In this guide to trading tin, we’ll explain how and where you can trade this important metal. We also list regulated brokers that are available in your country.

In a hurry? If you want to start trading tin, here are some brokers available in to consider:

Contents

Reasons You May Trade Tin

Traders could consider trading tin for the following reasons:

- Bet on Surging Global Economy

- Inflation and Weak US Dollar Hedge

- Portfolio Diversification

Important: This is not investment advice. The arguments presented here for and against investing in this commodity are informational only. Always consult a professional advisor before making any investment decisions.

Bet on Surging Global Economy

Expanding global demand for soldering, tin alloys, and tin-plated materials could contribute to a rise in tin prices.

For this scenario to unfold, China would have to resume its strong growth. The Chinese economy has experienced a slowdown in recent years, although there are signs this may be coming to an end.

Essentially, trading tin and other base metals is a bet on a resurging Chinese economy.

Inflation and Weak US Dollar Hedge

Trading tin is a way to bet on a weak US dollar and higher inflation.

Tin is priced in US dollars, so the performance of the American economy can impact its price. The US Federal Reserve Bank has kept interest rates low and the US dollar weak for many years.

US central bankers are likely to continue these policies to support consumer borrowing and spending. These conditions are likely to be very beneficial for commodity and base metal prices.

A weak dollar could stoke inflation concerns. There is a limited supply of tin, and producing it is an energy-intensive endeavor.

The price of the commodity would likely benefit from fears of inflation.

Portfolio Diversification

Most traders have the vast majority of their assets in stocks and bonds.

Commodities such as tin provide traders with a way to diversify and reduce overall portfolio risk.

Ways To Trade Tin

As a trader, you have several ways to trade tin instruments, whether that’s live shares in a tin company, buying physical bullion, or speculating with a derivative instrument like CFDs or options.

| Trading Method | Ownership | Management Costs | Security Costs | Expiry Date | Mgmt Cost | Leverage |

|---|---|---|---|---|---|---|

| Bullion | ✅ | ✅ | ✅ | ❌ | ❌ | ❌ |

| CFDs | ❌ | ❌ | ❌ | ❌ | ❌ | ✅ |

| Futures | ❌ | ❌ | ❌ | ✅ | ❌ | ✅ |

| Options | ✅* | ❌ | ❌ | ✅ | ❌ | ✅ |

| ETFs/Mutual Funds | ✅ | ✅ | ✅ | ❌ | ✅ | ❌ |

| Shares | ✅ | ❌ | ❌ | ❌ | ❌ | ❌ |

Tin Bullion

Physical tin bullion such as ingots is the most direct way to trade tin.

However, trading bullion may require a secure storage facility if safe storage isn’t available at home.

Ultimately, the cost of this storage and the low value-to-weight ratio makes holding physical tin an impractical proposition.

Tin Futures

The London Metal Exchange (LME) trades a contract on tin that is a minimum of 99.85% pure. Each contract represents 5 metric tons of tin and is quoted in dollars.

Futures are a derivative instrument through which traders make leveraged bets on commodity prices.

If prices decline, traders must deposit additional margin to maintain their positions.

At expiration, the contracts are physically settled by delivery of the metal.

Futures trading requires a high level of sophistication since factors such as storage costs and interest rates affect pricing.

Tin Options on Futures

The LME offers an American style options contract on tin futures.

Options are also a derivative instrument that employs leverage to trade commodities. As with futures, options have an expiration date.

However, options also have a strike price, which is the price above which the option finishes in the money.

Options buyers pay a price known as a premium to purchase contracts. Learn more about how options work in this Options Trading Guide.

An options bet succeeds only if the price of tin futures rises above the strike price by an amount greater than the premium paid for the contract.

Therefore, options traders must be right about the size and timing of the move in tin futures to profit from their trades.

Tin ETFs

These financial instruments trade as shares on exchanges in the same way that stocks do.

Traders can purchase iPath Dow Jones-UBS Tin ETN (NYSEARCA: JJT), which is an ETF that trades tin futures.

Shares of Tin Companies

The vast majority of tin production takes place in emerging markets.

Traders looking to gain exposure to tin prices through the purchase of stocks should consider companies like Yunnan Tin Co:

| Company | Current Price | Overview | Listings | Founded |

|---|---|---|---|---|

Yunnan Tin Co | Engages in the exploration, mining, production, and sale of tin products. Yunnan Tin is the largest tin producer and exporter in China and the world. | Shenzhen (SZ) | 1883 |

Tin CFDs

One way to trade tin is through contracts-for-difference (CFDs) derivative instruments.

CFDs allow traders to speculate on the price of tin without the need for owning the metal.

The value of a CFD is the difference between the price of tin at the time of purchase and its current price. Learn how CFDs work in this CFD Trading Guide.

IMPORTANT: CFDs are not available in the USA.

Where Can I Trade Tin?

Here is a list of regulated commodity brokers available in that offer tin trading products, primarily derivatives or shares:

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74%-89% of retail investor accounts lose money when trading CFDs. You should consider whether you can afford to take the high risk of losing your money.

Should I Trade Tin?

Three trends could raise tin prices in the years ahead:

- Chinese demand

- Electronics demand

- Energy costs.

Important: This is not investment advice. The arguments presented here for and against investing in this commodity are informational only. Always consult a professional advisor before making any investment decisions.

Chinese Demand

China is the top consumer of tin, and demand should grow if the Chinese economy rebounds.

Electronics Demand

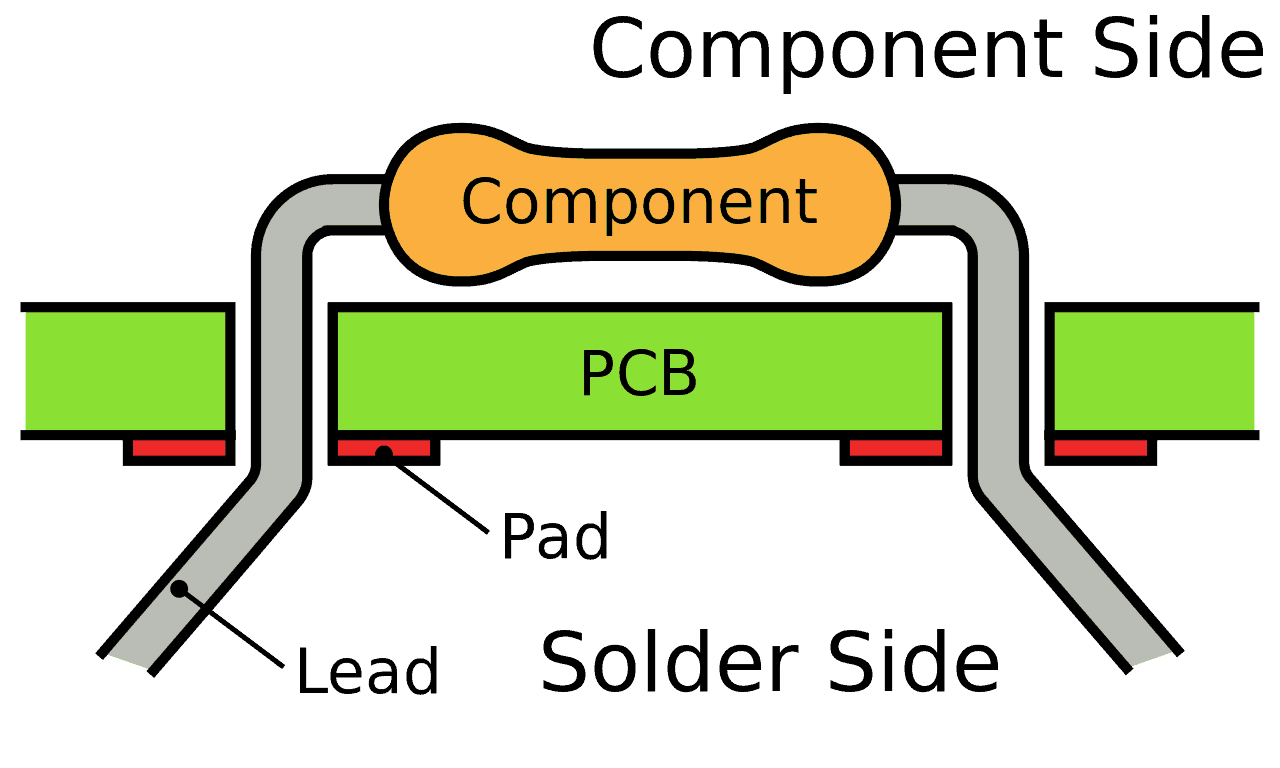

Electronics have become an important mainstay of consumer spending. These products require tin for soldering components.

Growth in this category should bode well for tin demand.

Energy Costs

Higher energy costs make mining an increasingly challenging business. As fuel and electricity costs rise, more mining operations could close or consolidate.

This may produce higher tin prices.

Tin Trading Risks

However, traders should also consider the risks of tin trading:

- A global recession could weaken Chinese demand.

- Overproduction or increased stockpiling by China could create a supply overhang on the market and send prices lower.

- Global economic or political turmoil could strengthen the US dollar and weaken demand for commodities.

Important: This is not investment advice. The arguments presented here for and against investing in this commodity are informational only. Always consult a professional advisor before making any investment decisions.

Further Reading

If you wish to learn more about tin as a commodity, how it’s produced, and what experts think, you can do so in our Tin Commodity Guide.

There are also many more Commodity.com trading guides available, like: