XM.com Broker Review: What’s the Deal With the Huge Leverage?

Risk Warning: Your Capital is at Risk.

XM is an online broker for trading on forex with a strict no re-quotes and no rejections policy.

As an internationally regulated and licensed broker, XM has more than 3.5 million clients in over 200 countries with access to trading more than 1,000 instruments.

Traders with XM can choose between the popular MetaTrader 4 or MetaTrader 5 platforms or access the XM WebTrader through their browser.

Since its founding in 2009, the broker has picked up over 30+ industry awards. This review gives readers in an in-depth overview of XM and discusses the broker’s advantages and disadvantages.

Contents

Key XM Facts & Features

www.xm.com |

|

|---|---|

| Our Overall Rating | |

| Broker Trust Rating | 80/100 |

| Trading Products | CFDs, forex |

| Markets | CFDs on commodities, energies, forex, indices, metals, and stocks |

| Countries Served | 196+ (full list below) |

| Minimum Deposit | Micro or Standard Account: $5, XM Zero Account: $100. (*account availability depends on the client's country of residence) |

| Spreads & Fees | Variable spread on each trade; overnight fees; account dormant for 90 days or more: $5 |

| Regulators | FCA, IFSC, ASIC, CySEC, and more. (See the full list.) |

| Customer Support | Email, phone, call back and live chat |

| Demo Account | Yes, up to 5 per trader, no expiry. |

Pros and Cons of Choosing XM

XM appeals to traders across the world who can rely on support in their language. The broker’s track record of over 2.4 billion trades executed with no re-quotes or rejections is further motivation for traders to consider this regulated broker.

XM’s forex fees are average and you can also expect to pay an inactivity fee if your account is dormant for more than 90 days.

| What's good about XM? | What could XM do better? |

|---|---|

What Can You Trade With XM?

XM offers clients access to trading forex and CFDs on stocks, energy commodities, soft commodities, precious metals, and indices. More than 1,000 instruments are available to trade.

Forex Pairs

XM offers trading in more than 55 currency pairs including majors, minors, and many exotics.

List of currency pairs available to trade with XM

| Currency Pair |

|---|

| AUD/CAD |

| AUD/CHF |

| AUD/JPY |

| AUD/NZD |

| AUD/USD |

| CAD/CHF |

| CAD/JPY |

| CHF/JPY |

| CHF/SGD |

| EUR/AUD |

| EUR/CAD |

| EUR/CHF |

| EUR/DKK |

| EUR/GBP |

| EUR/HKD |

| EUR/HUF |

| EUR/JPY |

| EUR/NOK |

| EUR/NZD |

| EUR/PLN |

| EUR/RUB |

| EUR/SEK |

| EUR/SGD |

| EUR/TRY |

| EUR/USD |

| EUR/ZAR |

| GBP/AUD |

| GBP/CAD |

| GBP/CHF |

| GBP/DKK |

| GBP/JPY |

| GBP/NOK |

| GBP/NZD |

| GBP/SEK |

| GBP/SGD |

| GBP/USD |

| NZD/CAD |

| NZD/CHF |

| NZD/JPY |

| NZD/SGD |

| NZD/USD |

| SGD/JPY |

| USD/CAD |

| USD/CHF |

| USD/CNH |

| USD/DKK |

| USD/HKD |

| USD/HUF |

| USD/JPY |

| USD/MXN |

| USD/NOK |

| USD/PLN |

| USD/RUB |

| USD/SEK |

| USD/SGD |

| USD/TRY |

| USD/ZAR |

Stock CFDs

CFDs on over 100 US, UK, and Germany stocks are available to trade on the XM platform.

See some of XM’s international stock CFDs

| Country | Stocks |

|---|---|

| US | Aflac, Alcoa, Alibaba, IBM, Tesla |

| UK | Aviva, BTGroup, HSBC, Unilever, Vodafone |

| France | AirFrance, Peugeot, Danone, Ubisoft, Veiola |

| Germany | Adidas, AllianzAG, Daimler, Deutsche Bank, Lufthansa |

| Netherlands | Philips, TomTom, Fugro, BAM, SBM |

| Spain | Santander, IAG, Sacyr, Mapfre, Repsol |

| Switzerland | Nestle, UBS, Swisscom, Oerlikon, Temenos |

| Belgium | Ontex, Proximus, Solvay, UCB, Dieteren |

| Italy | UniCredit, Moncler, FinecoBank, Ferrari, DeLonghi |

| Greece | Jumbo, Piraeus Bank, MotorOil, OPAP, PPC |

| Portugal | Semapa, Sonae, Galp Energia, Mota-Engil, NOS |

| Sweden | Ericsson, Volvo, H&M, Betsson, Husqvarna |

| Finland | Nokia, Fortum, Orion, Neles, Kemira |

| Norway | Orkla, Telenor, Salmar, Mowi, Norwegian Air |

| Austria | OMV, Verbund, Raiffeisen Bank, UNIQA, Andritz |

| Russia | Lukoil, Gazprom |

| Brazil | Petroleo BRA, BRF, Ambev, Gerdau, Vale |

| Canada | Aphria, Brookfield, Cronos, Shopify, Telus |

Access to shares CFDs depends on the client’s country of residence. Always check the broker website for the latest information.

Commodity CFDs

XM clients can trade popular soft commodity, energy, and metals futures CFDs.

List of XM commodities CFDs

| Commodity | Category |

|---|---|

| Brent Crude Oil | Energy |

| London Gas Oil | Energy |

| Natural Gas | Energy |

| WTI Oil | Energy |

| WTI Oil Mini | Energy |

| Gold | Metals |

| High-Grade Copper | Metals |

| Silver | Metals |

| Cocoa | Soft Commodities |

| Coffee | Soft Commodities |

| Corn | Soft Commodities |

| Cotton | Soft Commodities |

| Soybean | Soft Commodities |

| Sugar | Soft Commodities |

| Wheat | Soft Commodities |

Equity Indices

The indices CFDs offered for trading on the XM platform include cash and futures equity indices.

XM equity indices

| Symbol | Category |

|---|---|

| AUS200Cash | Cash Index |

| EU50Cash | Cash Index |

| FRA40Cash | Cash Index |

| GER30Cash | Cash Index |

| HK50Cash | Cash Index |

| IT40Cash | Cash Index |

| JP225Cash | Cash Index |

| NETH25Cash | Cash Index |

| SPAIN35Cash | Cash Index |

| SWI20Cash | Cash Index |

| UK100Cash | Cash Index |

| US100Cash | Cash Index |

| US30Cash | Cash Index |

| US500Cash | Cash Index |

| EU50 | Futures Index |

| FRA40 | Futures Index |

| GER30 | Futures Index |

| JP225 | Futures Index |

| SWI20 | Futures Index |

| UK100 | Futures Index |

| US100 | Futures Index |

| US30 | Futures Index |

| US500 | Futures Index |

| USDX | Futures Index |

Where Does XM.com Operate?

XM offers trading services to residents or citizens of more than 200 countries. The broker’s head office is in Limassol, Cyprus, while they also have offices in Athens and Sydney.

To confirm whether is on the list, you can go to the XM registration page for the most up-to-date information. This page will also tell you whether you’re eligible to open an account with XM or XM Global.

IMPORTANT: CFDs are not available in the USA due to local regulation, and regulated brokers do not accept US citizens or US residents as clients.

See the countries XM operates in

| Afghanistan |

| Albania |

| Algeria |

| Andorra |

| Angola |

| Anguilla |

| Antarctica |

| Antigua and Barbuda |

| Argentina |

| Armenia |

| Aruba |

| Australia |

| Austria |

| Azerbaijan |

| Bahamas |

| Bahrain |

| Bangladesh |

| Barbados |

| Benin |

| Belarus |

| Belgium |

| Bermuda |

| Bhutan |

| Bolivia |

| Bosnia and Herzegovina |

| Botswana |

| Brazil |

| British Indian Ocean |

| British Virgin Islands |

| Brunei |

| Bulgaria |

| Burkina Faso |

| Burundi |

| Cabo Verde |

| Cambodia |

| Cameroon |

| Cayman Islands |

| Central African Republic |

| Chad |

| Chile |

| Christmas Island |

| Coco (Keeling) Islands |

| Colombia |

| Comoros |

| Congo (Democratic Republic Of) |

| Congo (Republic Of) |

| Cook Islands |

| Costa Rica |

| Croatia |

| Curacao |

| Cyprus |

| Czech Republic |

| Denmark |

| Djibouti |

| Dominica |

| Dominican Republic |

| East Timor |

| Ecuador |

| Egypt |

| El Salvador |

| Eritrea |

| Ethiopia |

| Estonia |

| Falkland Islands |

| Faroe Islands |

| Fiji |

| Finland |

| France |

| French Guiana |

| French Polynesia |

| Gabon |

| Gambia |

| Georgia |

| Germany |

| Ghana |

| Gibraltar |

| Greece |

| Greenland |

| Grenada |

| Guadelope |

| Guatemala |

| Guinea |

| Guinea-Bissau |

| Guyana |

| Haiti |

| Honduras |

| Hong Kong SAR |

| Hungary |

| Iceland |

| India |

| Indonesia |

| Iraq |

| Ireland |

| Italy |

| Ivory Coast |

| Jamaica |

| Jordan |

| Kazakhstan |

| Kenya |

| Kiribati |

| Korea, South |

| Kuwait |

| Kyrgyzstan |

| Laos |

| Latvia |

| Lebanon |

| Lesotho |

| Libya |

| Liechtenstein |

| Lithuania |

| Luxembourg |

| Macau China |

| Madagascar |

| Malawi |

| Malaysia |

| Maldives |

| Mali |

| Malta |

| Marshall Islands |

| Martinique |

| Mauritania |

| Mauritius |

| Mayotte |

| Mexico |

| Micronesia |

| Moldova |

| Monaco |

| Mongolia |

| Montenegro |

| Montserrat |

| Morocco |

| Mozambique |

| Namibia |

| Nauru |

| Nepal |

| Netherlands |

| New Caledonia |

| Nicaragua |

| Niger |

| Nigeria |

| Niue |

| Norfolk Island |

| Norway |

| Oman |

| Pakistan |

| Palestine, State of |

| Panama |

| Papua New Guinea |

| Paraguay |

| Peru |

| Philippines |

| Pitcairn Islands |

| Poland |

| Portugal |

| Qatar |

| Republic of North Macedonia |

| Reunion |

| Romania |

| Russia |

| Rwanda |

| Saint Helena |

| Saint Kitts and Nevis |

| Saint Lucia |

| Saint Pierre and Miquelon |

| Samoa |

| San Marino |

| Sao Tome and Principe |

| Saudi Arabia |

| Senegal |

| Serbia |

| Seychelles |

| Sierra Leone |

| Singapore |

| Slovakia |

| Slovenia |

| Solomon Islands |

| Somalia |

| South Africa |

| Spain |

| Sri Lanka |

| St Vincent and the Grenadines |

| Sth Georgia & Sth Sandwich Isl |

| Suriname |

| Svalbard and Jan Mayen |

| Swaziland |

| Sweden |

| Switzerland |

| Taiwan Area |

| Tajikistan |

| Tanzania |

| Thailand |

| Togo |

| Tokelau |

| Tonga |

| Trinidad and Tobago |

| Tunisia |

| Turkey |

| Turkmenistan |

| Turks and Caicos Islands |

| Tuvalo |

| Uganda |

| Ukraine |

| United Arab Emirates |

| United Kingdom |

| Uruguay |

| Uzbekistan |

| Vanuato |

| Vatican City |

| Venezuela |

| Vietnam |

| Wallis and Futuna |

| Western Sahara |

| Yemen |

| Zambia |

| Zimbabwe |

XM does not provide trading services to residents of certain countries, including:

- United States of Ameria

- Canada

- Israel

- Islamic Republic of Iran

Website & Support Languages

The XM website is available in 22 different languages, with customer support provided in more than 25 languages.

Languages XM provides support in

- Arabic

- Bahasa Indonesia

- Bahasa Malay

- Bengali

- Bulgarian

- Cebuano

- Czech

- English

- French

- German

- Greek

- Hindi

- Italian

- Nepali

- Polish

- Portuguese

- Romanian

- Russian

- Serbian

- Simplified Chinese

- Slovakian

- Spanish

- Tagalog

- Thai

- Traditional Chinese

- Urdu

- Vietnamese

XM Account Types

Traders can choose from three XM account types: a Standard account, a Micro account, or an XM Zero account. You can also open a demo account to practice strategies and trading.

All XM account types offer negative balance protection for EU residents. That means losses cannot exceed deposits as required by ESMA.

This table summarizes XM’s three account types:

| Micro | Standard | XM Zero | |

|---|---|---|---|

| Base currency options | USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, ZAR | USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, ZAR | USD, EUR, JPY |

| Commission | No | No | Yes |

| Spread on all majors | As low as 1 Pip | As low as 1 Pip | As low as 0 Pips |

| Minimum deposit | 5$ | 5$ | 100$ |

| Islamic account | Optional | Optional | Optional |

Note: Availability of account types depends on the client’s country of residence.

What Instruments Do Accounts Have Access To?

Traders can choose forex or multi-asset options when opening their accounts. A multi-asset account allows trading forex as well as CFDs on the MT5 trading platform.

Once traders have opened an account, they have access to the XM Member section of the broker site and their trading platform of choice.

From here traders can manage their account, including depositing and withdrawing funds, claiming promotions, checking positions and leverage, and accessing the trading tools offered through XM.

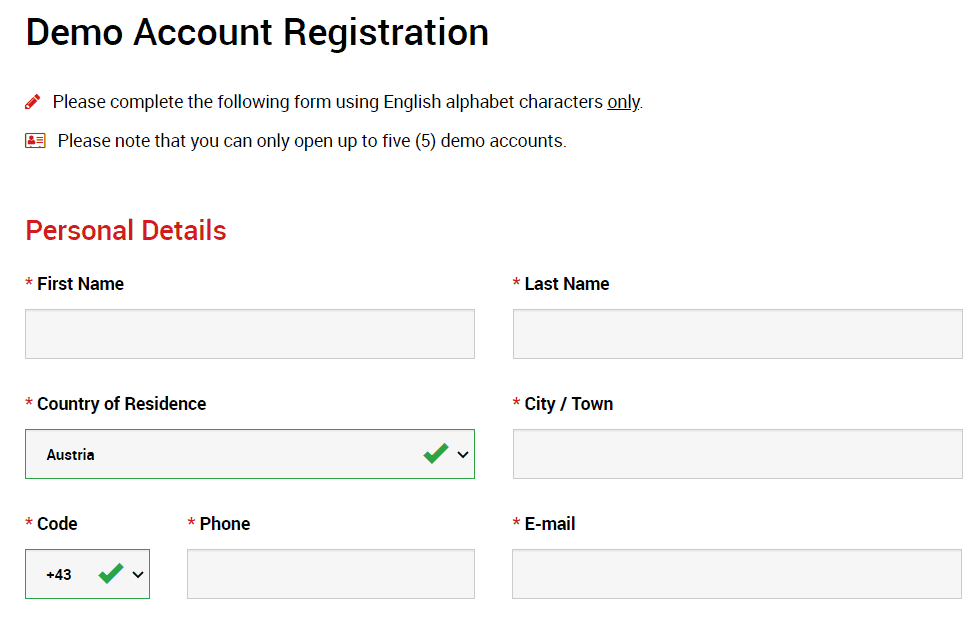

XM Demo Account With MT4

XM’s free demo account is popular among traders to practice ideas or even experienced traders to test strategies. Demo accounts have no expiry date, but they are closed when not used for 90 days.

Clients may apply for a new demo account at any time. Up to five demo accounts are allowed per trader.

Demo accounts have all the features and functions of a real account, including the speed of execution. Traders have access to $100,000 in virtual trading funds with real-time data and analytic tools.

Also, traders with demo accounts can make use of XM’s 24/5 support and all the broker’s educational materials.

Account Requirements

Opening an XM account takes less than five minutes.

First, you fill in some basic information including your name, address, and some information about your financial background and trading experience. XM then sends you an email with your log-in details.

Before you can trade with XM for the first time, you must provide identity and residential address verification.

Documents accepted include a color copy of a valid passport or other official identification documents (e.g. national ID card, driver’s license, or government ID).

What Acount Information Does XM Request?

The identification document must contain the following:

- Full name

- Issue or expiry date

- Place and date of birth or tax identification number

- Signature

To pass the residential address verification, you will need to provide a recent utility bill no older than 3 months. Acceptable bills include the following:

- Electricity bill

- Water or gas bill

- Phone bill

- Television services bill

- Internet bill

Traders then need to fund their accounts with a deposit, discussed below in the deposits and withdrawals section of this review.

Deposits and Withdrawals

Traders with Micro or Standard accounts can open and fund an account with a minimum of $5, while XM Zero accounts require a minimum deposit of $100.

How To Deposit With XM

XM offers several funding options for deposits and withdrawals. These include:

- Major credit cards

- Multiple electronic payment methods

- Bank wire transfer

- Local bank transfer

Exact details about each payment method are visible when you log in to the ‘Members Area‘. Once you selected a payment method of choice, there are clear instructions to follow to complete the process.

Funds are generally available instantly except for Union Pay, which takes 24-hours.

How To Withdraw Funds From XM

XM requires a $5 minimum withdrawal for Micro and Standard accounts. XM Zero accounts have a withdrawal minimum of $100.

All withdrawals above $200 processed by wire transfer are included in XM’s zero fees policy.

When making a withdrawal, XM transfers your funds back to the original funding method you used to fund your account. If this is not possible, they will transfer the funds to your identified bank account. This account must be in the same name as the account maintained with XM.

How Long Do Withdrawals Take?

All withdrawal requests are instantly reflected in clients’ trading accounts as pending withdrawals. XM processes requests within 24 working hours, but it may take up to five business days for funds to arrive depending on the final destination.

Withdrawal requests are processed in the currency in which the deposit was originally made.

XM may require copies of your credit card before approving a withdrawal request. Traders should consult the Funds Withdrawal section of the broker website for more details on this topic.

Leverage and Margins

CFD traders on the XM platform have access to varying amounts of leverage, from 2:1 up to 30:1, depending on the financial instrument traded and in their country of residence.

Margins vary by product type. Calculations are as follows:

| Product | Margin Formula |

|---|---|

| CFDs | Lots * Contract Size * Opening Price * Margin Percentage |

| Forex | Number of Lots * Contract size / Leverage |

| Gold & Silver | Lots * Contract Size * Market Price / Leverage |

Traders should keep track of their available margin. Accounts that exceed the allowable margin face the risk of having positions closed out by XM.

Margin level is calculated as: Equity / Margin * 100%

XM Spreads and Fees

Traders with Micro and Standard accounts pay the XM variable spread on CFD trades instead of a commission.

The broker offers variable spreads only, which means spreads can widen above the minimum XM spread as market conditions become more volatile.

Micro and Standard account spreads on all majors start as low as 1 pip, while XM Zero account holders can expect spreads as low as 0 pip. Always consult the broker website for up-to-date spreads.

Other Relevant Fees

- Overnight fee – Traders who hold positions open overnight are generally charged (or credited with) rollover interest. In the case of forex, the amount credited or charged is calculated based on the position taken as well as the rate differentials between the two currencies traded. In the case of stocks and stock indices, the amount credited or charged is calculated based on whether a short or a long position has been taken.

- Inactivity fee – Accounts that are dormant for 90 or more days incur a monthly inactivity fee of $5.

XM Trading Platform Overview

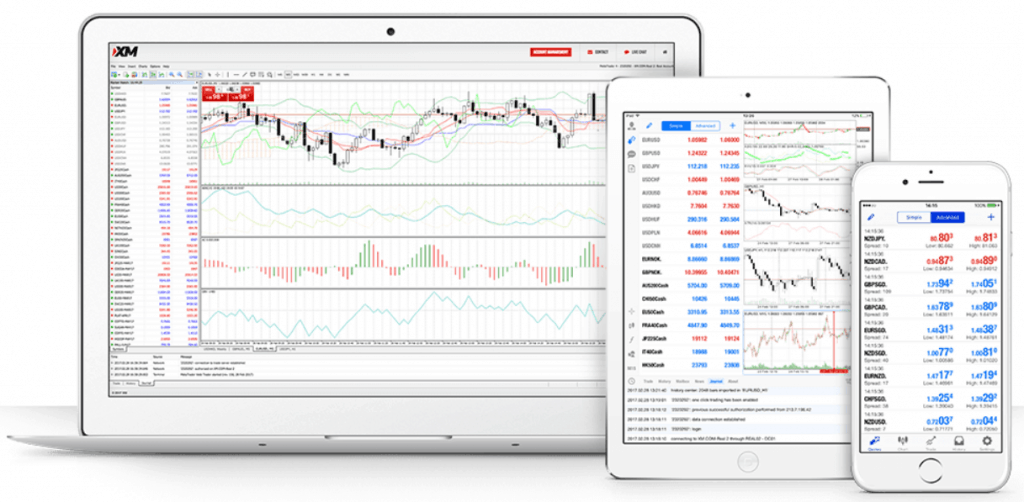

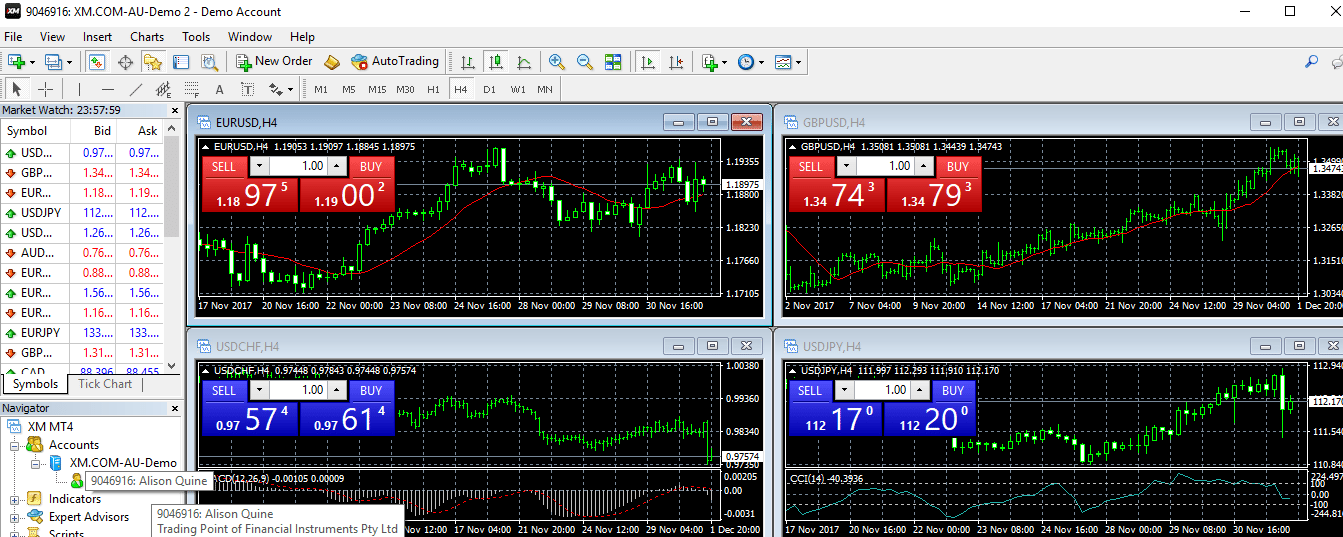

XM offers clients several mobile and desktop versions of both the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms.

Alternatively, traders can opt to access the XM WebTrader through their browser.

Mobile Trading With XM

Both MT4 and MT5 are available for Android and iOS mobile devices.

Links and download instructions for the XM MT4 and MT5 mobile apps are easy to find under ‘Platforms’ in the main menu of the broker website.

With MT4 and MT5 mobile trading, traders can follow the global markets from anywhere and instantly place and execute orders.

There’s no difference between trading assets, tools, or trading speeds for smartphones or tablets and those for desktop PCs.

Desktop Trading With XM

You can use the MT4 or MT5 desktop apps with your XM account or access WebTrader via your web browser instead.

The download is quick, provided you have a decent internet connection. Once traders agree to some standard disclosures they can click the MT4 or MT5 icon on their desktop and be on the platform in seconds.

MT4 and MT5 At a Glance

| XM MT4 Features | XM MT5 Features |

|---|---|

| Access to 1000+ instruments, including forex, futures, and most CFDs | Access to 1000+ instruments, including forex and CFDs (also individual stock CFDs) |

| Single login to 8 platforms | Single login to 7 platforms |

| 1-click trading | 1-click trading |

| Technical analysis with over 50 indicators and tools | Technical analysis with 80 indicators and tools |

| 3 chart types | Can display 100 charts at the same time |

| Hedging allowed | Hedging allowed |

| Full Expert Advisor functionality | Full Expert Advisor functionality |

| Historic data import/exports | Advanced built-in MQL5 development environment |

| Built-in help guides | Multi-currency tester and alerts |

| Guarantees full data back-up and security | Supports all order types |

How Is XM Regulated?

XM is owned and operated by Trading Point Holdings, which is a licensed and multi-regulated financial institution.

Trading Point Holdings is the holding company of Trading Point of Financial Instruments Limited, XM Global Limited, Trading Point of Financial Instruments Pty Ltd, and Trading Point MENA Limited. They are authorized and regulated as follows:

- Trading Point of Financial Instruments Limited is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC), Licence number: 120/10.

- XM Global Limited is authorized and regulated by the International Financial Services Commission (IFSC) (000261/106).

- Trading Point of Financial Instruments Pty Ltd is authorized and regulated by the Australian Securities and Investment Commission (ASIC), AFSL 443670.

- Trading Point MENA Limited is authorized and regulated by the Dubai Financial Services Authority (DFSA) (Reference No. F003484).

Additional Oversight

In addition to the regulators above, XM is under oversight by the following agencies:

See additional oversight agencies for XM.

| Agency | Abbreviation | Locale |

|---|---|---|

| French Prudential Supervision and Resolution Authority | ACPR | France |

| Authority for the Financial Markets | AFM | Netherlands |

| Federal Financial Supervisory Authority | BaFin | Germany |

| National Securities Market Commission | CNMV | Spain |

| Italian Companies and Exchange Commission | CONSOB | Italy |

| Financial Supervisory Authority | FI | Sweden |

| Finnish Financial Supervisory Authority | FIN-FSA | Finland |

| Financial Supervision Commission | UKNF | Poland |

| Hungarian National Bank | MNB | Hungary |

All these agencies have strict compliance guidelines. One such requirement by CySEC is that the broker must regularly submit financial statements to ensure the firm has adequate capital to operate.

The regulators also require XM to segregate client money in separate bank accounts at top-tier financial institutions.

Client funds are also protected through multiple compensation schemes, such as CySEC’s Investor Compensation Scheme. These programs compensate account holders in the event of a brokerage firm’s financial collapse or its inability to make customers whole on their account balances.

FAQs

Is XM legit?

As a multi-regulated online broker, XM must adhere to strict compliance guidelines. At present, XM is overseen by 13 different regulatory bodies based in over 10 countries. The company also boasts a track record of over 2.4 billion trades executed with no re-quotes or rejections. That said, traders are encouraged to do their own research and decide whether XM is the right broker for their needs.

What is the minimum deposit for XM?

The minimum deposit for Micro or Standard accounts is $5. The minimum for XM Zero accounts is $100. Traders can deposit funds into their XM accounts through methods like Visa, Visa Electron, Mastercard, Maestro Diners Club International, UnionPay, XM Card, Skrill, Neteller, Web Money, and bank wire transfers.

How long do XM withdrawals take?

XM withdrawal requests are processed within 24 hours. Clients receive their money on the same day for payments made via e-wallet. Payments by bank wire, credit card, or debit card can take between two-to-five business days. Withdrawals can only be processed via the method used to deposit the funds.

Does XM offer bonuses?

ESMA regulations prohibit CFD brokers from offering bonuses to retail investors in Europe to encourage CFD trading (or a greater volume of trading), including signup bonuses or fee rebates.

However, XM does provide a loyalty program and a rewards system for clients outside of the European Union. For example, clients who maintain an account balance (equity credit) of $5,000 or the currency equivalent get free access to XM’s Virtual Private Server (VPS).

Does XM provide educational resources?

The XM research and education section offers a very detailed library of educational materials for traders. These include market reviews, stock market news, forex news, investment-themed articles, technical analysis, videos, and a learning center where webinars, seminars, and video tutorials are presented.

Credits: Original XM review written by Lawrence Pines. Major updates and additions by Linda de Beer with contributions from the Commodity.com editorial team.