ETX Capital (aka OvalX) Reviewed: Lots To Like About This Technical Trading Platform. Here’s The Detail

:CapitalAtRisk:

OvalX (formerly ETX Capital) is an online broker offering Contracts-for-Difference (CFDs), forex, and spread betting. CFDs can be traded across five different asset classes and over 5,000 instruments.

You can choose from two mobile and two desktop platforms, one of them being MetaTrader 4 (MT4). Maximum leverages vary for retail traders based on their location — for example, UK traders get a 30:1 maximum leverage.

This FCA and FSCA-regulated broker’s parent company has over 50 years of industry experience offering trading products and financial services.

Read on to find out about what you can trade, account types, fees, and to dig into an in-depth platform review.

Contents

Pros & Cons

| Pros | Cons |

|---|---|

OvalX / ETX Capital: Key Facts

|

|

|---|---|

| ⭐ Overall Rating | |

| 🛍️ Product | CFDs Spread Betting |

| 📉 Markets | Forex Indices Shares Commodities Bonds Interest Rates Cryptocurrencies |

| 🗺️ Availability | 100+ countries (Read more) |

| 💳 Minimum Deposit | £100 |

| 💰 Fees | Bid/ask spread, Swap charge (Read more) |

| 🛡️ Regulator(s) | Financial Conduct Authority (FCA), Financial Sector Conduct Authority (FSCA), Cyprus Securities and Exchange Commission (CySec), Markets in Financial Instruments Directive (MiFID II) |

| 📞 Customer Support | 24/5 via email, phone, and live chat |

| 🎮 Demo Account | Yes |

Products & Spreads

Contracts-for-difference (CFDs) is one of the products available with OvalX. You don’t own the underlying asset, instead, you place a trade and ‘bet’ on a directional price movement.

:noUSACFDs:

You can also place spread bets on most instruments offered as CFDs. Both are a marginal form of trading. However, CFDs are subject to Capital Gains Tax, while spread betting is not.

A spread is the amount charged for buying and selling a trading instrument. It is made up of the difference between the buy and sell prices of a product often referred to as ‘pip‘.

On instruments like forex pairs, you can also trade forwards contracts — these have a future expiry date.

Here are the available CFD instruments at OvalX’s in-house TraderPro platform, as of January 2022. We included any information that is unlikely to go out of date anytime soon.

Forex CFDs

Minimum spread and minimum margin rates for forex pairs may change over time. Refer to OvalX’s website to ensure they’re up-to-date. Minimum bet sizes are less prone to variation.

See all forex majors.

| Minimum / Premium Spread | Min. Bet Size | Min. Margin | |

|---|---|---|---|

| AUD/USD | 0.8 | 10p | 0.05 |

| EUR/CHF | 1.6 | 50p | 0.0333 |

| EUR/GBP | 0.8 | 50p | 0.0333 |

| EUR/JPY | 0.8 | 50p | 0.0333 |

| EUR/USD | 0.6 | 10p | 0.0333 |

| GBP/EUR | 1.8 | 10p | 0.0333 |

| GBP/JPY | 2 | 50p | 0.0333 |

| GBP/USD | 1.2 | 10p | 0.0333 |

| NZD/USD | 1.6 | 50p | 0.05 |

| USD/CAD | 1.8 | 50p | 0.0333 |

| USD/CHF | 0.8 | 50p | 0.0333 |

| USD/JPY | 0.8 | 10p | 0.0333 |

See all forex minors.

| Minimum / Premium Spread | Min. Bet Size | Min. Margin | |

|---|---|---|---|

| AUD/CAD | 2.4 | 0.1 | 0.05 |

| AUD/CHF | 1.9 | 0.1 | 0.05 |

| AUD/JPY | 1.9 | 0.1 | 0.05 |

| AUD/NZD | 3 | 0.1 | 0.05 |

| CAD/CHF | 3 | 0.1 | 0.0333 |

| CAD/JPY | 2 | 0.1 | 0.0333 |

| CHF/JPY | 2.9 | 0.1 | 0.0333 |

| EUR/AUD | 2.6 | 0.1 | 0.05 |

| EUR/CAD | 3.3 | 0.1 | 0.0333 |

| EUR/NZD | 5 | 0.1 | 0.05 |

| GBP/AUD | 2.9 | 0.1 | 0.05 |

| GBP/CAD | 4 | 0.1 | 0.0333 |

| GBP/CHF | 3 | 0.1 | 0.0333 |

| GBP/HKD | 25 | 0.1 | 0.05 |

| GBP/NZD | 4.9 | 0.1 | 0.05 |

| GBP/ZAR | 190 | 0.1 | 0.05 |

| NZD/CAD | 2.5 | 0.1 | 0.05 |

| NZD/CHF | 4.9 | 0.1 | 0.05 |

| NZD/JPY | 2 | 0.1 | 0.05 |

| USD/HKD | 10 | 0.1 | 0.05 |

| USD/SGD | 4 | 0.1 | 0.05 |

Index CFDs

See the OvalX website for up-to-date minimum spreads, trading hours, and lot sizes for these indices.

See all daily index CFDs.

| Trade Size (Lots) | Min. Margin | |

|---|---|---|

| Euro Stocks 50 | 1 | 0.05 |

| France 40 | 0.1 | 0.05 |

| Germany 40 | 0.1 | 0.05 |

| Hong Kong 50 | 0.2 | 0.1 |

| Italy 40 | 0.1 | 0.1 |

| Japan 225 | 1 | 0.05 |

| Russell 2000 | 0.1 | 0.05 |

| SP 500 | 0.1 | 0.05 |

| Spain 35 | 0.5 | 0.1 |

| UK 100 | 0.1 | 0.05 |

| US Tech 100 | 0.1 | 0.05 |

| Wall Street | 0.1 | 0.05 |

See all futures index CFDs.

| Trade Size (Lots) | Min. Margin | |

|---|---|---|

| Dollar Index | 1 | 0.1 |

| Euro Stocks 50 | 1 | 0.05 |

| France 40 | 0.1 | 0.05 |

| Germany 40 | 0.1 | 0.05 |

| Germany Mid 50 | 1 | 0.1 |

| Germany Tech 30 | 1 | 0.1 |

| Hong Kong 50 | 0.2 | 0.1 |

| Italy 40 | 1 | 0.1 |

| Japan 225 | 1 | 0.05 |

| Russell 2000 | 1 | 0.05 |

| Spain 35 | 1 | 0.1 |

| SP 500 | 0.1 | 0.05 |

| Switzerland Market Index | 1 | 0.1 |

| UK 100 | 1 | 0.05 |

| US Tech 100 | 1 | 0.05 |

| Volatility Index | 1 | 0.1 |

| Wall Street | 0.1 | 0.05 |

Share CFDs

OvalX offers two categories of shares, those that are charged a commission, and commission-free shares.

There are over 200 commission-free shares across the categories listed above, including companies like Tesla, Apple, Rolls Royce, and Amazon.

Commodity CFDs

CFDs on commodities are offered as daily rolling contracts and futures CFD contracts.

There are four daily rolling CFD products at OvalX:

| Minimum Trade Size (Lots) | Margin Requirement From | |

|---|---|---|

| Gold | 0.1 | 0.05 |

| Silver | 0.1 | 0.1 |

| Brent Crude | 0.1 | 0.1 |

| Nymex Crude | 0.1 | 0.1 |

All other commodity CFDs are futures-based:

| Energy | Min. Spread | Min. Trade Size (Lots) | Min. Margin |

|---|---|---|---|

| Brent Crude Oil | 0.06 | 0.1 | 0.1 |

| Carbon Emissions | 0.08 | 1 | 0.1 |

| Natural Gas | 0.02 | 0.1 | 0.1 |

| Nymex Oil Futures | 0.06 | 0.1 | 0.1 |

| Metals | |||

| Copper | 0.4 | 0.1 | 0.1 |

| Gold | 0.6 | 0.1 | 0.05 |

| Palladium | 2 | 0.1 | 0.1 |

| Platinum | 2 | 0.1 | 0.1 |

| Silver | 0.3 | 0.1 | 0.1 |

| Agricultural | |||

| Corn | 1 | 1 | 0.1 |

| Cotton | 0.24 | 1 | 0.1 |

| London Cocoa | 4 | 1 | 0.1 |

| Lumber | 1.6 | 1 | 0.1 |

| Orange Juice | 0.3 | 1 | 0.1 |

| Robusta Coffee | 6 | 1 | 0.1 |

| Soybean | 1.5 | 1 | 0.1 |

| Soybean Oil | 0.08 | 1 | 0.1 |

| US Cocoa | 6 | 1 | 0.1 |

| US Coffee 'C' | 0.4 | 1 | 0.1 |

| US Sugar (no.11) | 0.04 | 1 | 0.1 |

| Wheat | 1 | 1 | 0.1 |

Crypto CFDs

All cryptocurrency CFDs at OvalX come with variable spreads and tiered margin requirements. These are:

- Bitcoin (USD/GBP/EUR)

- Bitcoin Cash (USD)

- Ethereum (USD)

- Litecoin (USD)

- Ripple (USD)

Please Note: Availability subject to regulations. Cryptocurrency CFDs are not available to UK retail traders.

Bond & Interest Rate CFDs

Here are all interest rate and bond CFDs offered:

| Interest Rates | Min. Spread | Trade Size (Lots) | Min. Margin |

|---|---|---|---|

| Euribor | 0.01 | 1 | 0.2 |

| EuroSwiss | 0.01 | 1 | 0.2 |

| Short Sterling | 0.01 | 1 | 0.2 |

| Bonds | |||

| 10 Yr UK Gilt | 0.01 | 1 | 0.2 |

| Euro Bobl | 0.01 | 1 | 0.2 |

| Euro Bund | 0.01 | 0.5 | 0.2 |

| Euro Schatz | 0.01 | 1 | 0.2 |

| French Oat | 0.01 | 1 | 0.2 |

| US T Bond | 0.01 | 1 | 0.2 |

| US 2 Year | 0.01 | 1 | 0.2 |

| US 10 Year | 0.01 | 1 | 0.2 |

Account Types & Fees

There are two live trading accounts available at OvalX. The trading account you register for determines which of the three available trading platforms you can use.

You can choose between these accounts:

- ETX TraderPro Account: Benefit from lower spreads than with an MT4 account. Access the OvalX proprietory trading platform via web and mobile apps (iOS and Android). You can also access ETX Connect, a newly released social trading app.

- MetaTrader 4 Account: Access to advanced trading and automation tools via MT4, though you’re charged higher spreads. Further access to a remastered version of MetaTrader 4, and the MT4 mobile app.

The main differences between the two account types are:

- Varying Spreads: TraderPro is cheaper to use.

- Technical Analysis Tools: MT4 may be preferred by those with prior experience using the software.

- Social Trading: MT4 account holders don’t get access to ETX Connect.

OvalX offers a professional account for traders with £500,000+ capital and trade history of at least 10 significant trades within the past quarter annum.

A free demo account is also available, though you need to provide the same details as to when you open a live account.

Account Fees

OvalX is one of the better brokers sporting a simple fee structure. Here is a summary of fees you’d expect to apply to a standard account, aside from the previously discussed trading costs.

| How the Fee Works | |

|---|---|

| Deposit Fee | Deposits are NOT charged. The only charges you could incur are from your bank or building society. |

| Withdrawal Fee | Five free withdrawals of any amount over $100 every year, $10 for each withdrawal thereafter. $10 for any single withdrawal below $100. |

| Swap Charge | Interbank rates + 1.35% per annum. Charged when positions are left open overnight (10PM GMT) |

| Inactivity Fee | £25 per month for dormant accounts with available funds. An account is dormant when it's inactive for 365+ days. |

OvalX receives most of its compensation through the market bid/ask spread and commission on share CFDs.

How to Register & Verify Your Account

Once you select the ‘Create Account’ option, you’ll need to provide the following details prior to the eligibility survey:

- Country of residence and tax registry

- Nationality

- Full name

- Date of birth

- Mobile number

- Email address

Then, you’ll be asked to choose your:

- Preferred platform (MT4 or TraderPro)

- Account type (CFD or Spread Betting)

- Currency

The same requirements apply to opening a free demo account.

Once you’ve registered, you need to verify your account before you make a deposit. To complete the process, you need:

- Proof-of-identification — like a passport, driver’s license, or national identity card.

- Proof-of-address — a recent document showing your current address, like a bank statement or utility bill.

Deposits & Withdrawals

You can deposit funds into your OvalX account via credit/debit card, bank transfer, or other online payment methods.

| Available Currencies | Deposit Processing Time | Withdrawal Processing Time | |

|---|---|---|---|

| Credit/Debit Card | GBP, USD, EUR, ZAR, PLN, NOK, DKK, CZK, CHF | Instant |

|

| Bank Transfer | GBP, USD, EUR, ZAR, SGD, SEK, RON, PLN, NOK, JPY, HRK, HKD, DKK, CZK, CHF, CAD, AUD | Within 2 hours |

|

| Skrill, Neteller, Union Pay (China) | GBP, USD, EUR, ZAR, PLN, NOK, DKK, CZK, CHF, CNY | Instant | Within 24 hours |

There is no deposit fee, but there is a minimum deposit of £100 (or currency equivalent).

Withdrawals have no additional cost for up to five transactions above £100 per year. Any more than five transactions or any transaction under £100 in value incurs a fee of £10.

Margin Requirements & Margin Calls

OvalX sets margin requirements based on the asset category and instrument you trade. The margin is shown as a percentage and represents the amount of cash you need to trade an amount higher than your initial deposit.

For example, OvalX’s margin rates start at 20% for share CFDs.

If you want to buy a CFD worth £1,000 at a margin of 20%, you need to deposit £200, while you borrow the rest from the broker.

Margin trading is risky, and a broker can close your position when your account balance drops under a defined percentage of the required margin for your open trades. This is called a margin call.

OvalX proceeds with margin calls when your cash balance drops under 50% of your initial deposit. Positions can be re-opened when additional funds are added to met the required margin.

OvalX Mobile & Desktop Platform Review

We tested the Trader Pro platform across several categories. If you trade with OvalX, you will encounter all of the below features at one point or another. Here’s our review and what you can expect.

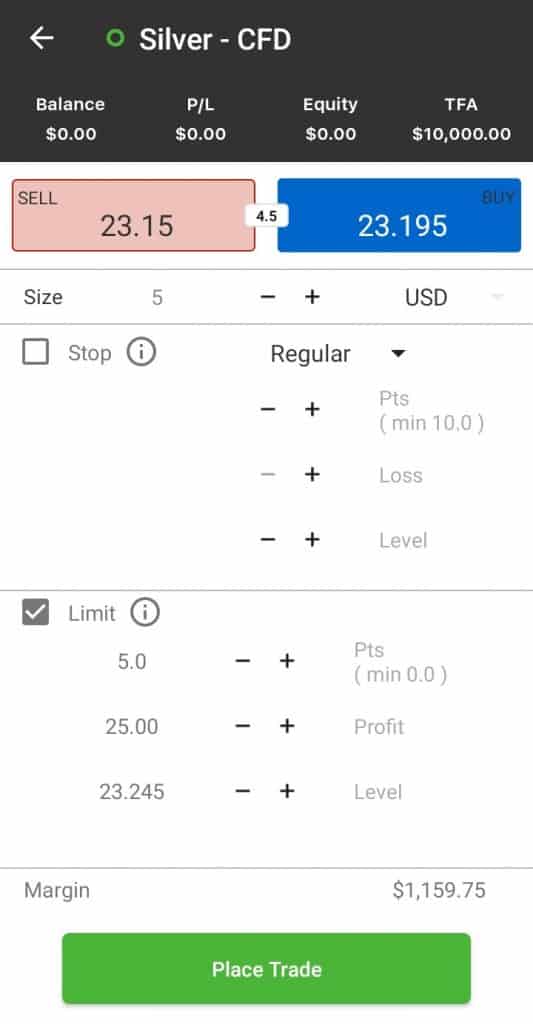

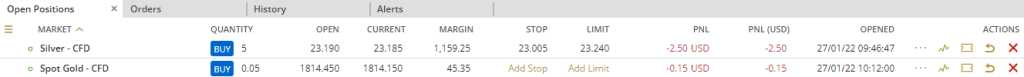

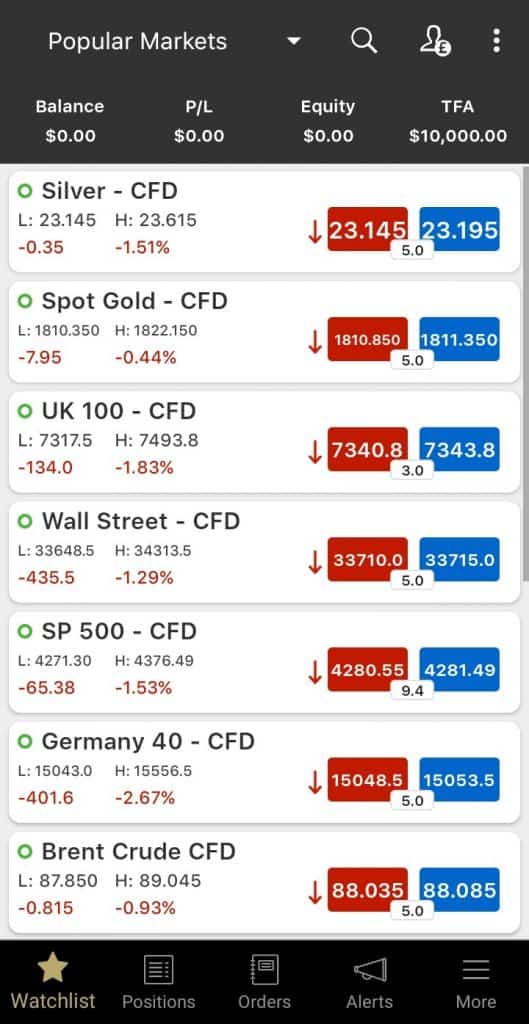

- Trading Ticket: Regular/trailing stop-loss and limit-order functionality on both mobile and desktop. There are informational pop-ups that explain how each field works, so it caters to all seasoned and traders-in-training. When you submit an order at a price other than the current market price, you can set an order expiry date.

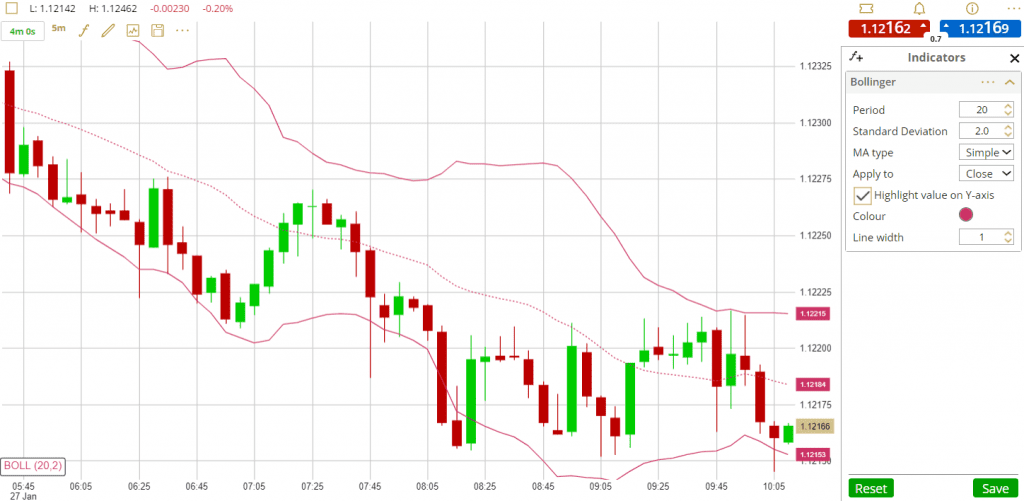

- Charting Tools & Analytics: Available tools include variations of bollinger bands, linear regression indicators, MACD, and more. All analytics tools and drawing features are available on both mobile and desktop versions of TraderPro.

- Position Management: On desktop, this displays under the main asset browsing screen and shows you the quantity, opening price/date, current price, margin, limits placed, and current profit/loss standing. If you didn’t add a stop-loss or take-profit limit when you opened the trade, you can do so afterwards by editing an open order. Order history and alerts are available in the same tab.

- Customizability: Every window within the trading dashboard has it’s pre-defined place. You can adjust certain views, like the asset browsing screen — instruments can be viewed in rows or blocks. To create new layouts, you need a live account. Watchlists can be made on mobile and desktop, the design is basic and works as it should.

- Customer Support: OvalX didn’t have live chat just over a year ago. We tested the live chat functionality several times as an unregistered user, and the chat software couldn’t connect to any agents. A representative did attempt to reach out via e-mail afterwards.

- Educational Material: Aside from a dedicated Trading Academy, OvalX offers eBooks, platform guides, webinars, and other specific guidance to trading fundamentals. The educational content and trading glossary are available for free, even for unregistered visitors.

How to Access MetaTrader 4 (MT4) with OvalX

Before you can use MetaTrader 4 with OvalX, you need to ensure that you’ve registered an account that specifically opts in for the software’s use.

Then you’ll have access to MT4 web. mobile, as well as a remastered version of MT4. You can download the MT4 app from the OvalX website for Windows, Mac, Android, and iOS.

The main differences using MT4 versus TraderPro are the spreads and technical analysis tools. Pips are higher on MT4 so you pay more to trade. There are 30+ technical indicators — TraderPro has a similar set of tools.

Who Regulates OvalX?

OvalX is regulated by the Financial Conduct Authority (FCA), and the Markets in Financial Instruments Directive (MiFID) allows the company to operate as a regulated entity throughout the European Union.

OvalX is regulated by two other financial regulatory bodies:

- Financial Sector Conduct Authority (FSCA) in South Africa under license number 50246.

- Cyprus Securities and Exchange Commission (CySec) in Cyprus under license number 096/08.

The FCA regulates OvalX’s activities in the United Kingdom — it is one of the most rigorous financial organizations in the world. Here’s an overview of what this means for British traders:

| Regulator | Countries Covered | Protection Offered | Additional Protection Offered |

|---|---|---|---|

| Financial Conduct Authority (FCA) | Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Gibraltar, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, The Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, UK | All client funds are held in a segregated client bank account | Financial Services Compensation Scheme (FSCS) may cover up to £50,000 if ETX Capital fails. |

OvalX’s customers in the United Kingdom are protected by the UK-based scheme Financial Services Compensation Scheme (FSCS), which was established to protect consumers when authorized financial services firms fail.

FSCS pays compensation up to £50,000 to customers in the United Kingdom if OvalX is unable to pay.

OvalX’s Financial Services Register reference number is 124721.

Where Does OvalX Operate?

The broker operates in 100+ countries, including Austria, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Gibraltar, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, The Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, and the UK.

OvalX does NOT accept traders from the United States, Belgium, Canada, Singapore, Switzerland, alongside other countries not covered under the FCA, FSCA, MiFID, and CySec licenses.

The website and platform are available in seven languages:

- English

- German

- Spanish

- Czech

- Italian

- Danish

- Slovakian

Other Brokers Compared

Unsure about OvalX? Here’s a direct comparison to two other UK-based brokers:

| ETX Capital | CMC Markets | HYCM | |

|---|---|---|---|

| Ways to Trade | CFDs, Spread betting | CFDs, Spread betting, Real shares | CFDs, Spread betting |

| Instruments | 5,000+ | 11,000+ | 300+ |

| Fixed Spreads Available | ❌ | ✅ | ✅ |

| Account Opening Fee | ❌ | ❌ | ❌ |

| Inactivity Fee | £25/mo after 365 days | £10/mo after 365 days | $10/mo after 90 days |

None of these UK brokers have deposit fees, except in exceptional cases of bank transfers. All have free withdrawal allowances, after which tailored charges apply.

If OvalX’s selection of 5,000+ instruments is not enough for you, CMC Markets is worth researching.

Start Trading Now at OvalX.com

FAQs

Is OvalX legit?

Regulated by four financial organizations, OvalX (formerly ETX Capital) is considered a legitimate online broker. The company is UK-based and is regulated by the Financial Conduct Authority (FCA) in aid of British traders. Other regulatory agencies with whom OvalX holds a license include the Financial Services Conduct Authority (FSCA), Cyprus Securities and Exchange Commission (CySec), and the Markets in Financial Instruments Directive (MiFID).

Who owns OvalX?

OvalX & ETX Capital are the trading names of a company known as Monecor (London) Ltd. Originally, the company was founded as Dusrolgraph Ltd. on June 16, 1965. Key executives currently include Philip Adler (CEO) and Nicholas Iggulden (CFO). Across the board of listed company directors, ownership of the company is not publicly declared.

Does OvalX allow scalping?

There is no specific information on OvalX’s website on the practice of scalping. Scalping is the act of buying and selling trading products within unusually short timeframes, with the aim of executing trades with narrow spreads and minimal pips. Despite the lack of guidance, traders should do their own research.

Is OvalX a market maker?

While OvalX seems like a market maker, it is actually an online brokerage service that connects traders with market makers. Market makers are larger institutions or exchanges. Brokers like OvalX are third-party mediums people can use to access the products listed by such market makers.