In this guide to Malta’s National Debt, we discuss the amount of the debt, what’s included in the number, who manages the debt, the country’s credit rating, and how it raises loans.

The National Debt Of Malta

As a member of the European Union, Malta calculates its national debt by a set of rules that are specified in the Maastricht Treaty. This formula counts the debts of all levels of government. It must also include guarantees and obligations made to EU institutions.

However, the country does not have to include guarantees given for loans to other organizations within its border. Malta also doesn’t have to include obligations to pay pensioners in the future.

How Malta’s Debt Is Calculated

Malta’s financial data is recorded by Eurostat and the International Monetary Fund (IMF). The rules that the IMF follows to calculate national debt are different from those used by Eurostat and the government of Malta.

For example, an EU expense that is counted by Eurostat and not included by the IMF are guarantees that underwrite the activities of the European Financial Stability Fund.

IMF vs Eurostat Calculations

Another difference between the calculations of Eurostat and the IMF is the way each values outstanding government securities.

- The European rules take the face value of government debt instruments. This is the amount of money that the government of Malta will have to pay on the maturity date of those bonds and bills.

- The IMF values those instruments at their market value, which in some cases can be considerably higher than their face value.

Depending on the difference between the face value and the market value of debt instruments and the size of Malta’s share of guarantees to European institutions, the difference between Eurostat figures and IMF calculations can be considerable.

Malta’s Debt-to-GDP Ratio

Economists are interested in how much a country owes versus the nation’s annual income, which is called the Gross Domestic Product (GDP). So, national debt figures are called the debt-to-GDP ratio and are expressed as percentages.

The gross debt-to-GDP figures given by the IMF and Eurostat for Malta for the end of 2019 are:

- IMF: 42.8%

- Eurostat: 42.6%

Malta’s Net Debt

The total of all Maltese general government debt is termed the “gross debt” of Malta. The IMF also calculates a net debt figure for each of the countries that it monitors.

Net debt is the gross debt minus all of the financial assets that the government holds. Assets such as buildings, armaments, and artworks are not included in this value.

Is Malta’s National Debt Growing?

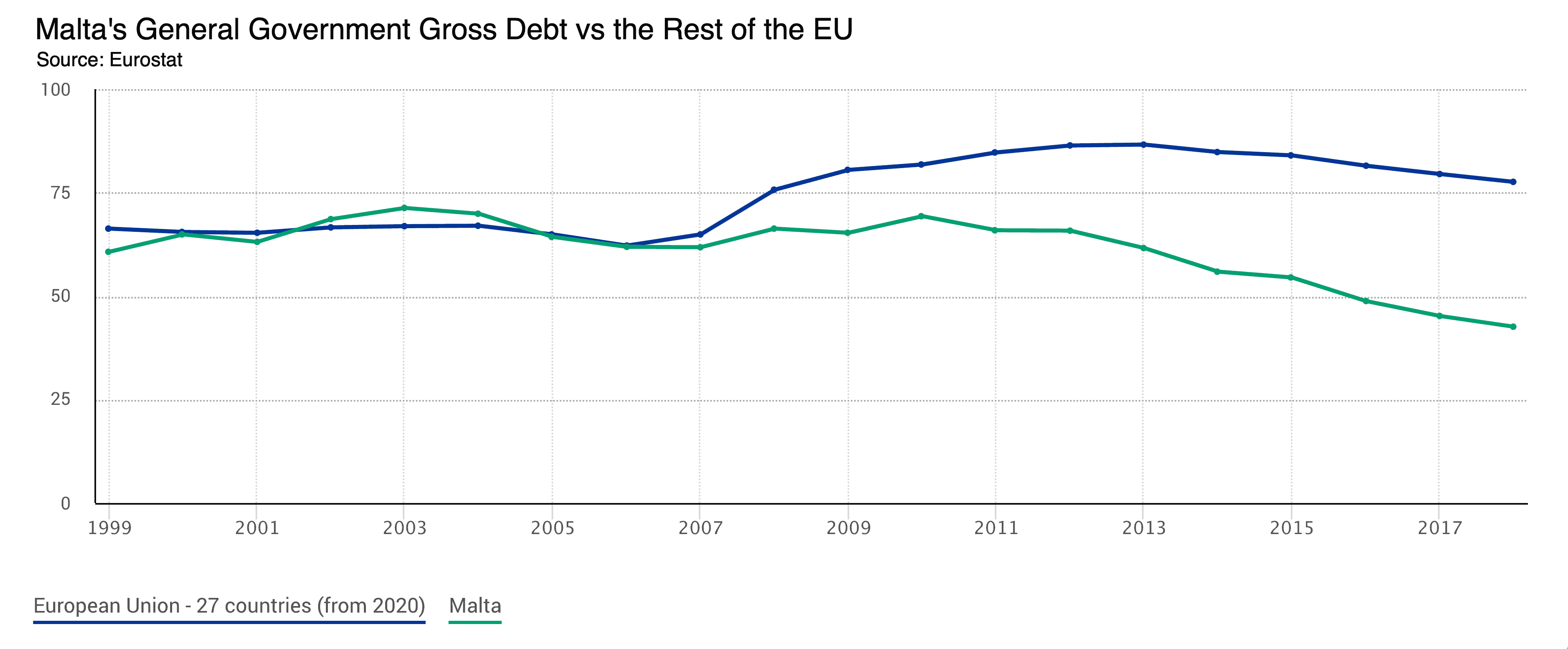

Since 2013, the Maltese government has managed to control its national debt, year by year, getting it to a surplus.

A sharp improvement in the country’s rate of economic growth since 2012 helped the government of Malta work towards its Maastricht debt targets.

The government deficit has been lower than 3% since 2013 and in a surplus since 2016. The country’s debt to GDP ratio has been below 60% since 2015 and it continues to fall.

What Is Malta’s Credit Rating?

The strong commitment of the government of Malta to keep the national debt under control is reflected in the credit ratings awarded to the country.

In terms of national debt, it is the long-term rating that matters most. All of the major ratings agencies give Malta A-grade ratings.

Agency Domestic Long-term Domestic Short-term Foreign Long-term Foreign Short-term Outlook

Standard & Poor's A- A-2 A- A-2 Positive

Moody's A3 n/a A3 n/a Positive

Fitch A+ F1+ A+ F1+ Stable

DBRS A (high) R-1 (middle) A (high) R-1 (middle) Stable

The top credit rating possible is “AAA.” However, getting up into the “A” bracket is a good achievement.

Who Manages Malta’s National Debt?

The parliament of the Republic of Malta has the ultimate authority over the country’s national debt. The ruling party in parliament also runs the administration of the government and the Ministry of Finance is responsible for setting the administration’s annual budget.

Budgets must be approved by the parliament and the Ministry increases or decreases the national debt with parliament’s approval.

The Ministry of Finance department that is specifically tasked with managing the national debt is the Treasury. The Central Bank of Malta has the task of selling debt instruments on behalf of the government.

How Does the Maltese Government Raise Loans?

The Republic of Malta is a small country that was once part of the British Empire. The country runs its government finances after models that were well-established in London.

Primary Market

It is common practice for a government to auction off government securities to a limited group of approved bidders, traditionally known as the primary market.

Auctions allow the Maltese government to make securities available to the wider market by using the primary dealers as market makers.

No Secondary Market

Since the Maltese government very rarely issues debt instruments, it isn’t worth the cost for a bank to set up a specialist Treasury division. The Central Bank of Malta, therefore, acts as an agent on behalf of the government of Malta and transmits its securities directly to the open market.

What Securities Does the Maltese Government Sell?

The government of Malta needs short-term financing to bridge the irregular pace of its income. Although the government is currently paying down its debt, it does occasionally need to refinance maturing debt instruments.

So the government of Malta needs:

- Short-term financing

- Long-term financing

Short-Term Financing via Treasury Bills

The government issues Treasury bills to cover short-term debt needs. These devices do not pay interest, but are sold at a discount and redeemed at full face value.

The Maltese government sells Treasury bills with maturities of one month, three months, six months, nine months, and one year.

Long-Term Financing via Bonds

Long-term financing for the government of Malta is carried out through a typical bond. These are called “Malta Government Stocks” (MGSs).

The Maltese government has issued fixed-rate MGSs and floating-rate MGSs. The majority of Malta Government Stocks currently in circulation are fixed-rate instruments with a small percentage of bonds with floating rates.

More Facts About Malta’s Debt

- You could wrap $1 bills around the Earth 38 times with the debt amount.

- If you lay $1 bills on top of each other they would make a pile 1,072 km, or 666 miles high.

- That's equivalent to 0.00 trips to the Moon.

Regulated Brokers: Where Can I Trade Commodities?

Start your research with reviews of these regulated brokers available in .

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74%-89% of retail investor accounts lose money when trading CFDs. You should consider whether you can afford to take the high risk of losing your money.

Further Reading

- Malta’s Biggest Import and Exports

- Real-Time World Debt Clock

- Learn to Trade Commodities

- Stock Broker Reviews

- Learn to Trade CFDs and Find a Broker