The National Debt Of Sweden

The IMF calculates the Kingdom of Sweden’s gross national debt to GDP ratio at 41%, but its net debt to GDP ratio as 41.9% at the end of 2020. Previously, the Swedish government reported a lower GDP-to-debt ratio than the IMF.

The difference is because the official figure reported by the government includes only those debts that are covered by investment instruments, such as bills and bonds.

The IMF figure includes much more, including guarantees for loans to other organizations, local government debt, and the debts of state-owned utilities.

How Is National Government Debt Calculated & Reported?

There are many different ways to count a country’s national debt and the Swedish government uses the “non-consolidated central government debt” model. Other countries cout “general government debt” and their national debt.

This figure includes the debts of all of the public sector, no matter how those debts were financed.

Another key surprise in the IMF figures is the big difference between gross debt and net debt. This means that, while maintaining debt, the government also has a lot of assets.

This is probably caused by the government integrating the accounts of the state pension system into its books.

How Did The Definition Of Swedish National Debt Change?

When the fund was run as an independent organization, it included assets, mainly in the form of financial instruments, to fund payments to pensioners.

By the Swedish government’s narrow definition of debt, it does not include the obligations to pensioners, but it does include the assets of the pension fund in its net debt calculation.

Facts About Sweden’s National Debt

What facts should you know about Sweden’s national debt?

- You could wrap $1 bills around the Earth 949 times with the debt amount.

- If you lay $1 bills on top of each other they would make a pile 26,627 km, or 16,546 miles high.

- That's equivalent to 0.07 trips to the Moon.

How Did Sweden’s National Debt Get So Low?

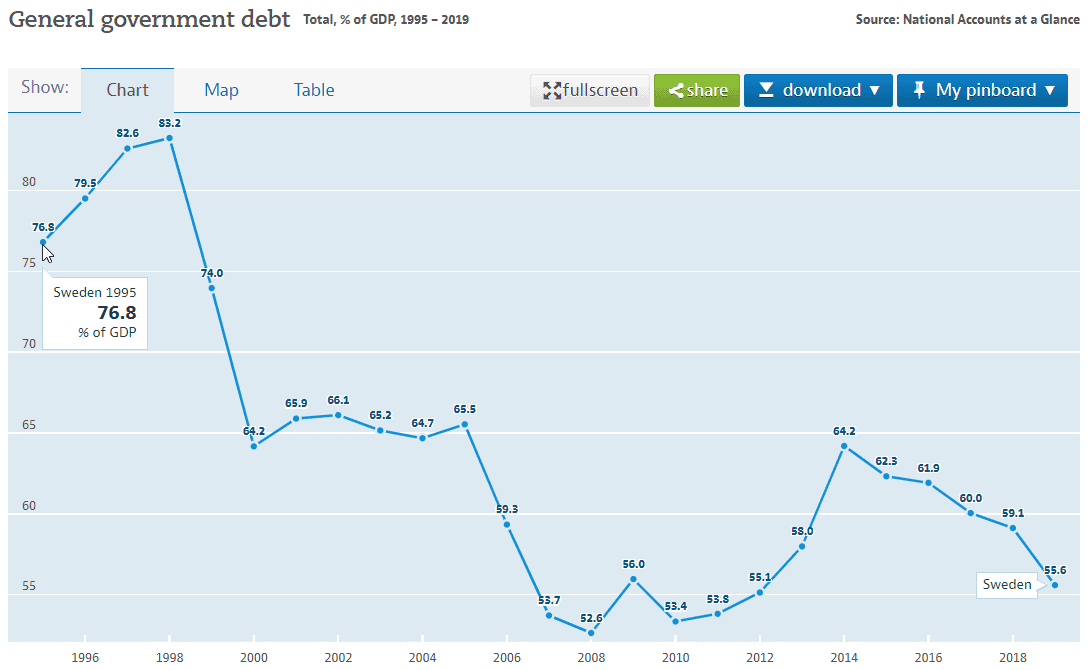

The government of Sweden has made a concerted effort to reduce its own debt, thus lowering public debt as well. In 1995, the central government debt to GDP ratio stood at almost 80%.

The integration of the state pension system into the government accounts gave the central government access to a large amount of savings, much of which was stored in government bonds.

The government used some of this fund to pay off part of the national debt. It also sold off state-owned enterprises to rise money for debt reduction.

What Is Sweden’s Credit Rating?

The table below shows the opinion of the top three scoring agencies on Sweden’s credit rating.

Agency Rating Outlook

Moody's Aaa stable

S&P AAA stable

Fitch AAA stable

Very few countries in the world have a triple-A credit rating. This is one of the main reasons that the government of Sweden does not have to pay a high-interest rate in order to attract investors to buy its bonds.

The most recent long-term bonds issued by the government of Sweden bore an interest rate of 0.39%. However, the low-interest rate is not solely based on credit rating.

As a comparison, Mexico, which has an A+ rating had to offer an interest rate of 7.25% on its most recent issue of long-term benchmark bonds.

Who Manages Sweden’s National Debt?

King Gustav III of Sweden set up the Swedish National Debt Office as the Riksgäldskontoret in 1789 to raise funds for a war with Russia.

The country already had a central bank, the Sveriges Riksbank, which is the oldest central bank in the world.

Although the central bank was originally created to raise money for the governance of the country, its rules stated that all bill issuances had to be backed by silver.

Why Did The Swedish King Set Up The Riksgäldskontoret?

The King wanted to raise more money than his silver stocks would allow, so the creation of the Riksgäldskontoret enabled him to source funds backed by nothing more than the reputation of the Kingdom of Sweden.

The Debt Office is answerable to the Ministry of Finance, which appoints the Office’s Board of Directors.

Debts Sold By The Swedish Central Bank

Answerable to the national parliament since 1989, the National Debt Office is still responsible for raising funds for the government through debt, while the central bank retains responsibility for managing the currency.

Curious about which commodities and goods Sweden trade the most? See the Economic Overview Of Sweden to find out.

Although the Sveriges Riksbank is not responsible for selling debt, it does have observer influence and has to take into account the actions of the government and the National Debt Office when it sets interest rates.

Also, the Bank overseas secondary debt markets and is allowed to buy Swedish government debt.

Types Of Swedish Government Securities

The Swedish National Debt Office is active in a number of markets. The table below shows where all of Sweden’s national debt was sourced.

Central government debt Debt instrument As at Aug 2018 SEK As at Aug 2018 USD

Capital market 1,130,349,383,375 124,573,544,843

Government bonds 628,854,850,000 69,304,835,309

Inflation-linked bonds 206,005,682,144 22,703,474,218

Public bonds, foreign currencies 295,488,851,231 32,565,235,316

Money market 53,843,880,522 5,934,026,385

T-bills 20,000,000,000 2,204,10,000

Liquidity management 28,857,329,406 3,180,308,559

Collateral 4,986,551,117 549,557,825

Retail market 7,078,643,497 780,123,142

Lottery bonds 6,996,675,000 771,089,558

National debt savings 81,968,497 9,033,584

Foreign exchange derivatives 12,034,449,738 1,326,292,637

Foreign exchange derivatives 12,034,449,738 1,326,292,637

Total 1,203,306,357,131 132,613,987,007

Most of the activities of the National Debt Office are denominated in Swedish Krona.

All debt falls into two basic categories:

- Short-term debt

- Long-term debt

What Are Swedish Short-Term Debt Securities?

Short-term debt refers to all borrowings that are repaid within a year. Sources of short-term financing used by the Swedish National Debt Office include:

- Treasury bills: no interest securities sold at a discount and redeemed at face value. Treasury bills have a maturity period of one year or less.

- Commercial paper: cash management devices that are used a little like a private individual would use an overdraft to make payments a few days before expected income arrives.

- Derivatives: a SEK 4.5 billion derivatives market.

- Retail savings accounts: where members of the general public deposit their savings and the bank pays them interest. The National Debt Office uses these funds for short-term financing.

What Are Swedish Short-Term Debt Securities?

Most of Sweden’s national debt is raised through bonds, which are long-term financing instruments.

The National Debt Office issues three types of bonds:

- Benchmark bonds

- Inflation-linked bonds

- Foreign currency bonds

Benchmark Bonds Or ‘Standard’ Bonds

The standard bond, or “benchmark bond,” provides the largest source of funds for the National Debt Office. The government owes almost three times as much through this type of bond than through its inflation-linked version.

A benchmark bond is issued for a maturity that is a year or longer and pays the same interest rate every year. At the maturity date, the Debt Office pays back the amount that was initially borrowed.

Inflation-Linked Bonds

Inflation-linked bonds rise in value along with Sweden’s Consumer Price Index. The interest rate is fixed for the duration of the bond, but the face value is adjusted each year for inflation.

This means that, with inflation, the actual dum paid out in interest will increase even though the rate remains the same because the capital value has increased. The Debt Office pays the inflation-adjust value of the bond on maturity.

Foreign Currency Bonds

The Swedish government actively pursues international investors by issuing its benchmark bonds in foreign currencies. There is no set rule about which currencies the National Debt Office will issue bonds.

Instead, the Office relies on market analysis to derive where the demand for their bonds lies. The majority of Swedish foreign currency bonds are issued in Euros and US Dollars.

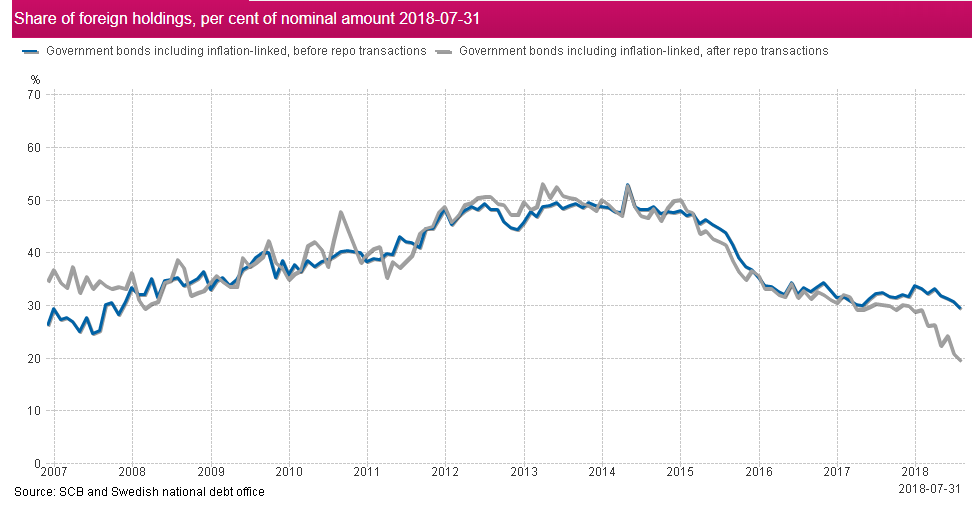

Although foreign investors also buy bonds in Swedish Krona, the issuance of bonds in other currencies has greatly assisted the Debt Office in attracting funds from overseas.

Foreign Investors In The Swedish Bond Market

The table below shows the involvement in the Swedish bond market by foreign investors.

The National Debt Office also has a retail bond to attract the savings of the general public. The Lottery bond is a fixed-term debenture that pays interest annually.

The bonds also double up as lottery tickets. This is not the Swedish National Lottery, but one run solely for the holders of the bonds.

Interested in Trading Commodities?

Start your research with reviews of these regulated brokers available in .

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74%-89% of retail investor accounts lose money when trading CFDs. You should consider whether you can afford to take the high risk of losing your money.

Further Reading

Learn about the national debt of other European countries like Germany, Spain, the UK, Switzerland, Belgium, and Italy.

If you’re interested in the overall economic health of a nation, see our economic overviews:

- Austria’s Economic Overview

- Hungary’s Economic Overview

- China’s Economic Overview

- India’s Economic Overview

- Australia’s Economic Overview

- Nigeria’s Economic Overview

Since the above countries trade many popular commodities, our guides on CFDs, options, bullion, stocks, forex, and cryptocurrency trading may be useful.