HYCM Analysis 2024: Can You Trade Safely With This Firm? We Review Their Track Record

Risk Warning: Your Capital is at Risk.

HYCM is a leading provider of contracts-for-difference (CFDs) and forex trading services with an operational history of over 40 years.

This review of HYCM covers key facts about the broker for clients in and discusses major advantages and disadvantages.

Contents

What Is HYCM?

HYCM offers trading in CFDs on forex, indices, commodities, stocks, and cryptocurrencies. In February 2020, the company expanded its CFD offering to include exchange-traded funds (ETFs).

CFDs are derivative securities that allow customers to speculate on the price of an asset without actually holding the instruments in their accounts.

The companies under the HYCM Group are regulated in multiple jurisdictions. Traders seeking a regulated and transparent broker that offers its clients access to over 200 forex and CFD instruments may find HYCM suitable.

Registered clients can practice trades and strategies in a demo account.

Key HYCM Facts & Features

www.hycm.com www.hycm.com |

|

|---|---|

| ⭐ Our Overall Rating | |

| 🏆 Broker Trust Rating | 85/100 |

| 🏁 Founded | 1977 |

| 🛍️ Product | CFDs, Forex |

| 📉 Markets | Forex, Indices, Metals, Oil and Gas Soft Commodities, Stocks, Cryptocurrencies, ETFs |

| 🗺️ Countries Served | 140 + (Full list below) |

| 💳 Minimum Deposit | Minimum deposit varies depending on the account you open |

| 💰 Fees | HYCM makes money through the market bid/ask spread. Two of their three real money accounts are commission-free.(See below) |

| 🛡️ Regulators | Cyprus Securities Exchange (CySEC) Financial Conduct Authority (FCA), Cayman Islands Monetary Authority (CIMA), Dubai Financial Services Authority (DFSA) |

| 📞 Customer Support | 24/5 email, phone, fax and live chat in multiple languages |

| 🥇 Awards | Winner of numerous international awards, including Best Forex Broker and Best Retail Platform |

| 🎮 Demo Account | Yes - free demo for registered clients. |

Pros & Cons Of HYCM

HYCM clients can trade CFDs on multiple trading instruments through the industry-standard MetaTrader platforms.

Below is a quick overview of what’s good and what not about opening an account with HYCM.

| What's Good About HYCM? | What Could HYCM Do Better? |

|---|---|

Where Does HYCM Operate?

HYCM’s forex and CFD trading services are available in more than 140 countries. To find out if HYCM operates in , toggle the lists below.

IMPORTANT: CFDs are not available in the USA due to local regulation, and regulated brokers do not accept US citizens or US residents as clients.

Countries where HYCM accepts clients from

- Aland Islands

- Algeria

- American Samoa

- Andorra

- Angola

- Anguilla

- Antigua and Barbuda

- Argentina

- Armenia

- Aruba

- Australia

- Austria

- Azerbaijan

- Bahrain

- Bangladesh

- Belarus

- Belize

- Benin

- Bermuda

- Bhutan

- Bolivia

- Bonaire, Sint Eustatius and Saba

- Bouvet Island

- Brazil

- British Indian Ocean Territory

- British Virgin Islands

- Brunei Darussalam

- Bulgaria

- Burkina Faso

- Burundi

- Cameroon

- Cabo Verde

- Cape Verde

- Cayman Islands

- Central African Republic

- Chad

- Chile

- China

- Christmas Island

- Cocos (Keeling) Islands

- Colombia

- Comoros

- Congo

- Congo, the Democratic Republic of the

- Cook Islands

- Costa Rica

- Croatia

- Cuba

- Curacao

- Cyprus

- Czech Republic

- Denmark

- Djibouti

- Dominica

- Dominican Republic

- Ecuador

- Egypt

- El Salvador

- Equatorial Guinea

- Eritrea

- Estonia

- Ethiopia

- Falkland Islands

- Faroe Islands

- Fiji

- Finland

- French Guiana

- French Polynesia

- French Southern Territories

- Gabon

- Gambia

- Georgia

- Germany

- Gibraltar

- Greece

- Greenland

- Grenada

- Guadeloupe

- Guam

- Guatemala

- Guernsey

- Guinea

- Guinea-Bissau

- Guyana

- Haiti

- Heard and Mc Donald Islands

- Helena

- Holy See(Vatican City State)

- Honduras

- Hungary

- Iceland

- India

- Indonesia

- Cote d’Ivoire

- Iran

- Ireland

- Isle of Man

- Israel

- Italy

- Jersey

- Jordan

- Kazakhstan

- Kenya

- Kiribati

- Korea

- Kuwait

- Kyrgyzstan

- Latvia

- Lebanon

- Lesotho

- Liberia

- Libya

- Liechtenstein

- Lithuania

- Luxembourg

- Macau

- Macedonia

- Madagascar

- Malawi

- Malaysia

- Maldives

- Mali

- Malta

- Marshall Islands

- Martinique

- Mauritania

- Mayotte

- Mexico

- Micronesia, Federated States of

- Moldova, Republic of

- Monaco

- Mongolia

- Montenegro

- Montserrat

- Morocco

- Mozambique

- Namibia

- Nauru

- Nepal

- Netherlands

- New Caledonia

- New Zealand

- Niger

- Nigeria

- Niue

- Norfolk Island

- Northern Mariana Islands

- Norway

- Oman

- Pakistan

- Palau

- Palestine

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Pitcairn

- Poland

- Portugal

- Puerto Rico

- Qatar

- Reunion

- Romania

- Russian Federation

- Rwanda

- Saint Helena

- Saint Kitts and Nevis

- Saint Lucia

- Pierre and Miquelon

- Saint Vincent and the Grenadines

- Samoa (Independent)

- San Marino

- Sao Tome and Principe

- Saudi Arabia

- Senegal

- Serbia

- Seychelles

- Sierra Leone

- Singapore

- Sint Maarten (Dutch)

- Slovakia

- Slovenia

- Solomon Islands

- Somalia

- South Africa

- South Georgia and the South Sandwich Islands

- South Korea (Republic of Korea)

- Spain

- Sri Lanka

- Suriname

- Svalbard and Jan Mayen Islands

- Swaziland

- Sweden

- Switzerland

- Taiwan

- Tajikistan

- Tanzania

- Thailand

- Timor-Leste

- Togo

- Tokelau

- Tonga

- Trinidad and Tobago

- Tunisia

- Turkmenistan

- Turks and Caicos Islands

- Tuvalu

- Ukraine

- United Arab Emirates

- United Kingdom

- Uruguay

- Uzbekistan

- Venezuela

- Vietnam

- Wallis and Futuna Islands

- Western Sahara

- Zambia

Restricted Regions

HYCM does not accept clients from the following countries:

- Afghanistan

- Albania

- Bahamas

- Barbados

- Belgium

- Botswana

- Cambodia

- Canada (British Columbia, Quebec, Saskatchewan)

- France

- Ghana

- Hong Kong

- Iraq

- Jamaica

- Japan

- Lao PDR

- Mauritius

- Myanmar

- Nicaragua

- North Korea

- Panama

- Sudan

- Syria

- Turkey

- Uganda

- USA

- Vanuatu

- Yemen

- Zimbabwe

Furthermore, HYCM does not offer CFD trading to clients with the following nationalities:

- United States

- Hong Kong

- North Korea

- Sudan

What Can I Trade With HYCM?

HYCM’s products include forex, indices, commodities, stocks, cryptocurrencies, and ETFs. With the exception of foreign exchange, all products are structured as CFDs.

Product availability may depend on the country you’re in or the type of account you’re holding. For example, trading in cryptocurrency CFDs is available to Cayman Islands (HYCM Ltd) clients only.

Between 74-89% of retail investor accounts lose money when trading CFDs.

Forex Pairs

More than 60 currency pairs are available to trade through HYCM. Spreads start at 0.2 pips and margins from 3.33%.

See all HYCM forex pairs:

- EUR/USD

- USD/JPY

- GBP/USD

- USD/CHF

- AUD/USD

- USD/CAD

- NZD/USD

- AUD/JPY

- GBP/AUD

- GBP/JPY

- GBP/NZD

- CAD/JPY

- EUR/AUD

- EUR/GBP

- EUR/JPY

- AUD/CAD

- AUD/CHF

- AUD/NOK

- AUD/NZD

- AUD/SEK

- AUD/SGD

- CAD/CHF

- CHF/JPY

- CHF/NOK

- EUR/CAD

- EUR/CHF

- EUR/NZD

- EUR/SEK

- EUR/SGD

- EUR/TRY

- GBP/CAD

- GBP/CHF

- GBP/SGD

- NZD/CAD

- NZD/CHF

- NZD/JPY

- USD/HUF

- USD/MXN

- USD/NOK

- USD/PLN

- USD/SEK

- USD/SGD

- USD/TRY

- USD/ZAR

- USD/INR

- USD/RUB

- CHF/DKK

- CHF/PLN

- EUR/HKD

- EUR/HUF

- EUR/MXN

- EUR/NOK

- EUR/PLN

- GBP/DKK

- GBPNOK

- GBP/PLN

- GBP/SEK

- GBP/ZAR

- HKD/JPY

- MXN/JPY

- NOK/JPY

- NOK/SEK

- NZD/SGD

- SEK/JPY

- SGD/JPY

- TRY/JPY

- USD/CZK

- USD/DKK

- ZAR/JPY

CFDs On Indices

HYCM clients can trade CFDs on 28 global indices.

See all HYCM CFDs on indices:

- US 500 Index CFD

- US 100 Index CFD

- US 30 Index CFD

- UK 100 Index CFD

- Germany 30 Index CFD

- Euro 50 Index CFD

- France 40 Index CFD

- Italy 40 Index CFD

- Spain 35 Index CFD

- Japan 225 Index CFD

- Hong Kong 50 Index CFD

- China H-Shares Index CFD

- China 300 Index CFD

- China A50 Index CFD

- India 50 Index CFD

- Shanghai 50 Index CFD

- US100

- US30

- US500

- UK100

- EUR50

- FRA40

- GER30

- AUS200

- JPN225

- NL25

- SPA35

- SWI20

Commodity CFDs

HYCM offers clients the possibility to speculate on ten commodities’ prices without owning the physical asset.

Stock CFDs

CFDs are available on the following ten popular shares to trade:

- Alibaba

- Amazon.com

- Apple

- Jd.com

- Microsoft

- Tesla Motors

- Vipshop Holdings

Cryptocurrency CFDs

The following cryptocurrencies are available to trade in some countries:

Please Note: Availability subject to regulations. Cryptocurrency CFDs are not available to UK retail traders.

CFDs On ETFs

HYCM introduced ETF CFDs as a trading product in 2020.

List of ETF CFDs offered by HYCM

- VelocityShares 3x Inverse Crude Oil ETN

- iShares MSCI Taiwan Index

- iShares MSCI South Korea

- iShares Russell 2000 Index

- iShares Silver Trust

- SPDR S&P 500

- ProShares UltraPro Short QQQ

- ProShares UltraShort 20+ Year Treasury

- ProShares UltraPro QQQ

- VelocityShares 3X Long Natural Gas ETN

- United States Oil

- VelocityShares 3x Long Crude Oil ETN

- Materials Select Sector SPDR

- Energy Select Sector SPDR

- Financial Select Sector SPDR

- Industrial Select Sector SPDR

- Technology Select Sector SPDR

- Consumer Staples Select Sector SPDR

- Utilities Select Sector SPDR

- Health Care Select Sector SPDR

HYCM Spreads and Fees

HYCM receive their compensation through the market bid/ask spread. The underlying financial instrument and the type of account determine the spreads that traders pay.

The broker obtains the data from reputable third-party sources, who obtain the data directly from exchange feeds. Depending on market conditions, the company reserves the right to increase or decrease spreads on very short or even no notice.

In their bid to be transparent, HYCM communicates exact charges per trade through its trading platform.

Other Fees

| Commission | Holders of Raw accounts pay a commission of $4 per round. Fixed and classic accounts are commission-free. |

| Deposit Fee | None |

| Withdrawal Fee | $30 for wire transfers under $300. 1% fee for Skrill and Neteller withdrawals over $5,000. No fees for other methods. |

| Overnight Interest | Applicable to rolling contracts. The fee depends on current interest rates, trade size and the open price of the trade. Here are the formulas for calculating overnight fees:

|

| Guaranteed Stop Orders | Traders who want to guarantee that their position closes at a specified price may pay wider HYCM spreads to execute these trades. |

Note: Different fees and conditions may apply to Islamic accounts.

HYCM Account Comparison

HYCM offers clients three types of live trading accounts and a demo account. Based on their requirements and experience, traders can choose between a Fixed, Classic, and Raw account.

HYCM Accounts at a Glance

Here are a few comparison points between the three live accounts:

| Fixed | Classic | Raw | |

|---|---|---|---|

| Min. Deposit | $100 | $100 | $200 |

| Min. Trade Volume | 0.01 | 0.01 | 0.01 |

| Mobile Trading | Yes | Yes | Yes |

| Islamic Account Available? | Yes | Yes | Yes |

| Expert Advisor Available | No | Yes | Yes |

Account Requirements

When you click on the red ‘Open Live Account’ button on the HYCM website, the system asks you to pick your country of origin from a drop-down menu.

Before you execute your first trade, you need to enter your name, email address, country of origin and phone number. Then you answer a few questions about your background and financial knowledge.

After completing this form, prospective traders must complete two more steps:

- Verify the account

- Deposit funds into the account

How To Verify Your HYCM Account

Traders must provide the following documents to HYCM within seven days of opening an account:

- Copy of a passport or a national ID card

- Proof of address — the following are acceptable:

- Bank statement

- Utility bill issued within the last 3 months

- If you deposited by credit card, HYCM requires a photocopy of the front of the card

Traders can submit these documents by email, fax, computer upload, or mobile device upload.

Can I Open a Demo Account with HYCM?

Only registered HYCM clients can open a demo account to practice trading or try new strategies without the risk of losing real money.

The demo account looks like the live account, and traders get the same functionality, except the ability to trade real funds.

To open a demo account, traders must go to their Client Portal and click on ‘Create Demo Account‘ under the ‘Trading Account’ menu.

The MetaTrader 4 platform is used for the demo account. Clients have access to $50,000 in virtual money. Accounts stay active for 14 days, but clients can open as many demo accounts as they wish over an unlimited time period.

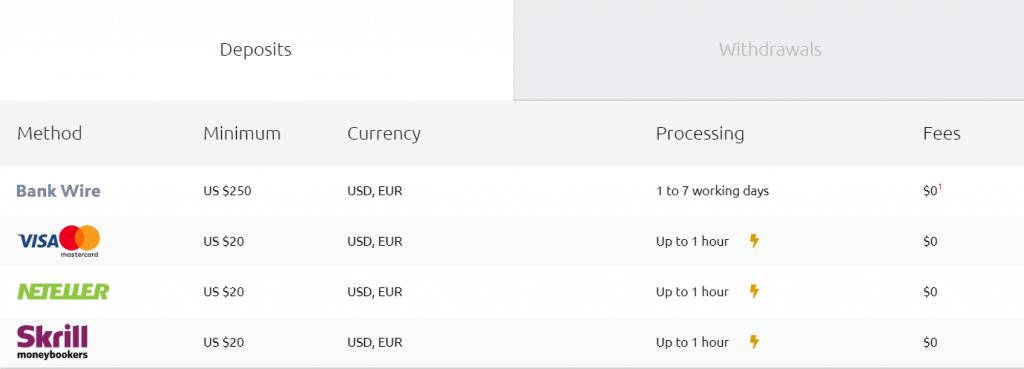

HYCM Deposits and Withdrawals

Here’s a summary of HYCM’s deposit and withdrawal processes, including any fees trades may incur.

How To Deposit Funds With HYCM

Depending on their region, HYCM clients can make deposits via:

- Visa or MasterCard

- Wire transfer

- e-Wallets: WebMoney, Neteller, China UnionPay, Skrill, Interac

The minimum deposit to start trading is $100. After that, the minimum amount required to make a deposit starts at $20 via Visa/Master cards or e-Wallets. These methods are processed as fast as one hour.

The minimum deposit by wire transfer is $250 and takes up to 7 working days to process.

Where Is The Deposit Menu?

Making a deposit is fast and simple. Traders click on the banking and deposit funds buttons of the account they wish to use on their main client portal screen.

Then, they select the deposit method of their choice, fill in the required information, and click “Submit“.

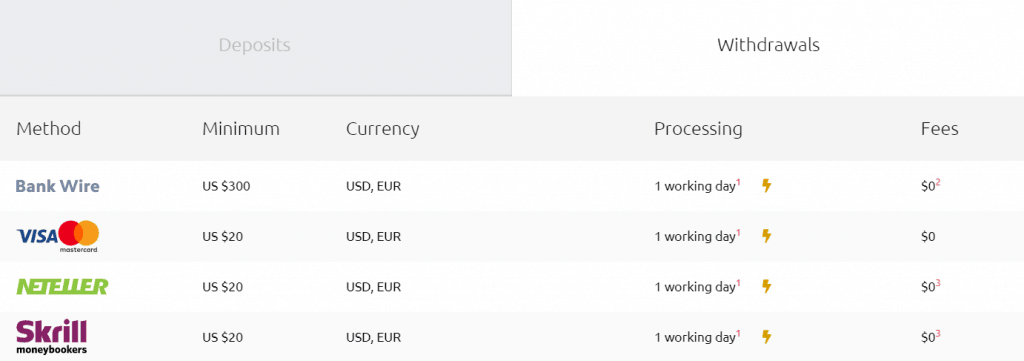

How To Withdraw Funds From HYCM

HYCM transfers funds back to the original source you used to fund your account (otherwise via wire transfer only directly into your bank account).

Withdrawal minimums apply depending on the method of withdrawal:

- Visa/Master Cards and e-Wallets: $20 (1% fee on Skrill and Neteller withdrawals over $5,000.)

- Wire Transfers: $30 on amounts under $300

HYCM may require copies of your credit card before approving a withdrawal request. Traders should consult the banking section of the HYCM website for more details.

While withdrawal requests are generally processed within one business day, it can take between 3 and 7 days for the funds to show in your account due to stringent security checks.

HYCM Trading Platform Review

HYCM offers traders the option to trade forex and CFDs with the industry-standard MetaTrader 4 (MT4) or MetaTrader 5 (MT5) trading platforms.

More importantly, they can trade on-the-go using MetaTrader mobile applications

Both platforms can be downloaded and installed directly from the HYCM website.

This review will discuss the different features of the two platforms to help you decide which one is best for you.

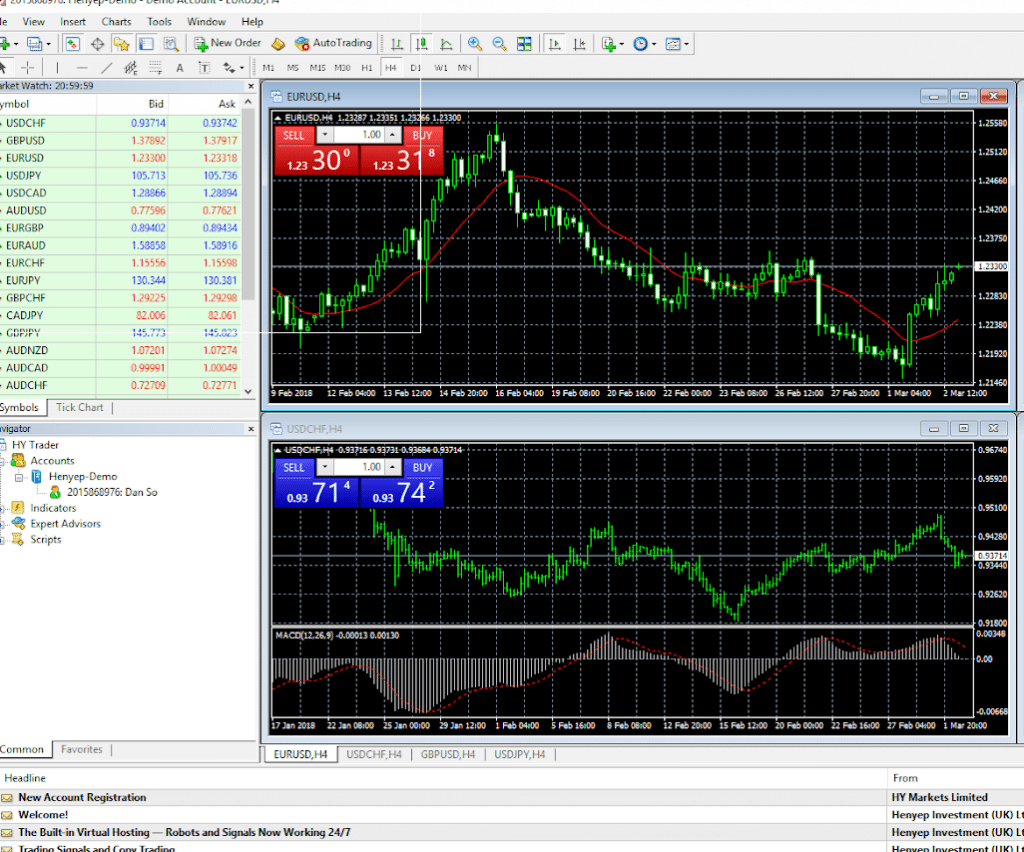

HYCM MetaTrader 4 Platform Features

Logging in to the HYCM Metatrader 4 (MT4) platform for the first time is simple and straightforward. The overview page directs you to the download link and the setup window.

After download and installation, traders agree to some standard disclosures and access the MT4 icon on their desktop.

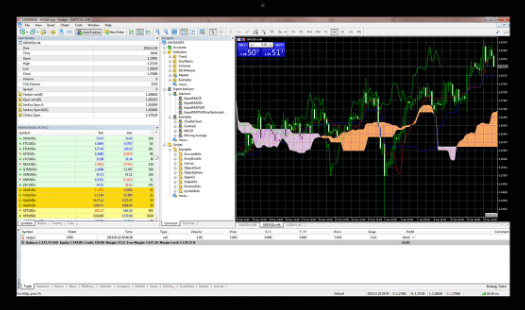

After logging in with their username and password, traders arrive at the main trading screen, which contains the three main panels that comprise the platform:

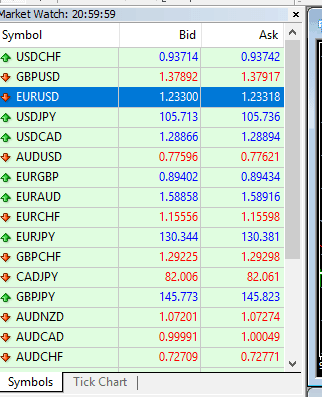

Market Watch Panel

This panel contains the live prices and symbols of popular instruments traded on HYCM.

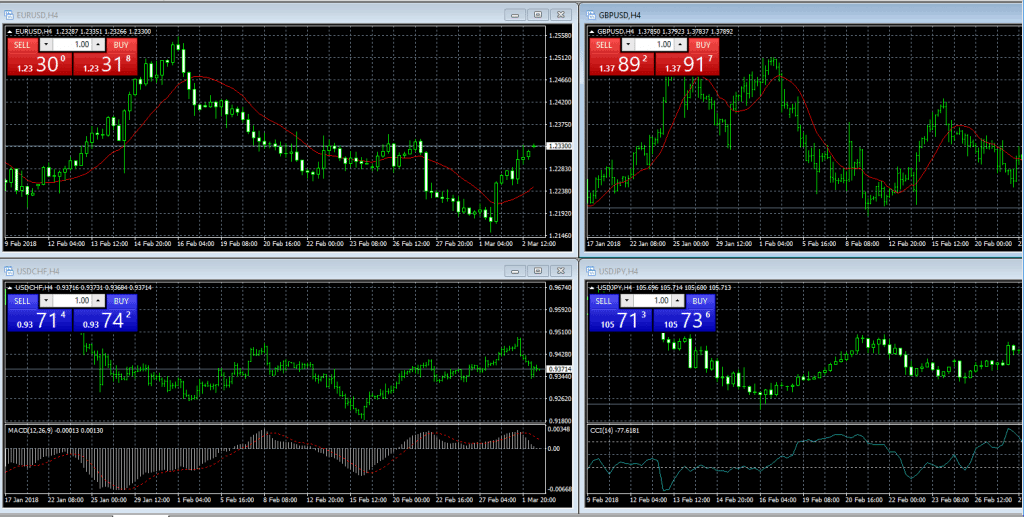

Chart and Ticket Window

This large panel in the middle of the screen displays the historical prices, technical indicators and charting tools used to create price charts.

It opens with four charts which traders can customize and configure each with unique indicators and technical analysis tools.

This feature may prove useful to traders, since:

- It allows the trader to look at four charts for different instruments or different timeframes at the same time, and

- It has a built-in ticket feature that allows traders to click on the price and instantly send an order to buy or sell.

Traders can also right-click on any part of the Market Watch panel to get a list of useful data points such as high-low prices, depth of market, and tick chart. If you click on the chart window choice, then a new chart will appear along with the four charts that populate the window upon opening it.

When traders click on any of the other data points, the information appears in the Market Watch panel. Traders can also right-click on a symbol and pull up a tick chart for a particular instrument.

Customizable Chart

Traders can access their open orders and a ticket window by right-clicking on a specific chart. They can also change the timeframe, perspective, and colors of a chart.

With the window tab at the top of the platform, traders can organize the charts in cascade, horizontal or vertical format.

Active traders that like to keep multiple charts open at once are certainly going to find these features attractive.

Terminal Window Panel

This panel shows the trader’s active, pending, and closed trades. This is also where the trader can configure alerts and monitor the platform’s trading and system notifications.

The top menu on MT4 has a help section that contains documentation, video tutorials, and other guides to using MT4.

HYCM MetaTrader 5 Platform Features

While MT4 is perfectly adequate for trading CFDs and forex, MetaTrader 5 (MT5) comes with advanced features and functions.

MT5 offers traders 21 timeframes and 6 types of pending orders. In addition, its advanced technical analysis options include 38 technical indicators, 44 analytical objects, and unlimited charts.

One of MT5’s most helpful features is an economic calendar where traders can keep track of events that can impact the market. It’s also compatible with automated trading applications such as Expert Advisors and Trading Central.

While MT5 boasts some practical features, they may be excessive for HYCM clients who are trading forex and CFDs only. However, if you’re a trader interested in additional tools, MT5 may be suitable.

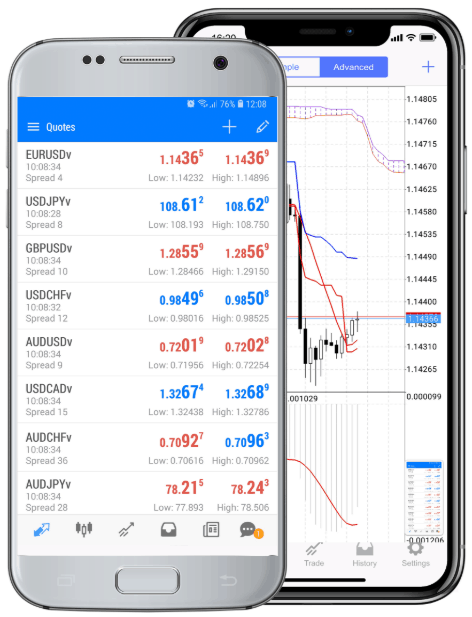

HYCM Mobile Trading

Mobile applications have made it possible for traders to trade from anywhere in the world. HYCM clients have complete control over their trading accounts from their smartphones through the MetaTrader 4 and MetaTrader 5 mobile applications.

Both the MetaTrader 4 and MetaTrader 5 trading platforms are available as iOS or Android application. No Windows app is available.

- MT4 App – This app allows traders to monitor their account status, execute trade transactions, and track trade history. Furthermore, it gives traders access to quote charts, trade orders, and top analytical tools. Push notifications and the possibility to chat with other traders are some more handy features of the MT4 mobile trading app.

- MT5 App – MetaTrader 5 was improved to support both netting and hedging over MetaTrader 4. It also features Market Depth and professional technical analysis through a range of indicators and analytical objects.

HYCM Education Resources

HYCM has an education section on their website that offers a variety of tools for learning about HYCM markets and trading.

The section is divided into three subsections:

- Forex Education – Under this section traders will find a range of tutorials, trading strategies, educational videos, and eBooks. These include tutorials, but also cover topics such as Trading Psychology and the different asset classes.

- Webinars and Workshops – HYCM clients can learn from market and trading experts by attending weekly webinars and online workshops. The Monday webinars help traders prepare for the week ahead by analyzing market movements. In the online workshops, and HYCM expert shows clients the ins and outs of trading by using their demo accounts.

- Seminars- The HYCM seminars are live events held in different locations across the globe. Future events are always announced on the website.

Customer Support and Security

HYCM offers customers dedicated 24/5 customer support in multiple languages. Traders can contact HYCM customer service by phone, fax, email or live chat or directly through the company’s worldwide offices.

The HYCM website is available in 12 different languages to make it more accessible to all its clients from different countries across the world.

List of HYCM website languages

- English

- Spanish

- Arabic

- Italian

- Russian

- Czech

- Chinese

- Swedish

- Persian

- Polish

- French

- Vietnamese

HYCM has implemented technology and security processes to meet security standards and ensure data protection.

Client information is encrypted with 128-bit SSL certificates issued by VeriSign. Connections between clients and HYCM’s servers are also encrypted and secured in accordance with banking standards.

Can I trust HYCM?

HYCM has a reputation as a popular online forex and CFD broker. In addition to being regulated in multiple jurisdictions, they have an operating history of more than 40 years.

How Is HYCM Regulated?

HYCM is the trading name of Henyep Capital Markets (UK) Limited, HYCM (Europe) Ltd, HYCM Limited, and Henyep Capital Markets (DIFC) Limited for which the Henyep Capital Markets group is the holding company.

The different companies in the group are regulated as follow:

- Henyep Capital Markets (UK) Limited is authorized and regulated under the Financial Conduct Authority (FCA) with reference number 186171.

- HYCM (Europe) Ltd is authorized and regulated under the Cyprus Securities and Exchange Commission (CySEC) under license number 259/14.

- HYCM Ltd is authorized and regulated under the Cayman Islands Monetary Authority (CIMA) under reference number 1442313.

- Henyep Capital Markets (DIFC) Limited is authorized and regulated by the Dubai Financial Services Authority (DFSA) with license number 000048.

In addition, HYCM Europe is individually registered with the following EU member states:

- Germany – Federal Financial Supervisory Authority (BaFin)

- France – Autorité de Contrôle Prudentiel (ACP)

- Spain – Comisión Nacional del Mercado de Valores (CNMV)

- Poland – Polish Financial Supervision Authority (KNF)

- Sweden – Finansinspektionen (FI)

- Italy – Commissione Nazionale per le Società e la Borsa (CONSOB)

- UK – Financial Conduct Authority (FCA)

- Hungary – Magyar Nemzeti Bank (MNB)

UK and Europe Client Money Protection

Here’s a summary of what protection HYCM clients can expect by an FCA and CySec regulated broker:

| Regulator | Countries Covered | Protection Offered | Additional Protection Offered |

|---|---|---|---|

| Cyprus Securities Exchange (CySEC) | Austria, Belgium*, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, The Netherlands, United Kingdom. CySEC also offers a provision of services to certain countries outside of the EU. *No CFD trading available. | All client funds are held in a segregated client bank account | The Investor Compensation Fund may provide up to €20,000 if HYCM fails. |

| Financial Conduct Authority (FCA) | United Kingdom | All client funds are held in a segregated client bank account | The Financial Services Compensation Scheme (FSCS) may cover up to £85,000 if HYCM fails. |

Brief History of HYCM

The Henyep Group was founded in 1977 as Henyep Gold Dealers and subsequently became a member of the Hong Kong Gold and Silver Exchange Society.

In 2000, Henyep Investments was at the forefront of the creation of CFD trading on energy and commodities. They were a founding member of the online stock trading platform Hotrade.

Henyep consolidated its capital markets investment brands in 2016. As a result, a multi-platform online trading website HYCM.com was launched.

HYCM has their headquarters in London, United Kingdom, with other offices in Cyprus, and Hong Kong.

HYCM Rewards & Promotions

Because HYCM is regulated within the EU, they are unable to offer sign-up promotions due to the Markets in Financial Instruments Directive (MiFID). This has been introduced across the EU in order to protect traders with a more transparent approach to markets.

However, HYCM does offer a 10% credit reward for all deposits made over $100 (to a maximum of $5,000) to clients of HYCM Limited (regulated by the Cayman Islands Monetary Authority). These clients are also eligible to receive a $200 cash reward for referring new clients who fund their accounts with at least $500 and continue to trade 3 lots. [T&C’s apply]

Key HYCM Takeaways

As a long-established and internationally regulated CFD broker, HYCM clients are assured of trading with a regulated trading platform.

The popular MetaTrader 4 and MetaTrader 5 platforms, in desktop and mobile versions, are an added advantage when opening an account with HYCM.

Furthermore, traders who opt to sign up with HYCM have access to a diverse product offering including forex and a list of CFDs, from commodities to stocks and indices.

FAQs

Is HYCM regulated?

Yes, HYCM is regulated by the Cyprus Securities Exchange (SySEC), the Financial Conduct Authority (FCA), the Cayman Islands Monetary Authority (CIMA), and the Dubai Financial Services Authority (DFSA). HYCM has been operating for over 40 years and is regulated in multiple jurisdictions. See how clients are covered by the FCA and CySec.

Is HYCM a good trading platform?

HYCM gives its clients access to the leading MetaTrader 4 and MetaTrader 5 online trading platforms. This includes state-of-the-art apps for mobile trading.

What is the minimum deposit for HYCM?

The minimum deposit to start trading with HYCM is $100. After that, a minimum deposit of $20 is required to top funds up via Visa/Master cards or e-Wallets. Any deposits by wire transfer must be $250 or more. Different minimum deposits may apply to Islamic accounts opened with HYCM.

How do I withdraw money from HYCM?

Withdrawing available funds from HYCM is done through Visa or Master Card, e-wallets, or wire transfer. Minimum amounts depend on the withdrawal method. Funds are generally withdrawn to the trader’s deposit card’s bank account via wire transfer.

For withdrawals to Visa/Master cards and e-Wallets, the minimum amount is $20. On wire transfers of less than $300, a withdrawal fee of $30 is charged.

Credits: Original review written by Lawrence Pines. Major updates in Jan 2021 by Linda de Beer with contributions from the Commodity.com editorial team.