XTB Review: What Can You Expect From This Online Trading Platform in 2024?

Risk Warning: Your Capital is at Risk.

XTB is an online brokerage firm that provides customers a platform for Contracts-for-Difference (CFD) trading. Alongside forex, XTB’s CFDs markets include indices, commodities, shares, ETFs, and cryptocurrencies.

Traders have a choice of three trading platforms – XTB’s web-based xStation 5, xStation Mobile, and MetaTrader4 (MT4). XTB Traders can access over 5,400 instruments and demo account options with all three.

XTB focuses on customers in Eastern and Central Europe, but traders in Western Europe can also open accounts with the broker.

Read on to find out more about XTB’s services as a broker, including whether they operate in .

Contents

Key XTB Features

|

|

|---|---|

| Our Overall Rating | |

| Broker Trust Rating | 80/100 |

| Founded | 2002 |

| Products | CFDs, Real Shares (See all products) |

| Markets | Indices, Cryptocurrencies, Commodities, Shares, ETFs |

| Countries Served | Central and Western Europe, including Germany, France, and Portugal (Read more) |

| Minimum Deposit and Fees | £250, €250, or $250 (See all fees below) |

| Regulator(s) | Financial Conduct Authority (FCA), Komisja Nadzoru Finansowego (KNF), Cyprus Securities and Exchange Commission (CySEC), International Financial Services Centre (IFSC) (See regulatory info) |

| Customer Support | 24/5 customer support by email, live chat and phone |

| Demo Account | Free 4-week demo account with 100,000 demo credits |

Where Does XTB Operate?

XTB has focused on growing its business in key Central and Eastern European countries, including Cyprus, Czech Republic, France, Germany, Hungary, Italy, Poland, Portugal, Romania, Slovakia, Spain, and Turkey.

The company has also expanded into new markets including Latin America. XTB offers its services in the European Union via the “single EU passport.”

XTB now offers trading services worldwide in well over 100+ countries (based on their regulators).

Restricted countries include Brazil, Canada, Hong Kong, Iran, North Korea, and the US.

See the full list of countries restricted by XTB.

Afghanistan

Albania

Australia

Bangladesh

Belgium

Belize

Bosnia and Herzegovina

Cuba

Ethiopia

Guyana

Hong Kong

India

Indonesia

Iran

Iraq

Israel

Japan

Kenya

Laos

Libya

Macao

Mauritius

Mozambique

New Zealand

North Korea

Pakistan

Palestine

Panama

Republic of the Congo

Republic of Zimbabwe

Singapore

South Korea

Syria

Turkey

Uganda

United States

Vanuatu

Venezuela

Yemen

IMPORTANT: CFDs are not available in the USA due to local regulation, and regulated brokers do not accept US citizens or US residents as clients.

The XTB website is available in the following languages:

- Arabic

- Chinese

- Cypriot

- Czech

- English

- French

- German

- Hungarian

- Italian

- Polish

- Portuguese

- Romanian

- Russian

- Slovenian

- Spanish

- Turkish

- Vietnamese

XTB offers customers dedicated 24/5 customer support by email, live chat, and phone. Traders can also contact the firm 24/5 in several languages through local phone numbers for its regional offices.

If XTB is not available in , see our broker reviews for an alternative broker.

Can I Trust XTB?

XTB is regulated by four official bodies:

- Financial Conduct Authority (FCA)

- Komisja Nadzoru Finansowego (KNF)

- Cyprus Securities and Exchange Commission (CySEC)

- International Financial Services Centre (IFSC)

While XTB is a legitimate regulated broker, it must be noted that the firm was accused and fined $2.7 million by the KNF in 2018. XTB is operating and maintained its regulated status.

XTB Background

Here is a brief overview of XTB’s history as a broker.

- 2002 – XTB was established under the name of X-Trade

- 2004 – X-Trade merged with XTB to comply with new regulations in the Polish market

- 2005 – The KNF (Polish Financial Supervision Authority) granted the firm permission to offer brokerage services on all financial products

- 2007 – X-Trade Brokers became a member of the Warsaw Stock Exchange and the Polish National Clearinghouse, opening new offices worldwide

- 2009 – X-Trade Brokers re-branded as XTB Online Trading

- 2010 – New offices in the UK and Turkey

- 2016 – XTB successfully listed on the Warsaw Stock Exchange

- 2018 – The Polish Financial Supervision Authority (KNF) fined XTB a $2.7 million fine for asymmetric price slippage.

In 2020, XTB signed soccer manager Jose Mourinho as their official brand ambassador.

XTB is regulated by several financial regulatory agencies.

What Can I Trade With XTB?

XTB offers retail customers over 5,000 financial instruments in forex, CFDs, and real shares. XTB divides the products it offers to traders into six categories: forex, indices, shares, ETFs, commodities, and cryptocurrencies.

The spreads below are the minimum spreads listed by XTB — up to date, spreads may vary.

Real Shares

In 2022, XTB UK introduced zero-commission real share trading for clients residing in FCA-regulated jurisdictions. Traders can choose from shares of 2,000+ company stocks.

These include major company stocks like Apple, Amazon, Tesla, and Facebook, as well as smaller international company shares.

Forex CFDs

XTB provides its traders with access to over 40 forex pairs, including major currency pairs, minors, and exotics.

See all 48 Forex pairs XTB offers

| Currency Pair | Min. Spread* | Margin |

| AUD/CAD | 0.00044 | 1:20 (5%) |

| AUD/CHF | 0.00044 | 1:20 (5%) |

| AUD/JPY | 0.04 | 1:20 (5%) |

| AUD/NZD | 0.00091 | 1:20 (5%) |

| AUD/USD | 0.00017 | 1:20 (5%) |

| CAD/CHF | 0.00047 | 1:30 (3.33%) |

| CAD/JPY | 0.041 | 1:30 (3.33%) |

| CHF/HUF | 0.14 | 1:20 (5%) |

| CHF/JPY | 0.035 | 1:30 (3.33%) |

| CHF/PLN | 0.002 | 1:20 (5%) |

| EUR/AUD | 0.00043 | 1:20 (5%) |

| EUR/CAD | 0.00051 | 1:30 (3.33%) |

| EUR/CHF | 0.00021 | 1:30 (3.33%) |

| EUR/CNH | 0.00215 | 1:20 (5%) |

| EUR/CZK | 0.021 | 1:20 (5%) |

| EUR/GBP | 9.00E-05 | 1:30 (3.33%) |

| EUR/HUF | 0.18 | 1:20 (5%) |

| EUR/JPY | 0.021 | 1:30 (3.33%) |

| EUR/MXN | 0.0105 | 1:20 (5%) |

| EUR/NOK | 0.0037 | 1:20 (5%) |

| EUR/NZD | 0.00106 | 1:20 (5%) |

| EUR/PLN | 0.0019 | 1:20 (5%) |

| EUR/RON | 0.0038 | 1:20 (5%) |

| EUR/RUB | 0.045 | 1:10 (10%) |

| EUR/SEK | 0.0041 | 1:20 (5%) |

| EUR/TRY | 0.00057 | 1:20 (5%) |

| EUR/USD | 6.00E-05 | 1:30 (3.33%) |

| EUR/ZAR | 0.014 | 1:20 (5%) |

| GBP/AUD | 0.00075 | 1:20 (5%) |

| GBP/CAD | 0.00024 | 1:30 (3.33%) |

| GBP/CHF | 0.00037 | 1:30 (3.33%) |

| GBP/JPY | 0.049 | 1:30 (3.33%) |

| GBP/MXN | 0.0125 | 1:20 (5%) |

| GBP/NZD | 0.00075 | 1:20 (5%) |

| GBP/PLN | 0.0032 | 1:20 (5%) |

| GBP/USD | 9.00E-05 | 1:30 (3.33%) |

| GBP/ZAR | 0.0152 | 1:20 (5%) |

| NZD/CAD | 0.00039 | 1:20 (5%) |

| NZD/CHF | 0.00021 | 1:20 (5%) |

| NZD/JPY | 0.036 | 1:20 (5%) |

| NZD/USD | 0.00022 | 1:20 (5%) |

| USD/BRL | 0.0095 | 1:20 (5%) |

| USD/CAD | 0.00019 | 1:30 (3.33%) |

| USD/CHF | 0.00014 | 1:30 (3.33%) |

| USD/CLP | 0.45 | 1:20 (5%) |

| USD/CNH | 0.0011 | 1:20 (5%) |

| USD/CZK | 0.021 | 1:20 (5%) |

| USD/HUF | 0.25 | 1:20 (5%) |

| USD/JPY | 0.007 | 1:30 (3.33%) |

| USD/MXN | 0.0037 | 1:20 (5%) |

| USD/NOK | 0.0038 | 1:20 (5%) |

| USD/PLN | 0.0013 | 1:20 (5%) |

| USD/RON | 0.0047 | 1:20 (5%) |

| USD/RUB | 0.039 | 1:10 (10%) |

| USD/SEK | 0.0041 | 1:20 (5%) |

| USD/TRY | 0.00058 | 1:20 (5%) |

| USD/ZAR | 0.0129 | 1:20 (5%) |

*These spread values only apply to traders who use the xStation platform.

Index CFDs

XTB offers a total of 42 index CFD markets :

See all the Indices XTB offers

| Index | Min. Spread* | Margin |

| AUS200 | 4 | 1:20 (5%) |

| AUT20 | 20 | 1:10 (10%) |

| BRAComp | 117 | 1:10 (10%) |

| CHNComp | 19 | 1:10 (10%) |

| CZKCASH | 2.8 | 1:10 (10%) |

| DE30 | 0.9 | 1:20 (5%) |

| DE30.cash | 0.9 | 1:20 (5%) |

| EU50 | 1.6 | 1:20 (5%) |

| EU50.cash | 1.6 | 1:20 (5%) |

| FRA40 | 1.1 | 1:20 (5%) |

| FRA40.cash | 1.1 | 1:20 (5%) |

| HK.cash | 12 | 1:10 (10%) |

| HKComp | 21 | 1:10 (10%) |

| ITA40 | 11 | 1:10 (10%) |

| ITA40.cash | 11 | 1:10 (10%) |

| JAP225 | 21 | 1:20 (5%) |

| KOSP200 | 0.3 | 1:10 (10%) |

| MEXComp | 117 | 1:10 (10%) |

| NED25 | 0.24 | 1:10 (10%) |

| RUS50 | 2.5 | 1:10 (10%) |

| SPA35 | 6 | 1:10 (10%) |

| SPA35.cash | 6 | 1:10 (10%) |

| SUI20 | 4 | 1:10 (10%) |

| UK100 | 0,9 | 1:20 (5%) |

| UK100.cash | 1.7 | 1:20 (5%) |

| US100 | 1 | 1:20 (5%) |

| US100.cash | 1 | 1:20 (5%) |

| US2000 | 0.4 | 1:10 (10%) |

| US30 | 1 | 1:20 (5%) |

| US30.cash | 2 | 1:20 (5%) |

| US500 | 0.5 | 1:20 (5%) |

| US500.cash | 0.5 | 1:20 (5%) |

| USBIOT | 1.4 | 1:10 (10%) |

| USCANNA | 4.2 | 1:10 (10%) |

| USCHN | 1.4 | 1:10 (10%) |

| USDIDX | 0.012 | 1:5 (20%) |

| USFANG | 1.4 | 1:10 (10%) |

| USGAME | 2.1 | 1:10 (10%) |

| USLITH | 1.4 | 1:10 (10%) |

| USMEDIA | 2.1 | 1:10 (10%) |

| VOLX | 0.11 | 1:5 (20%) |

| W20 | 1.6 | 1:10 (10%) |

*These spread values only apply to traders who use the xStation platform.

Share CFDs

XTB offers CFD trading on more than 1,700 shares of companies trading in the following countries:

- Belgium: Cofinimmo SA, bpost SA, Solvay SA, Barco NV

- Czech Republic: Komercni Banka AS, Philip Morris CR AS, Erste Group Bank AG

- Denmark: Pandora A/S, DSV A/S, Vestas Wind Systems A/S

- Finland: Tieto OYJ, Metso OYJ, Orion OYJ

- France: Safran SA, Orpea, Legrand, IPSOS

- Germany: Vonovia SE, Krones AG, Leoni AG, Puma SE

- Italy: Biesse SpA, DiaSorin SpA, Ferrari NV

- Netherlands: Heineken NV, Unilever NV, TomTom NV

- Norway: Mowi ASA, DNO ASA, Norwegian Air Shuttle ASA

- Portugal: Banco Comercial Portugues SA, Sonae, Jeronimo Martins SGPS SA

- Spain: Ercros SA, Talgo SA, Vidrala SA

- Sweden: ABB Ltd, Nokia OYJ, Electrolux AB, Boliden AB

- Switzerland: Geberit AG, SGS SA, Novartis AG

- UK: Aston Martin Lagonda Global Holdings PLC, Domino’s Pizza Group PLC, AA PLC

- US: Tesla Motors Inc., Colgate-Palmotive Co, Nucor Corp, Apple Inc

ETF CFDs

XTB offers over 100 exchange-traded funds CFDs to trade.

See all XTB ETF markets

| Company | Margin |

|---|---|

| Aberdeen Standard Physical Palladium Shares | 1:2.5 (40%) |

| Consumer Discretionary Select | 1:5 (20%) |

| Consumer Staples Select Sector | 1:5 (20%) |

| CurrencyShares Euro Trust | 1:2.5 (40%) |

| Direxion Daily Financial Bull 3X Shares (Dist, USD) CFD | 1:1 (100%) |

| Direxion Daily Semiconductors Bull 3x Shares | 1:1 (100%) |

| Energy Select Sector SPDR Fund | 1:5 (20%) |

| Financial Select Sector SPDR | 1:5 (20%) |

| Global X Copper Miners | 1:5 (20%) |

| Global X Silver Miners | 1:5 (20%) |

| Global X Uranium | 1:2 (50%) |

| Guggenheim S&P 500 Equal Weight | 1:5 (20%) |

| Health Care Select Sector SPDR | 1:5 (20%) |

| Industrial Select Sector SPDR | 1:5 (20%) |

| Invesco CurrencyShares Australian Dollar Trust | 1:2.5 (40%) |

| Invesco DB Base Metals Fund | 1:1 (100%) |

| Invesco India Exchange-Traded Fund Trust | 1:5 (20%) |

| Invesco S&P 500 Pure Growth | 1:5 (20%) |

| iPath Series B S&P 500 VIX Short-Term Futures ETN | 1:1 (100%) |

| iShares 1-3 Year Treasury Bond | 1:5 (20%) |

| iShares 20+ Year Treasury Bond | 1:5 (20%) |

| iShares 7-10 year Treasury Bonds | 1:5 (20%) |

| iShares China Large-Cap | 1:5 (20%) |

| iShares Core S&P 500 | 1:5 (20%) |

| iShares Core S&P Mid-Cap | 1:5 (20%) |

| iShares Core S&P Small-Cap | 1:5 (20%) |

| iShares Core S&P Total US Stock Market | 1:5 (20%) |

| iShares Core US Aggreagte | 1:1 (100%) |

| iShares CoreFTSE 100 UCITS ETF (Acc, EUR) CFD | 1:5 (20%) |

| iShares Europe | 1:5 (20%) |

| iShares Global Clean Energy (Dist, USD) | 1:5 (20%) |

| iShares Global Clean Energy UCITS ETF (Dist EUR) CFD | 1:5 (20%) |

| iShares Gold Trust | 1:2.5 (40%) |

| iShares iBoxx $ High Yield Cor | 1:2 (50%) |

| iShares iBoxx $ Investment Grade Corporate Bond | 1:2 (50%) |

| iShares JP Morgan USD Emerging Markets Bond | 1:5 (20%) |

| iShares MSCI All Country Asia ex Japan | 1:5 (20%) |

| iShares MSCI All Peru Capped Index | 1:3.3 (30%) |

| iShares MSCI Brazil Capped | 1:5 (20%) |

| iShares MSCI Chile | 1:5 (20%) |

| iShares MSCI EAFE | 1:5 (20%) |

| iShares MSCI Emerging Markets | 1:5 (20%) |

| iShares MSCI France | 1:5 (20%) |

| iShares MSCI Germany | 1:5 (20%) |

| iShares MSCI Japan | 1:5 (20%) |

| iShares MSCI Mexico Capped | 1:5 (20%) |

| iShares MSCI South Korea Cappe | 1:5 (20%) |

| iShares MSCI Taiwan | 1:5 (20%) |

| iShares MSCI Turkey | 1:2 (50%) |

| iShares MSCI United Kingdom | 1:5 (20%) |

| iShares Nasdaq Biotechnology Index | 1:5 (20%) |

| iShares PHLX Semiconductor | 1:5 (20%) |

| iShares Russell 1000 Growth | 1:5 (20%) |

| iShares Russell 2000 Value | 1:5 (20%) |

| iShares S&P 100 | 1:5 (20%) |

| iShares S&P 500 Value | 1:5 (20%) |

| iShares S&P GSCI Commodity Indexed Trust | 1:2 (50%) |

| iShares Silver Trust | 1:2.5 (40%) |

| iShares TIPS Bond | 1:5 (20%) |

| iShares Transportation Average | 1:2 (50%) |

| iShares U.S. Home Construction | 1:5 (20%) |

| iShares US Aerospace & Defense | 1:5 (20%) |

| Lyxor MSCI EM Latin America UCITS | 1:2 (50%) |

| Lyxor MSCI India UCITS | 1:2 (50%) |

| Lyxor MSCI Turkey UCITS ETF (Acc, EUR) CFD | 1:2 (50%) |

| Lyxor Nasdaq-100 UCITS ETF CFD (Acc EUR) | 1:5 (20%) |

| Lyxor STOXX Europe 600 Technology UCITS | 1:1 (100%) |

| Market Vectors Gold Miners | 1:5 (20%) |

| Market Vectors Oil Service | 1:2 (50%) |

| Market Vectors Russia | 1:5 (20%) |

| Physical Platinum Shares | 1:2.5 (40%) |

| PowerShares DB US Dollar Index Bullish Fund | 1:2.5 (40%) |

| PowerShares QQQ Trust Series 1 | 1:5 (20%) |

| PowerShares S&P 500 Low Volatility Portfolio | 1:5 (20%) |

| ProShares Short QQQ | 1:1 (100%) |

| ProShares Short Russell2000 | 1:1 (100%) |

| ProShares Short VIX Short-Term Futures | 1:1 (100%) |

| ProShares Ultra QQQ | 1:1 (100%) |

| Proshares Ultra S&P 500 | 1:1 (100%) |

| ProShares UltraPro Dow30 | 1:1 (100%) |

| ProShares UltraPro QQQ | 1:1 (100%) |

| ProShares UltraPro S&P 500 | 1:1 (100%) |

| ProShares UltraShort 20+ Year | 1:1 (100%) |

| ProShares UltraShort QQQ | 1:1 (100%) |

| Schwab US Dividend Equity | 1:5 (20%) |

| SDPR S&P 500 Trust | 1:5 (20%) |

| SPDR Barclays High Yield Bond | 1:2 (50%) |

| SPDR Dow Jones Industrial Average Trust | 1:5 (20%) |

| SPDR Euro Stoxx 50 | 1:5 (20%) |

| SPDR Gold Shares | 1:2.5 (40%) |

| SPDR S&P Homebuilders | 1:5 (20%) |

| SPDR S&P Metals & Mining | 1:5 (20%) |

| SPDR S&P Midcap 400 | 1:5 (20%) |

| SPDR S&P Oil & Gas Exploration | 1:5 (20%) |

| SPDR S&P Retail | 1:5 (20%) |

| Technology Select Sector SPDR | 1:5 (20%) |

| United States Natural Gas | 1:2.5 (40%) |

| Utilities Select Sector SPDR | 1:5 (20%) |

| VanEck Vectors Coal | 1:2 (50%) |

| VanEck Vectors Junior Gold Min | 1:5 (20%) |

| VanEck Vectors Rare Earth | 1:1 (100%) |

| Vanguard FTSE Developed Market | 1:5 (20%) |

| Vanguard FTSE Emerging Markets | 1:5 (20%) |

| Vanguard Global ex US Real Estate (Dist, USD) | 1:5 (20%) |

| Vanguard Information Technology | 1:2 (50%) |

| Vanguard Intermediate-Term Bond | 1:2 (50%) |

| Vanguard REIT | 1:2 (50%) |

| Vanguard Total Bond Market | 1:1 (100%) |

| Vanguard Total International Bond | 1:1 (100%) |

| Vanguard Total Stock Market | 1:5 (20%) |

| Vanguard Total World Stock | 1:5 (20%) |

Commodity CFDs

XTB offers 22 commodity CFDs traders can choose from.

See all the commodities XTB offers

| Commodity | Min. Spread* | Margin |

| Aluminium | 11 | 1:10 (10%) |

| BUND10Y | 0.02 | 1:5 (20%) |

| Cocoa | 11 | 1:10 (10%) |

| Coffee | 0.25 | 1:10 (10%) |

| Copper | 21 | 1:10 (10%) |

| Corn | 0.36 | 1:10 (10%) |

| Cotton | 0.19 | 1:10 (10%) |

| EMISS | 0.07 | 1:5 (20%) |

| Gold | 0.3 | 1:20 (5%) |

| Natural Gas | 0.01 | 1:10 (10%) |

| Nickel | 99 | 1:10 (10%) |

| Crude Oil | 0.04 | 1:10 (10%) |

| Oil (WTI) | 0.04 | 1:10 (10%) |

| Palladium | 20 | 1:10 (10%) |

| Platinum | 7 | 1:10 (10%) |

| SCHATZ2Y | 0.05 | 1:5 (20%) |

| Silver | 0.04 | 1:10 (10%) |

| Soybeans | 0.95 | 1:10 (10%) |

| Sugar | 0.05 | 1:10 (10%) |

| TNOTE | 0.04 | 1:5 (20%) |

| Wheat | 1.04 | 1:10 (10%) |

| Zinc | 11 | 1:10 (10%) |

Cryptocurrency CFDs

With XTB, traders can make a selection from 25 cryptocurrency markets, including crypto pairs.

Please Note: Availability subject to regulations. Cryptocurrency CFDs are not available to UK retail traders.

See all Cryptocurrency markets

| Instrument | Min. Spread* | Margin |

| ADA/BTC | 0.5% of market price | 1:2 (50%) |

| BCH/BTC | 0.5% of market price | 1:2 (50%) |

| Bitcoin | 1% of market price | 1:2 (50%) |

| Bitcoin Cash | 1% of market price | 1:2 (50%) |

| Dash | 2% of market price | 1:2 (50%) |

| DSH/BTC | 0.5% of market price | 1:2 (50%) |

| EOS | 1% of market price | 1:2 (50%) |

| EOS/BTC | 0.5% of market price | 1:2 (50%) |

| EOS/ETH | 0.5% of market price | 1:2 (50%) |

| ETH/BTC | 0.5% of market price | 1:2 (50%) |

| Ethereum Classic | 2% of market price | 1:2 (50%) |

| Ethereum | 2% of market price | 1:2 (50%) |

| IOTA/BTC | 0.5% of market price | 1:2 (50%) |

| Litecoin | 2% of market price | 1:2 (50%) |

| LTC/BTC | 2% of market price | 1:2 (50%) |

| NEO/BTC | 0.5% of market price | 1:2 (50%) |

| Ripple | 2% of market price | 1:2 (50%) |

| Stellar | 2% of market price | 1:2 (50%) |

| TRX/BTC | 0.5% of market price | 1:2 (50%) |

| TRX/ETH | 0.5% of market price | 1:2 (50%) |

| XEM/BTC | 0.5% of market price | 1:2 (50%) |

| XLM/BTC | 0.5% of market price | 1:2 (50%) |

| XMR/BTC | 0.5% of market price | 1:2 (50%) |

| XRP/BTC | 0.5% of market price | 1:2 (50%) |

| ZEC/BTC | 0.5% of market price | 1:2 (50%) |

XTB Account Types

XTB offers two types of accounts: standard and pro. Here are the main differences between the two accounts.

| Maximum Leverage | ||

| Minimum Spread | ||

| Negative Balance Protection | ||

| Minimal Order | ||

| Automated Trading | ||

| Trading Platforms | WEB, DESKTOP, MOBILE, TABLET, SMARTWATCH | WEB, DESKTOP, MOBILE, TABLET, SMARTWATCH |

| Account Setup & Management | ||

| Forex, Indices, Commodities, Cryptocurrencies | ||

| Stock CFDs and ETF CFDs |

Traders can also open a demo account, where they can trade risk-free for four weeks with £100k in virtual funds.

XTB Fees and Funding Methods

XTB fees and commissions depend both on the instrument traded and the type of account. For some products, such as forex or index trading with a pro account, XTB spreads are competitive.

Additional fees and costs are based on the instruments traders want to trade and the type of account they open.

Basic account holders can use guaranteed stops and this protection comes with wider trading spreads.

Deposit and Withdrawal Methods

Traders can deposit and withdraw funds via:

- Credit/Debit card

- Bank transfer

- E-Wallets: PayPal, Paysafe (formerly Skrill)

The minimum first deposit is $/€/£250.

Credit card and e-wallet transfers take around 24 hours, while bank transfers arrive within 3-5 working days.

Before executing deposits and withdrawals, traders must undergo an account verification process.

General Fees

XTB may charge some generic fees. Fees traders should be aware of include:

- Deposit Fees (E-Wallet): 2% of deposit with USD, 5% of deposit with HUF

- Withdrawal Fees:

- $20 for withdrawals under $100

- €10 for withdrawals under €100

- £12 for withdrawals under £60

- 3,000 HUF for withdrawals under 12,000 HUF

- Monthly Account Maintenance Fee: Up to 10 EUR (Only applies to previously active traders if no trades were made within 365 days or no deposits within 90 days)

- Penalty Interest: Outlined in Terms of Business clause 24. Essentially, XTB deducts any late penalties from traders’ accounts. These include bank charges or in the case of legal action, court fees, and the like.

Commissions

All retail traders pay a commission when trading stock CFDs and ETF CFDs. The following charges apply:

- Transaction Fee: 0.08% of the trade amount

- Dividend Deductions: Up to 35% of the asset’s dividend’s equivalent

Professional Trader Fees

XTB charges professional traders the following fees for opening and closing positions (charges incurred per lot, excluding stocks CFDs, ETF CFDs, and cryptocurrencies):

- 3.00 GBP

- 3.50 EUR

- 4.00 USD

- 1,200 HUF

Professional traders are also charged a €3.50 transaction fee when opening and closing a cryptocurrency CFD trade.

Other Fees

Italy FTT (financial transaction tax): All transactions on share CFDs from Italy, ITA.40, which are based on Italian equities, are subject to FTT (financial transaction tax).

Tax is charged as a fixed fee related to notional transaction value.

The scheme below presents notional transaction value brackets and related tax values:

- Up to €2,500: €0,25

- €2,500- 5,000: €0.5

- €5,000- 10,000: €1

- €10,000- 50,000: €5

- €50,000- 100,000: €10

- €100,000- 500,000: €50

- €500,000- 1,000,000: €100

- Over €1,000,000: €200

Account Requirements

After you click the green ‘Create Account‘ button on the website, XTB asks you a few questions including your name, phone number, and National Insurance Number. Thereafter, you are required to enter your postal code and address.

Traders must proceed to choose a trading platform (xStation 5 or MT4), an account type (see above), currency, and language.

The next XTB screen asks you for basic information like:

- Estimated annual income

- Net worth

- Occupation

- Expected annual trading volume

- Source of account funding

On the following screen, XTB asks you a few questions to determine your level of experience and knowledge about CFD products.

Account Verification

After entering your personal information, XTB takes you to the main trading screen where they ask you to activate your account. To activate the account, traders must pass the XTB identity verification.

You will need to upload both an ID and proof of residence. The ID must be one of the following:

- Identity Card

- Passport

- Driver’s License

How To Upload Verification Documents To XTB

You can take a picture of your ID card and upload it to XTB using your mobile phone. The document confirming proof of identity should not be expired and must show the whole document (with all 4 corners).

Applicants must pass the address verification and submit a recent utility bill to XTB that contains their current address.

To deposit funds, traders must click on the ‘Deposit Funds‘ tab at the top of the page. They are then taken to the client office where they can choose from several deposit methods.

Margin Requirements

XTB offers different amounts of leverage depending on the CFD product, but the maximum leverage on all three types of accounts is 1:500.

Traders should visit the XTB website for specific leverage allowances for each product. Each CFD also has specific XTB margin requirements that traders must maintain.

Traders who fall below the XTB margin requirements risk receiving a margin call and having their position closed prematurely.

XTB Platform Review

XTB offers traders two platforms for trading.

Traders can choose xStation 5, which is the broker’s proprietary multi-asset platform, or the industry-standard MetaTrader4 (MT4) platform. Both platforms offer mobile trading options.

This review covers the xStation 5 platform.

Dashboard and Asset Browsing

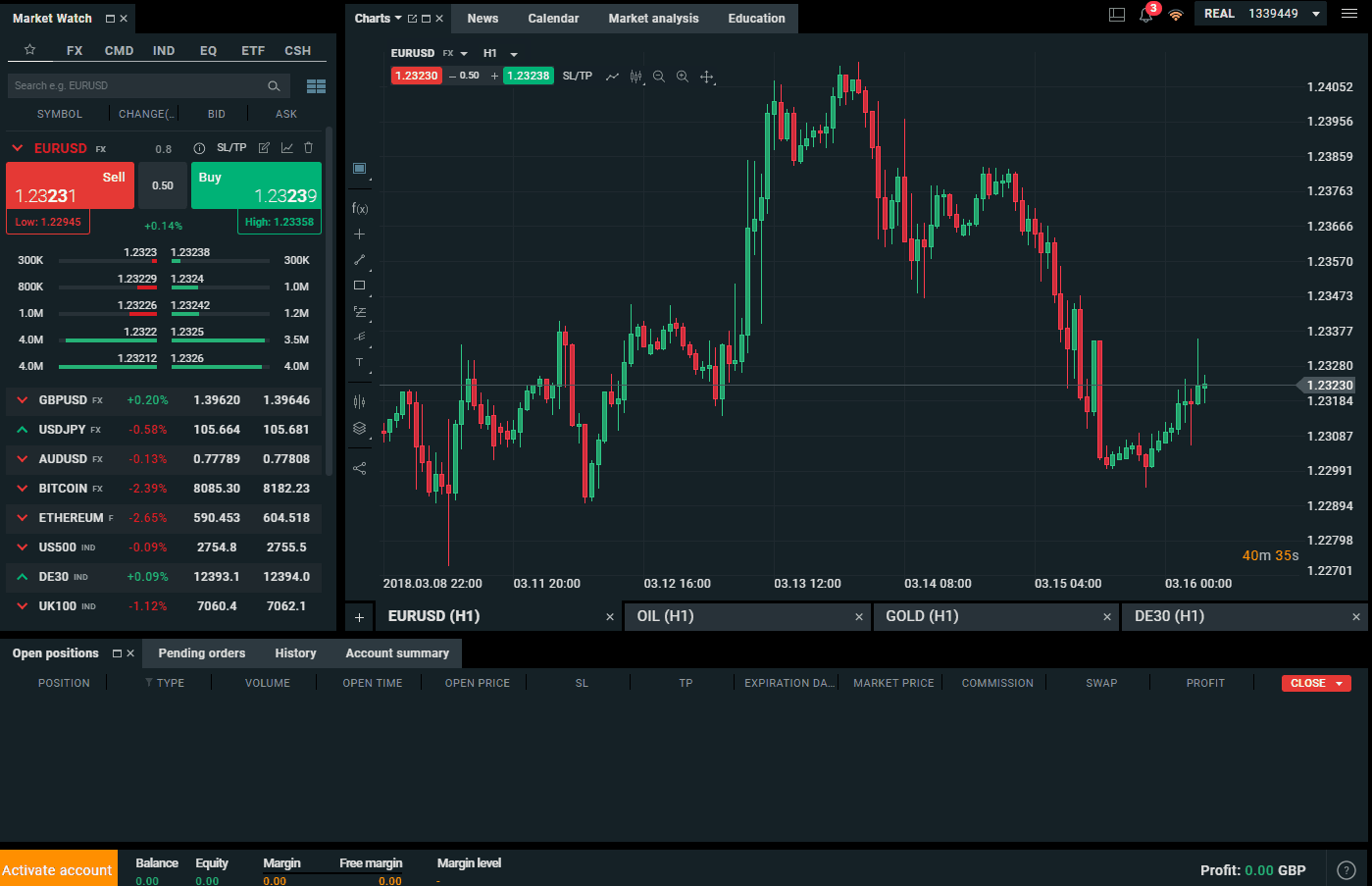

XTB’s custom trading application, xStation 5, has the look and layout of many other trading platforms.

The main screen has menus, watchlists, charts, and notifications.

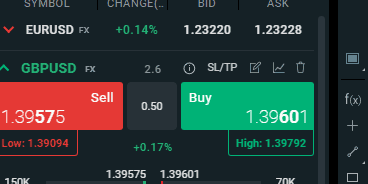

The platform launch speed was relatively quick and navigation between the different panels was seamless. The Market Watch section facilitates trading by populating the screen with a brightly color-coded trade ticket each time you click on a new symbol.

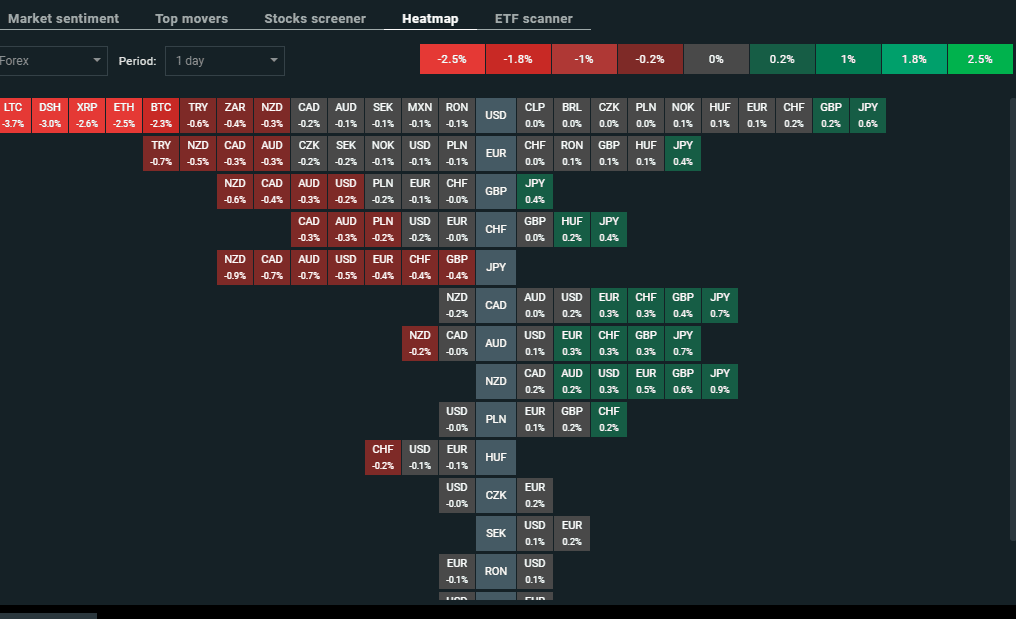

The system allows for easy access to market sentiment indicators, heat maps, top movers, and an ETF scanner. Below is a screenshot of the color-coded heat map:

Customization and Trading Tools

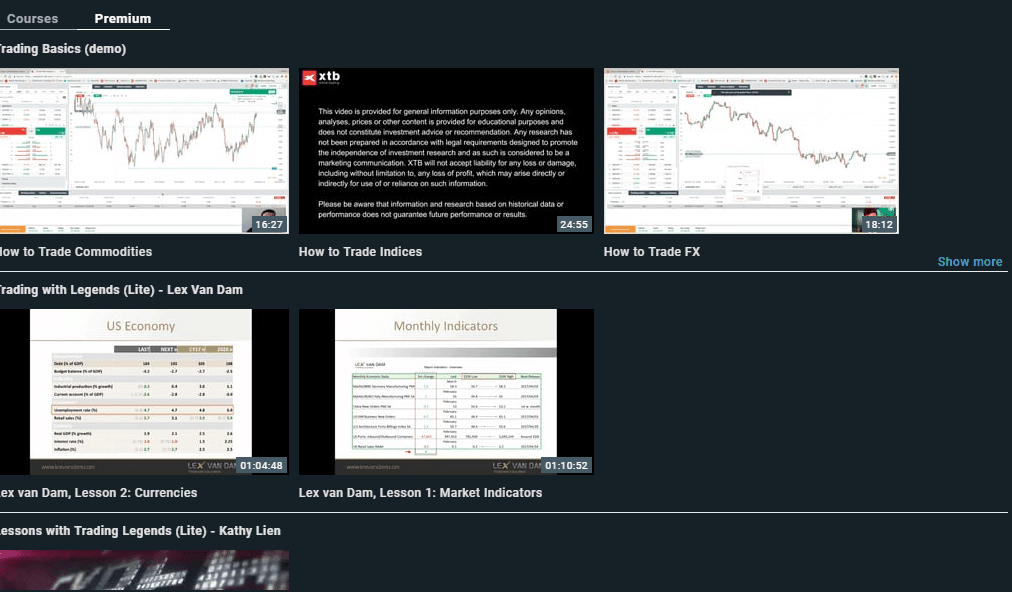

xStation 5 offers many industry-standard tools such as position monitoring, account summary, news, and calendars. One feature that stood out was the integration of educational tools within the platform.

Traders can click on this section and find videos on Trading Basics as well as more advanced videos on Trading with Legends.

Unfortunately, xStation 5 lacks tools for automated trading and back-testing strategies. Also, there are no tools for creating custom indicators.

MetaTrader 4

XTB supports MetaTrader 4 (MT4), a popular software with many online brokers.

MT4 can be used as a web-trader in a browser or traders can download it on a Windows desktop, as well as iOS and Android devices. The software offers technical trading tools, strategy testing and automation, and custom indicators.

XTB Demo Account

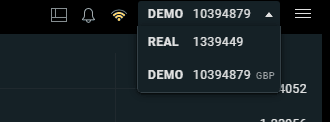

Traders can open a demo account with XTB. The demo account expires four weeks after opening and is pre-loaded with £100k in virtual funds. Traders can choose either xStation 5 or MT4 for their demo account. Once opened, traders can toggle back and forth between the real and demo accounts:

The screen layout for the demo is identical to the real account.

Learning Resources

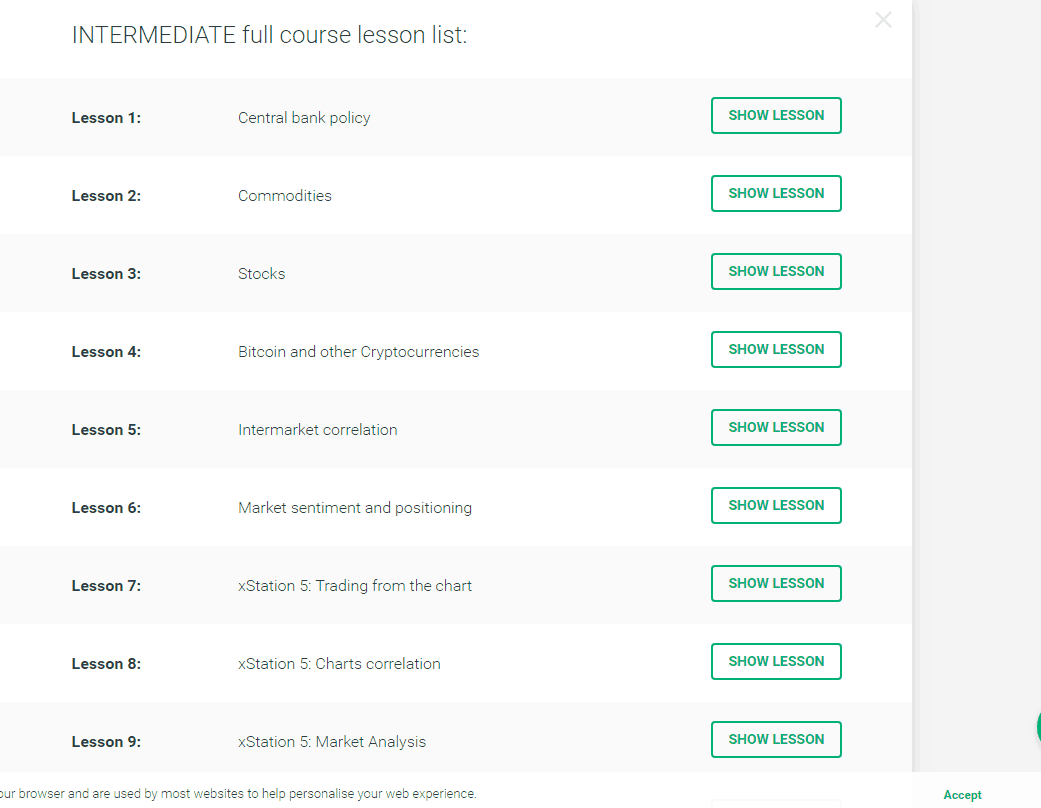

In addition to the in-platform educational videos, XTB has a Trading Academy section on its website dedicated to teaching traders of all levels. The site lists four categories: basic, intermediate, expert, and premium.

However, only the first two categories contained material at the time of writing this review. XTB noted that the expert category is in development, and we couldn’t find information on the premium offerings.

In the XTB Basic tutorial section, even unregistered users have free access to 27 lessons, including forex and CFD basics. The lessons can also be categorized by topic, based on which platform you want to trade on.

Topics in the intermediate section covered a range of both fundamental and technical topics.

The site also hosts a live webinar section with a calendar of upcoming events and a trading glossary with terms used in CFD and forex trading.

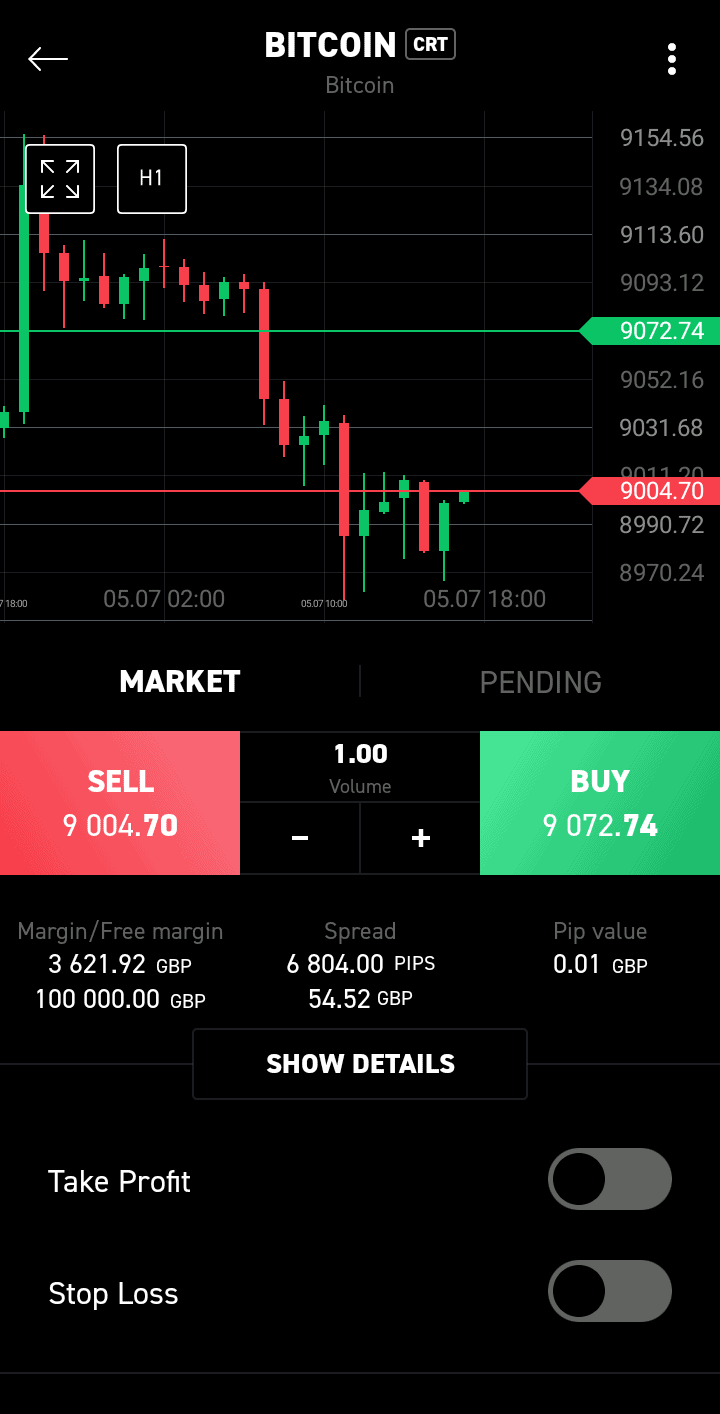

xStation Mobile Platform Review

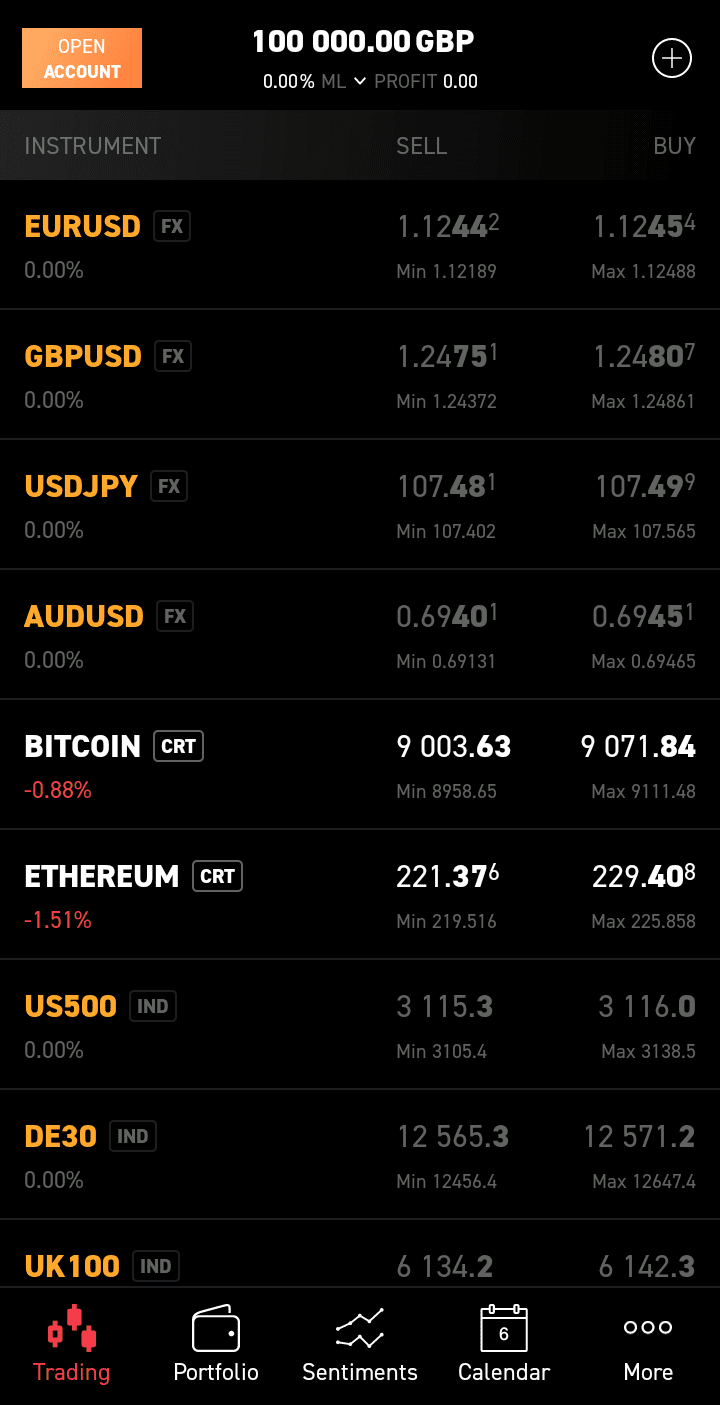

Mobile traders can download xStation Mobile on iOS and Android devices. Upon opening the application, traders are welcomed by the asset browsing screen where instruments are listed.

Instruments can be added by tapping the ‘+’ sign in the top right corner of the screen. The top bar of every tab shows:

- Account balance

- Active margin percentage

- Profit/loss standing

Executing Trades

The trade execution screen has the same features as the desktop version with the options to:

- Buy or sell

- Set profit/loss limits

- Combine the asset with existing open positions of the same asset

- Price alerts

- Price statistics

Managing Positions

Traders can manage open, pending, and closed positions under the ‘Portfolio‘ tab. Thumbnails show the instrument name, volume, and net profit/loss.

To switch over to a live account, you can tap the ‘Open Account‘ button on the top left of the screen.

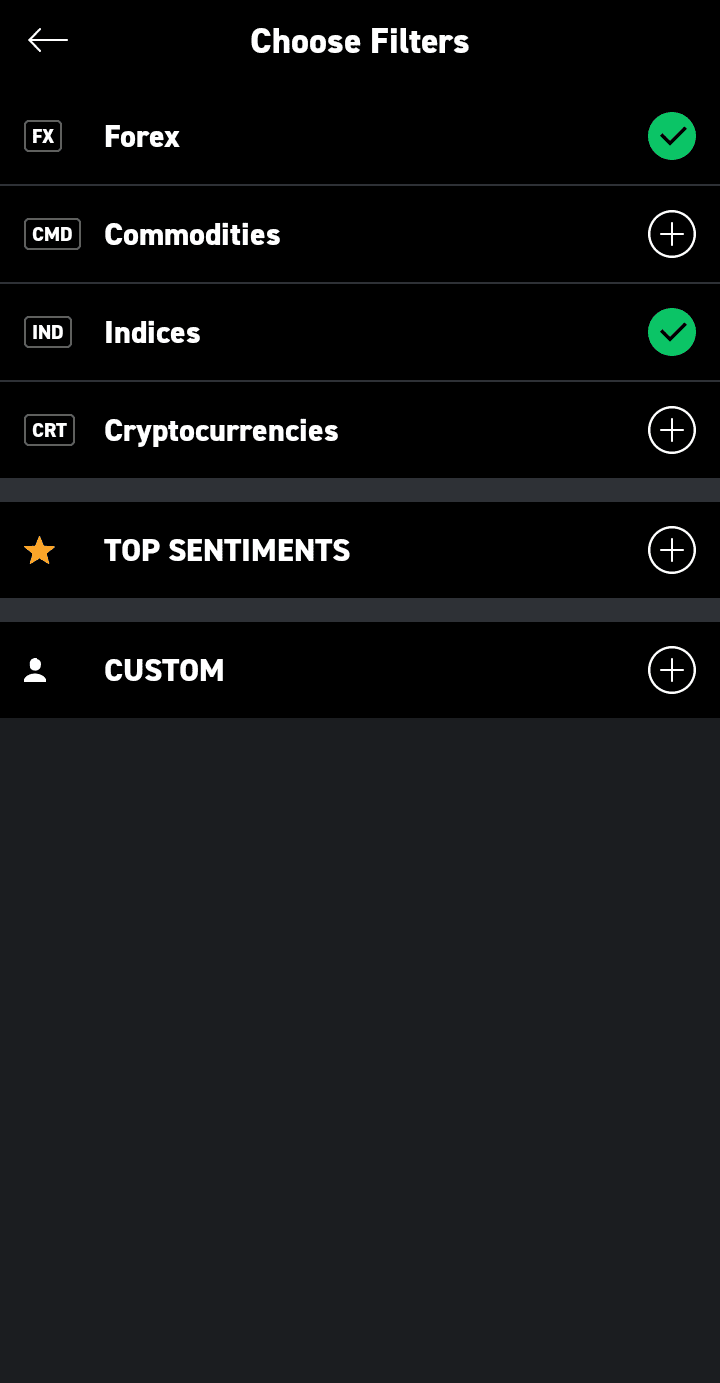

Market Sentiment

The sentiments tab allows traders to keep track of market performance. The custom sentiments feature also allows users to add personalized sentiments for insight.

Sentiments can be customized by adding filters to weave out the preferred asset classes.

Mobile Account Menu

The mobile account menu is located under the ”More‘ tab, from where traders can access:

- News

- List of top movers

- Learning resources

- Deposit and withdrawal menu

- Profile settings

- Customer support

FAQs

Who is XTB regulated by?

XTB is regulated by four different regulatory bodies, the Financial Conduct Authority (FCA), the Polish Financial Supervision Authority (KNF), Cyprus Securities and Exchange Commission (CySec), and the International Financial Services Center (IFSC). We cover regulatory information in more detail elsewhere in this article, along with the countries XTB operates in.

What trading platforms does XTB offer?

XTB offers three different trading platforms. The primary platform xStation, is web-based, while xStation mobile is available on mobile devices and tablets for both iOS and Android users. The third trading platform supported by XTB is MetaTrader 4, one aimed at traders who prefer advanced trading tools and automation features.

What cryptocurrencies can I trade with XTB?

XTB offers 25 different cryptocurrency assets to trade, among which you can find Bitcoin, Ethereum, Bitcoin Cash, Dash, EOS, Ethereum Classic, IOTA, Litecoin, NEO, Ripple, Stellar, and TRX. The asset classes include individual cryptocurrency CFDs, and cryptocurrency pairs like IOTA/BTC, EOS/ETH, and ADA/BTC.

Credits: Original XTB review written by Lawrence Pines. Major updates and additions in Feb 2021 by Marko Csokasi with contributions from the Commodity.com editorial team.