In this guide to Denmark’s national debt, you’ll learn how the country’s debt is calculated by different role players, how government loans are raised, and who manages the debt.

The National Debt of Denmark

Denmark’s national debt includes any debts accrued by the local as well as the central government. The country has a very low national debt but the exact amount varies according to the calculation used.

According to the IMF, at the end of 2020, Denmark’s gross national debt-to-GDP ratio was 31.9%. At the same time, the country’s net debt-to-GDP was only 14.83%.

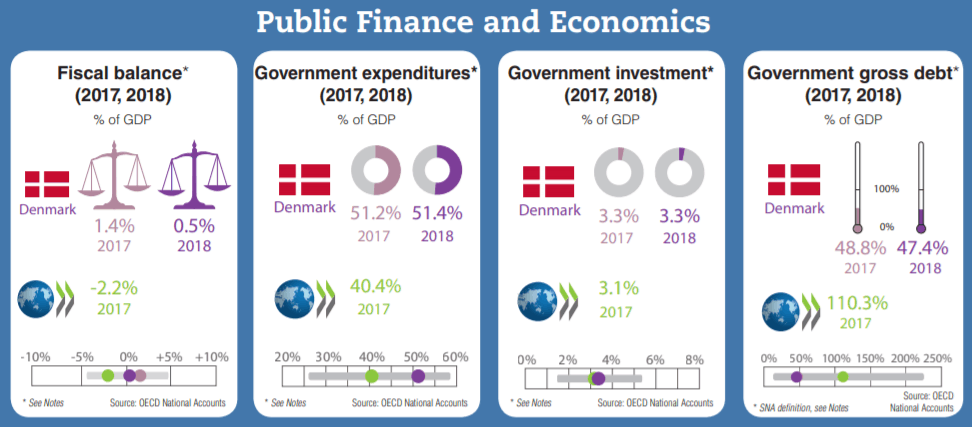

The OECD measures national debt differently, including all public debt. Their calculations for 2020 put Denmark’s gross debt-to-GDP ratio at 51.4%.

The difference between the OECD figure and the IMF figure is accounted for by the debts of the non-governmental public sector. That includes state-owned enterprises and government guarantees for loans issued by key industries.

Denmark’s National Bank comes up with a much lower figure when it calculates national debt. It only counts the debt of the central government and only debt that is represented by government securities, such as bonds and treasury bills.

The National Bank estimates Denmark’s gross national debt to be 18% of GDP. It is calculated as the nominal value of domestic and foreign debt less the balance on the central government’s account at the National Bank and the assets of the government funds.

Therefore, it can be deduced that the difference between the National Bank debt-to-GDP figure and that of the IMF is accounted for by the local government debt.

The different methods used to calculate national debt in Denmark shows that determining how much the country owes is not a simple question.

However, by examining all the different measurements of debt, we can deduce that the entire national debt of Denmark is the OECD figure of around 51% of GDP.

Is Denmark’s National Debt Rising?

The Danish government did a good job of reducing the national debt until 2008 when the global banking crisis occurred. That event caused the national debt to rise and since 2012 it has come back under control.

Although the government managed to get its spending under control, the budget surpluses produced by the Danish governments in 2014 and 2017 are not large enough to account for the rapid reduction in the country’s debt-to-GDP ratio.

This is seen in the light of the government running a deficit in 2015 and 2016, which would have added to central government debt.

The reason that Denmark’s debt-to-GDP ratio began to fall in 2012 is that the Danish economy has shown strong growth.

The effects of the 2008 banking crisis dented the country’s income in one year only. Since 2009, the economy has continued to grow, helping the banks of Denmark recover and staving off disastrous unemployment, which increases government spending.

The increasing wealth of Denmark has helped to reduce its debts as a proportion of GDP.

However, the estimate for central government finances in 2020 has deteriorated since December 2019 as a consequence of the corona crisis.

Who Manages Denmark’s National Debt?

The Danish government’s ministry of finance has the ultimate responsibility for managing the national debt.

The ministry has direct control over central government borrowing, but can also control local government borrowing through legislation in the parliament (Folketing) and can control the debt growth of state-owned enterprise by command.

The finance ministry does not raise debt itself. That task has been contracted out to the Danish National Bank.

The bank has a special department, which takes care of all work related to the central government’s debts. This is called the government debt management office.

As well as raising funds for the government, the National Bank manages three government funds:

- Social Pension Fund (SPF)

- Advanced Technology Foundation

- Fund for Better Working Environment and Labour Retention

These three funds account for those public assets that make the Danish net national debt so low.

How Does the Danish Government Raise Loans?

When the Danish government needs money from debt, it issues securities through the market rather than going to a bank for a loan. The Danish National Bank performs this task on behalf of the government.

All government securities are sold through auctions. The auctions are not open to all.

The bank will only accept tenders for part of an issue of securities from a group of approved buyers. These approved businesses are called primary dealers.

Anyone else can buy and hold Danish government securities. However, they are not allowed to buy them directly from the Danish National Bank.

Large buyers of securities can contact a primary dealer and arrange to buy an allocation from an auction, with that dealer acting as an agent. All other buyers need to go to the secondary markets.

Primary dealers do not always have all of the allocations that they buy pre-sold, and so they resell those securities on the debt and money markets.

What Government Securities Does the Danish National Bank Sell?

The Danish government needs money to cover day-to-day expenses. When tax receipts don’t arrive at a regular pace, the government needs to cover those income gaps with debt.

Long-term projects need to be financed differently. The Danish National Bank borrows money on behalf of the government in two different ways:

- Short-term debt instruments

- Long-term debt instruments.

Short-Term Debt Instruments

The Skatkammerbeviser is the Danish government’s way of borrowing over the short term. These devices never have maturities of more than a year.

The format of the Skatkammerbeviser is that of a treasury bill. This is the standard method of short-term borrowing used by just about every government in the world.

These instruments do not pay interest. However, they are sold at a discount and redeemed at full face value. The difference between the value of the bill and its discounted price provides the investor with a profit.

Long-Term Debt Instruments

The Danish National Bank issues two types of devices to provide the Danish government with long-term debt. These are:

- Nominelle obligationer

- Inflationsindekserede obligationer

The nominelle obligationer is the classic government benchmark bond. These bonds pay a fixed interest every year and are redeemed in full at the maturity date. The maturity periods of these bonds are always longer than a year.

The inflationsindekserede obligationer is an index-linked bond. The capital amount of these bonds is adjusted each year in accordance with the country’s consumer price index.

The bonds pay a fixed interest rate each year. However, as the capital amount of the bond increases, the actual interest payment will increase, too.

These bonds also always have maturities of more than a year and the Danish National Bank pays out the inflation-increased value of the bond on the maturity date.

Fun Facts About Denmark’s National Debt

- You could wrap $1 bills around the Earth 562 times with the debt amount.

- If you lay $1 bills on top of each other they would make a pile 15,775 km, or 9,802 miles high.

- That's equivalent to 0.04 trips to the Moon.

Interested in Trading Commodities?

Interested in trading Danish commodities? Start your research with reviews of these regulated brokers available in .

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74%-89% of retail investor accounts lose money when trading CFDs. You should consider whether you can afford to take the high risk of losing your money.

Sources and Further Reading

- International Monetary Fund

- Learn more about the state of world government debt from our other country debt clock pages.

- See our global economic indicator guide to more than 45 countries.

- Get our full guide to trading commodities.