How Is Nickel Produced?

The supply of nickel derives from two sources: primary production (mining) and secondary production (recycling).

Mining provides most of the supply, although the United States Geological Survey (USGS) estimates the quantity recovered from recycling in the United States represented 43% of total consumption.

The Philippines is the largest nickel mining country in the world. However, no single country dominates in production of the metal. Mining takes place in a variety of geographies and countries:

Top Nickel Mining Countries

These are the reserves of each country as reported by the USGS:

| Rank | Flag | Country | Thousands of Metric Tons |

|---|---|---|---|

| #1 |  | Philippines | 500,000 |

| #2 |  | Russia | 256,000 |

| #3 |  | Canada | 255,000 |

| #4 |  | Australia | 206,000 |

| #5 |  | New Caledonia | 205,000 |

| #6 |  | Indonesia | 168,500 |

| #7 |  | Brazil | 142,000 |

| #8 |  | China | 90,000 |

| #9 |  | Guatemala | 58,600 |

| #10 |  | Cuba | 56,000 |

Countries With The Largest Nickel Reserves

| Rank | Flag | Country | Thousands of Metric Tons |

|---|---|---|---|

| #1 |  | Australia | 19,000 |

| #2 |  | Brazil | 10,000 |

| #3 |  | Russia | 7,600 |

| #4 |  | New Caledonia | 6,700 |

| #5 |  | Cuba | 5,500 |

Primary Production

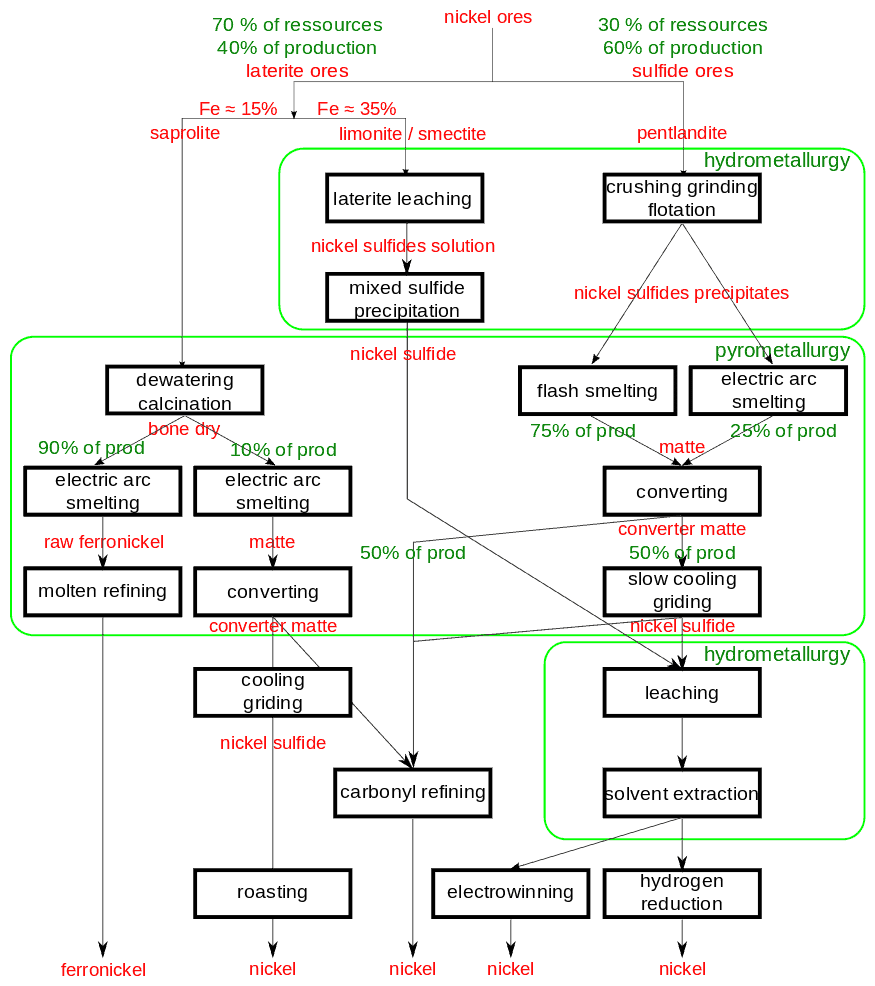

Nickel derives primarily ore mining, more specifically, from two types of ores, sulfidic and lateritic. Each type has specific characteristics related to how it is mined:

Characteristics of Sulfidic and Lateritic Ores

| Sulfidic | Lateritic | |

|---|---|---|

| Ore Bodies | Pentlandite, pyrrhotite, and millerite | Limonite and garnierite |

| Characteristics | Usually found with copper-bearing ores | Ores contain iron |

| Nickel Content | About 1% | About 4% |

| Geographical Location | Mostly in the Canadian Shield and Siberia | Tropical regions such as New Caledonia |

| Deposit Location | Deposits are generally found deep underground. | Deposits are generally found in varying depths just below the surface. |

| Mining Method | Miners sink vertical shafts into the ground and drive horizontal tunnels into the ore. | Large equipment excavates the earth and removes the ore bodies. |

| Cost of Mining | Labor-intensive and expensive to extract | Less expensive since mining occurs at the surface. |

Processing the ores and separating nickel from them also varies depending on the ore type.

Although sulfidic ores are more expensive to mine, separating the nickel from these ores is cheaper than extracting nickel from lateritic deposits. Additionally, sulfidic ores generally contain other valuable minerals that can be extracted during nickel production.

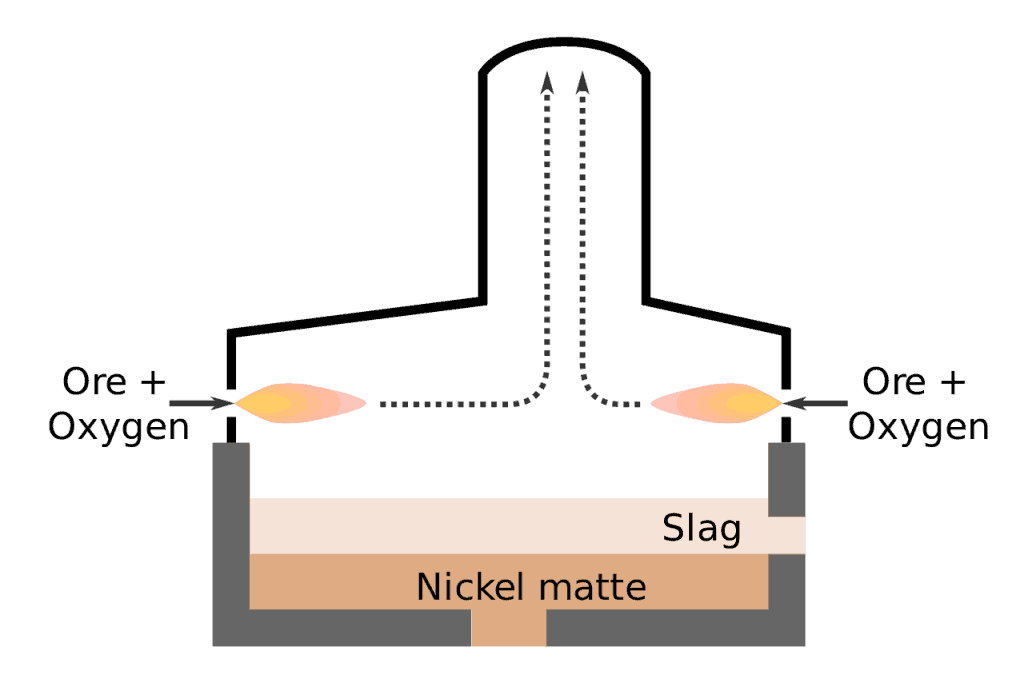

Sulfidic Ore Processing

Separating nickel from sulfidic ores takes place using froth flotation tanks and magnetic processes. These produce two products – nickel matte and nickel oxide. These intermediate products contain between 40 and 70% nickel, but each requires further refining.

Further processing of nickel matte occurs using the Sherritt-Gordon process. With this technique, hydrogen sulfide is added to the molten material to remove copper. This leaves a concentrate of only cobalt and nickel. Solvent are then used to extract cobalt. This leaves a final product with a nickel concentration of more than 99%.

Further processing of nickel oxide occurs using the Mond process. With this technique, nickel reacts with carbon monoxide at temperatures of between 100℉ and 175℉ to produce nickel carbonyl.

At this point, chemists obtain purer nickel from the nickel carbonyl through one of two processes:

- Nickel carbonyl passes through high-temperature chambers that decompose it into pure nickel.

- Nickel carbonyl passes through smaller chambers that circulate the material at temperatures of about 450℉. This creates a fine, pure nickel powder.

Lateritic Ore Processing

The high iron content of lateritic ores makes smelting the preferred method of nickel extraction. Lateritic ores have high moisture content that requires drying the ores in kiln furnaces.

These kiln furnaces produce nickel oxide from the lateritic ores. At this stage, electric furnaces heat the nickel oxide at temperatures between 2,480 and 2,930℉ and produce Class 1 nickel metal and nickel sulfate.

The natural iron content of lateritic ores usually creates a final product after smelting that is ferro-nickel (a combination of iron and nickel). Steel producers can remove impurities such as silicon, carbon, and phosphorous from this combination and produce strong steel alloys.

Secondary Production

Very little nickel is recycled to its original elemental state. Instead, scrap products are often recycled into economically valuable materials containing nickel.

For example, it is generally not economically feasible to extract the nickel from scrap stainless steel products. However, recycling these products allows manufacturers to create new stainless steel products that contain nickel.

Nickel is strong, ductile, magnetic, corrosion- resistant and heat-resistant. As a result of these favorable properties, nickel has become one of the most widely used metals in the world.

What Drives the Price of Nickel?

The price of nickel is driven mostly by these five factors:

- Chinese Demand

- Global Stocks

- Global Demand Outlook

- Government Policies

- Input Prices

Chinese Demand

China accounts for more than half of the annual global demand for nickel. Only 10 years ago, Chinese nickel consumption represented less than 20% of global demand.

Rapid economic development in China over the past decade has certainly accounted for the increased consumption. However, China’s GDP growth has slowed considerably in recent years, creating doubts about future demand for all industrial metals including nickel.

Ultimately, nickel prices depend heavily on Chinese demand for everything from stainless steel products to batteries. If industrialization and urbanization in China renews its high growth trajectory, then the price of nickel should rise. Traders should pay close attention to Chinese economic data for clues about nickel prices.

Global Stocks

The London Metals Exchange (LME) keeps track of global stock levels for nickel and other industrial metals. Traders follow these inventory levels closely for clues about supply shortages or surpluses.

If inventory levels drop, the market may be facing a shortage of nickel supply in the near future. This could lead to higher prices for the metal. Similarly, if stockpiling occurs and inventory levels expand, then the market might face an oversupply of the metal, which can lead to lower prices.

Nickel traders keep close tabs on Chinese inventories, in particular, since they have the largest impact on nickel prices. Data on shipping containers entering Chinese ports can provide valuable clues about demand for nickel and other commodities.

Global Demand Outlook

Overall economic activity, particularly in the industrial sector, affects demand for nickel.

The use of nickel in stainless steel alloys for building projects is a market segment that deserves close attention. Stainless steel nickel alloys are used to produce durable structures and protect against corrosion. The Great Bridge of China is one example of a construction project that used nickel.

The United States has not invested in major infrastructure projects in decades.

If the government earmarks funding for new infrastructure projects, the price of nickel could move significantly higher. Similarly, as other developed economies replace their infrastructure, nickel prices could rise.

Government Policies

There are numerous examples of government policies affecting nickel prices:

Historically, Indonesia has been a leading exporter of nickel. However, the country has also banned laterite ore exports in recent years. The rationale for this policy was a desire by the government to support the domestic smelting industry. Ultimately, budget deficits in Indonesia led to a resumption of exports.

The Philippines, the world’s largest nickel miner, has recently threatened to end all mining in the country.

Actions by these and other governments can have a dramatic effect on nickel supplies and prices.

Input Prices

Nickel occurs in ore bodies, and breaking down these ore bodies to extract nickel expends energy.

Producing nickel requires ample supplies of coal, electricity and crude oil.

Mines and blast furnaces utilize energy to extract nickel ores from the ground and process it into nickel. These costs can have a big effect on primary production. Similarly, the costs of scrap metal can impact the price of secondary production.

What Do Experts Think About Nickel?

Many analysts have a dour view of the nickel market. They cite overproduction from major producers Indonesia and the Philippines as reasons for their pessimism.

“Miners have been holding on as long as they can. They will be close to running out of wiggle room in terms of cutting costs. We need to see some reasonably sized refined capacity cutbacks to restore prices and confidence back to the market.”

Mark Pervan, consultancy AME Group, Sydney

Other experts agree that the current economic fundamentals of the nickel industry are unsustainable.

Consultant Wood McKenzie notes that half of the global nickel miners now operate at a loss, while Citi recently informed its clients that it sees little chance for a rally in prices in the short, intermediate, or long run.

Where Can I Trade Nickel?

Start your research with reviews of these regulated brokers available in .

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74%-89% of retail investor accounts lose money when trading CFDs. You should consider whether you can afford to take the high risk of losing your money.

IMPORTANT: CFDs are not available in the USA due to local regulation, and regulated brokers do not accept US citizens or US residents as clients.