In this guide, you’ll learn what Belgium’s national debt is made up of, how it’s managed, and how loans are raised.

The National Debt of Belgium

Following the rules laid down in the Maastricht treaty, the government of Belgium is obliged to count all public debt in its national debt figures.

Belgian public debt was set to rise to 122.1% of GDP in 2020 as a result of the coronavirus crisis. This is a sharp increase compared to the average debt-to-GDP ratio of 98.8% in 2019.

As of 30 June 2020, the Belgian federal government debt amounted to EUR 434.52 billion.

The federal government debt is all debt issued or taken over by the federal government. This does not include local government or social security debt.

Negotiable government debt is all public debt traded on an exchange or other market. This is largely made up of linear bonds and treasury certificates, which represents about 90% of Belgium’s federal debt.

The general government debt, as defined in the Maastricht Treaty, is the debt of the entire general government sector – gross, consolidated, and nominal value.

The table below explains what is included in Belgium’s national debt figure and what isn’t:

Belgian Government Obligation Government Department Included in National Debt?

Government-issued bonds The Belgian Debt Agency Yes

Short-term debt instruments The Belgian Debt Agency Yes

Region government debt The Belgian Debt Agency Yes

Local government debt The Belgian Debt Agency Yes

Civil Service pension obligations All No

National pension obligations Federal Pension Service No

Rescued “bad bank” The Belgian Debt Agency Yes

National bank guarantee scheme Federal Public Service Finance No

State-owned bank debts Federal Public Service Finance No

Accounts Payable (unpaid bills) All No

Is Belgium’s National Debt Rising?

Under the Maastricht Treaty of 1992, the Belgium government is obliged to reduce its national debt to a debt-to-GDP ratio of 60%. The country has never managed to reach that target.

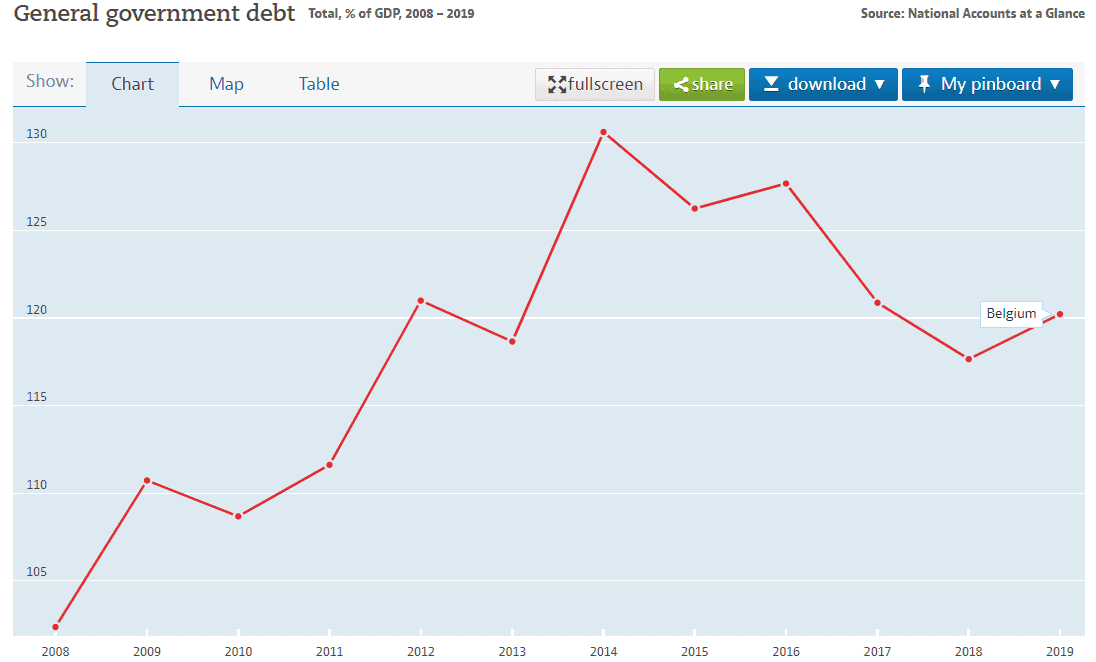

The government managed to reduce its debt every year from 1993 to 2007. The financial crisis of 2008 and the Greek debt restructuring of 2010 (which hit Dexia Bank hard) has placed obligations on the Belgian government that has prevented it from continuing with its target.

The 2017 drop in debt is due to the government managing to sell a quarter of its shareholding in BNP Paribas. This is an investment that it acquired as part of its strategy to rescue Fortis Bank in 2008.

By the end of 2020, it was the coronavirus crisis that pushed the Belgian national debt to a historic increase. Fiscal experts warned that it could stay above 120% of GDP for years to come if successful measures to curb public debt aren’t put in place.

Who Manages Belgium’s National Debt?

The federal government calls its ministries “federal public services”.

The budget minister presides over the federal public service finance. Within this department, the treasury performs the bulk of the work to manage the country’s finances.

The job of managing debt and issue new debt instruments is delegated to the independent Belgian Debt Agency.

Although the agency operates independently, it is answerable to the treasury, the federal public service finance, the budget minister, the nation’s Prime Minister, and, ultimately, the King of Belgium.

How Does the Belgian Government Raise Loans?

The Belgian Debt Agency issues bonds through an auction process. Although members of the public and any corporate investor are allowed to buy Belgian government debt instruments, only primary dealers and recognized dealers are allowed to buy them directly from the Belgian Debt Agency.

Government debt instruments fall into three categories:

- Short-term debt instruments

- Medium-term debt instruments

- Long-term debt instruments

Short-Term Debt Instruments

Treasury Certificates

Short-term debt is placed as treasury certificates. These are discounted devices that pay no interest, but are repaid as the full face value.

The Belgian Debt Agency issues treasury certificates (TCs) with three-month, six-month, and one-year maturity periods. The agency holds sales of TCs twice a month.

TCs are also denominated in Euros. Roughly 90% of all outstanding TCs are held by foreign investors.

Euro Commercial Paper

One other short-term instrument that the Belgian Debt Agency issues is the Euro Commercial Paper (ECP). These may be issued in Euro, or in any other currency.

ECPs are intended to smooth over cash flow problems that the treasury experiences when tax receipts are remitted at an irregular pace. The majority of ECPs are issued in Euro, but the agency also issues them in Swiss francs.

There is no set schedule for the sale of ECPs. They are sold whenever a cash flow shortage arises. The maturity period of ECPs can range from 3 days to one year.

Medium-Term Debt Instruments

The Belgian Debt Agency issues Euro medium-term notes (EMTN).

The profile of these devices overlaps the purpose of both the short-term and long-term instruments that the agency uses to raise funds. This is because the maturity period of an EMTN can be set as low as one month, meaning that it competes with the treasury certificate.

One difference between an EMTN and a treasury certificate is that the medium-term note is sold at face value and pays interest.

The EMTN also competes with Euro Commercial Paper because it can be denominated in Euros or in a foreign currency.

The maturity period of an EMTN can be as long as 100 years, so this device also competes with the bonds that the agency sells.

EMTNs can be of fixed interest or variable interest rate pegged to the ECB base rate, or at a differential to that rate. They can also be indexed linked, meaning that the capital amount of the note will rise with inflation.

The definition of EMTNs is very broad and allows the Belgian Debt Agency to create new issues in accordance with negotiations with potential buyers.

These notes are written on an ad-hoc basis, but can only be sold to primary dealers or recognized dealers. The agency has issued EMTNs denominated in Euros, Japanese yen, Norwegian krona, Swiss francs, British pounds, and US dollars.

Long-Term Debt Instruments

The standard long-term debt instrument is the government bond. Here again, the Belgian Debt Agency allows itself room for creativity in the definitions of the types of bonds that it issues.

The three types of instruments in the long-term category are:

- Linear bonds – The linear bond is the standard government bond that any investor around the world would understand. It pays a fixed rate of interest and endures for a term that is longer than one year but could be for a term of up to 100 years.

- Floating-rate bonds – The floating rate bonds follow the variable EURIBOR three-month rate.

- Schuldscheine – The Schuldschein is a German concept and is issued specifically to raise funds in the German market. These devices don’t count as bonds but are actually loan agreements.

All of the Belgian Debt Agency’s long-term debt instruments are denominated in Euros.

Other Sources of Belgian Credit

The treasury also accepts deposits, acting as a bank, paying interest on the amount deposited in an account with the Belgian Debt Agency.

Deposit accounts can be for a fixed term of up to one year, continuous with a 48-hour withdrawal notification condition, or long-term with a deposit period of more than one year.

For both long-term and short-term deposit accounts, the deposit can only be made in multiples of 1,000 Euros, and an account requires a minimum deposit of 250,000 Euros.

The 48-hour withdrawal notification deposit account must hold a minimum of 500,000 Euros.

Fun Facts About Belgium’s National Debt

- You could wrap $1 bills around the Earth 2,522 times with the debt amount.

- If you lay $1 bills on top of each other they would make a pile 70,748 km, or 43,961 miles high.

- That's equivalent to 0.18 trips to the Moon.

Interested in Trading Commodities?

Interested in trading Belgian commodities? Start your research with reviews of these regulated brokers available in .

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74%-89% of retail investor accounts lose money when trading CFDs. You should consider whether you can afford to take the high risk of losing your money.

Sources and Further Reading

- Belgian Debt Agency

- Learn more about the state of world government debt from our other country debt clock pages.

- See our global economic indicator guide to more than 45 countries.

- Get our full guide to trading commodities.

Also see our guides on stock, CFD, and commodity brokers to find out which online trading platforms are available in .