In this guide to IOTA (MIOTA), we’ll teach you the basics about this altcoin and how it’s made. We also provide live price data and compare IOTA to Bitcoin.

Interested trading or buying IOTA? Here are brokers and exchanges available in that offer IOTA and other cryptocurrencies:

Contents

What Is IOTA?

IOTA (MIOTA) is the first cryptocurrency to take advantage of devices connected to the Internet of Things (IoT). It is regarded as an attempt to move cryptocurrency beyond the blockchain.

IOTA uses a directed acyclic graph (DAG) called Tangle to solve the scalability problems that plague Bitcoin and to facilitate free micro-transactions between Internet of Things devices.

How Did IOTA Begin?

IOTA began in 2015 when it was founded by a team consisting of David Sønstebø, Sergey Ivancheglo, Dominik Schiener, and Dr. Serguei Popov.

Popov, Serguei, and Ivancheglo helped complete the mathematics and programming behind the unique Tangle system. David Sønstebø is the project lead.

The Internet of Things Economy

IOTA is a cryptocurrency designed to operate as the backbone of the Internet of Things economy. IoT devices have become an increasingly important part of the world economy.

These devices all generate a lot of data that non-related companies might find useful. Unfortunately, at present, there isn’t a way for those companies to purchase this information.

IOTA is designed to offer a solution to this problem by creating a fee-free cryptocurrency that can operate on the most humble of devices.

Limits of Blockchain

Traditional blockchain technology is not particularly well suited for the IoT. Bitcoin and other blockchain-based cryptocurrencies run into scalability issues and the fees required to make a transaction mean that sending a micro-transactions (of $0.01, for example) is unviable.

To provide a solution that is fit for the IoT, IOTA needs to ensure that it is scalable, can process transactions quickly, and can process micro-transactions without burdensome fees.

To do this, IOTA looked away from the blockchain and opted to use a different kind of technology – a Directed Acyclic Graph (DAG) called the Tangle.

The Tangle

The Tangle gives IOTA two main advantages over traditional blockchain technology:

- IOTA eliminates the need for miners.

- It allows for near-infinite scaling.

No Need For Miners

Each transaction must process two other transactions before it can be accepted on the network. The Proof of Work required to process these transactions is so low power that essentially any device is capable of doing so.

This means that miners are not necessary to maintain the integrity of the network and, thus, fees associated with mining are eliminated.

Near-Infinite Scaling

When transactions are processed in a blockchain they are all grouped together and processed at once. This causes problems when there are a lot of outstanding transactions on the network.

If they can’t all go into a block then they have to wait for the next block to be processed. The Tangle gets around this by processing each transaction individually.

Before any transaction can be processed it needs to process two others, either directly or indirectly. This theoretically allowed the Tangle to accommodate an infinite number of devices.

Quantum Proof

Another feature of IOTA is the so-called Quantum Proof. This uses hash-based signatures that are generally faster than elliptic curve cryptography (ECC). Hash-based signatures also help simplify the signing and verification process and help reduce the overall complexity of the Tangle protocol.

These features are designed to make IOTA uniquely suited to being utilized by IoT devices.

How is IOTA Made?

Unlike most cryptocurrencies, IOTA does not use a blockchain. This means that there is no need for anybody to mine tokens in order to ensure the integrity of the blockchain.

As such, all IOTA tokens were created at launch with a fixed supply of 2,779,530,283,277,761 tokens.

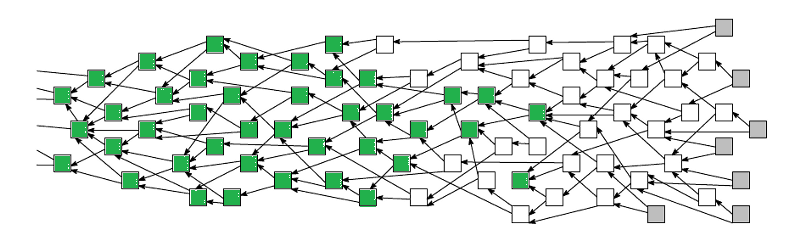

How Does Tangle Work?

Instead of a blockchain, IOTA is powered by a DAG called the Tangle. The team behind IOTA decided to use a DAG rather than a blockchain because they believed it would help resolve many of the scalability and cost problems associated with a blockchain.

The Tangle allows each transaction to be processed individually, rather than simultaneously, and even allows for them to be processed asynchronously.

Sites and Nodes

A Tangle is composed of sites and nodes. Nodes are the users of the Tangle who are able to issue transactions while sites contain one or more transactions that link together.

In order for a few transactions to be processed, it has to process two previous transactions. This theoretically allows the network to grow infinitely and even allows for faster processing when more devices are connected to the Tangle.

All nodes are subject to a propagation incentive whereby they are dropped by their neighbors if they do not process enough transactions.

Asynchronous Transactions

It is possible for Tangle to process asynchronous transactions. The network works under the assumption that any incorrect transaction would be automatically orphaned, or erased, as the tangle grows.

A new unapproved transaction is called a Tip. Each new Tip should reference two previous transactions. Ideally, the network uses the Random Walk Monte Carlo240 algorithm to ensure that only good tips are chosen.

This randomly checks a large number of nodes against the last known “legitimate” node, and if a sufficient percentage of checked nodes are good (generally 95-99%) the transaction is considered validated.

This consensus method is effective because every new tip must approve two older tips before it can be considered valid itself. This means that as more devices are added to the network it theoretically becomes easier to find consensus.

Image via IOTA.org)

Coordinator Nodes

The problem with this method, however, is that it requires a very large network to function correctly. So initially, all Tip validation is controlled by coordinator nodes.

Every minute the coordinator node makes a normal transaction with its signature on it, known as a milestone. In order for a transaction to be considered verified, the newest milestone must directly or indirectly verify your Tip.

A milestone signature cannot be faked, so this helps prevent a malicious actor from hijacking the Tangle and creating fake signatures.

“Random Walk Monte Carlo” Algorithm

While an effective solution, the coordinator node has received a great deal of criticism for being too centralized. The argument is that if the coordinator node is somehow compromised then it could create two separate Tangles and double-spend funds on the network.

IOTA has argued that while the attack is theoretically possible, it would be economically illogical, so should not be a concern. They have also stated that the Coordinator node is a purely temporary solution to the small network size.

Once the network is large enough to be self-sustaining, the Coordinator will be turned off and the Random Walk Monte Carlo algorithm will be used in its place.

What’s the Price of IOTA?

Tip: Click the ‘Advanced’ button below the chart to access technical indicators and oscillators. Click ‘Reset’ to start over.

What Drives the Price of IOTA?

Despite being a unique currency, the price of IOTA is governed by the same factors as more traditional blockchain-based cryptocurrencies. Even by cryptocurrency standards, the price of IOTA has always fluctuated wildly.

Corporate Partnerships

One of the most important price drivers for a service-focused cryptocurrency, like IOTA, is corporate partnerships.

When the media believed that IOTA had managed to form a partnership with industry giants on the launch of their data marketplace, the value of IOTA surged by 90%. This then dropped by 15% after IOTA and Microsoft issued a clarification that they were not engaged in a direct partnership.

If any future collaborations are announced then you should expect to see major price rises.

Media Attention

Media attention and hype about new features also play a key role in determining the price of a cryptocurrency.

If a token appears in the news regularly, you should expect to see a sudden surge in price. This is often followed by a short, sharp corrective period as traders engage in profit-taking.

What Is the Price Outlook for IOTA?

As with most cryptocurrencies, the short-term price outlook for IOTA can be described in one word – “volatile.” The cryptocurrency market is still young and, therefore, still unstable. That’s why you should expect fairly big peaks and troughs in the short term.

On a medium- to long-term basis, the future of IOTA is very much tied up in the future of the Internet of Things. If IoT devices continue to grow in popularity, IOTA will serve an incredibly useful purpose by facilitating simple machine-to-machine transactions.

However, if IoT doesn’t take off, IOTA could find itself at something of a loose end.

IOTA vs Bitcoin

Since Bitcoin (BTC) was the first and still is the most successful cryptocurrency, it can be helpful to compare it to altcoins like IOTA.

| IOTA (MIOTA) | Bitcoin (BTC) | |

|---|---|---|

| Purpose | An attempt to move cryptocurrency beyond the blockchain | Decentralized digital currency |

| Founded | 2015 | 2009 |

| Founder(s) | David Sønstebø, Sergey Ivancheglo, Dominik Schiener and Dr. Serguei Popov | Satoshi Nakamoto (alias) |

| Market Cap | Over $5 billion | Over $250 billion |

| How long did it take to hit $100? | N/A | 51 months |

| Notable Supporters | Jeff Currie (Goldman Sachs) Peter Theil (Venture capitalist) Christine Lagarde (IMF) Marc Andreessen (Early internet Pioneer) |

|

| Supply Cap | 2,779,530,283 | 21,000,000 |

| Initial Distribution | Directed Acyclic Graph | Mining |

| Mining Method | Tangle | ASIC |

| Consensus Method | Proof of work | Proof of work |

| Network Hash Rate* | Over 40 BTC per hour | |

| Difficulty Increase | Every 2,016 Blocks |

What Do Experts Say?

IOTA is a new, fairly experimental piece of technology so it shouldn’t be surprising that experts have been vocal about it.

MIT Media Lab

Even MIT is divided over whether they believe that IOTA will be successful. The MIT technology review released an article stating that they believed IOTA could outperform Bitcoin.

MIT media lab quickly shot back, arguing that many of the points in the technology review article were either incorrect or misleading.

This wasn’t the first time the MIT media lab had criticized IOTA. A team from MIT and Boston University had previously found vulnerabilities in IOTA’s code that allowed it to be easily attacked.

Although IOTA quickly patched the vulnerability, the MIT team argued that IOTA had made a mistake by breaking the first rule of cryptography, don’t roll your own crypto.

Bruce Schneier, Technology and Security Expert

Image by Rama via CC BY-SA 2.0 FR

It is notoriously difficult to design your own cryptography and most systems undergo years of rigorous tests before they are allowed to go live. When told about the vulnerability, Bruce Schneier, a renowned technology and security expert, said:

In 2017, leaving your crypto algorithm vulnerable to differential cryptanalysis is a rookie mistake. It says that no one of any caliber analyzed their system and that the odds that their fix makes the system secure is low.

Bruce Schneier

Sergey Ivancheglo, Former Founding Partner of IOTA

Sergey Ivancheglo said that the flaw was a deliberate attempt to copyright the code:

Remembering how quickly Nxt protection was disarmed I was keeping in secret the fact of the existence of such mechanism in IOTA. I was pretty sure that the protection would last a long time because it was hidden inside the cryptographical part and programming skills would be insufficient to disarm the mechanism. But nothing lasts forever and finally, the copy-protection measure was found by Neha Narula’s team.

Sergey Ivancheglo

Nick Johnson, Ethereum Developer

Many, such as Ethereum developer, Nick Johnson, have argued that this excuse is not only inadequate but even hostile towards the very concept of open source technology:

It honestly astounds me that anyone would think this justification redeems them; it’s an admission of hostile intent towards the open-source community, akin to publishing a recipe but leaving out a critical step, rendering the resulting dish poisonous to anyone who eats it.

Nick Johnson

Other Sectors

Despite the open hostility of many experts and developers from other cryptocurrencies, IOTA has found support from other sectors. A large number of companies have been working with IOTA to attempt to develop their data marketplace.

Bret Greenstein, IBM’s VP of IoT consumer business demonstrates that IOTAs strongest supporters will probably continue to come from the corporate sector.

Five Interesting IOTA Facts

- IOTA began development in 2015 and many of the IOTA tokens were sold during a crowdsale from November to December 2015, during which 100% of the token supply was issued.

- After the crowdsale, a significant portion of the IOTA community decided to donate 5% of all IOTA tokens toward the non-profit IOTA Foundation. This organization is designed to incentivize the future development of IOTA.

- Transactions using IOTA aren’t processed on a blockchain like other cryptocurrencies. Instead, IOTA uses a directed acyclic graph called Tangle in order to facilitate large numbers of transactions without running into Bitcoin scalability problems.

- IOTA is specifically designed to operate on the Internet of Things devices, such as smartwatches and weather trackers. The aim of IOTA is to allow owners to monetize the useful data stored within these devices.

- The Proof of Work (PoW) consensus method used by IOTA is designed to be low powered enough that ordinary Internet of Things devices are able to process transactions on Tangle.

Where Can I Buy and Trade IOTA?

See our full guide to trading IOTA, or start your research with reviews of these regulated crypto brokers available in .

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74%-89% of retail investor accounts lose money when trading CFDs. You should consider whether you can afford to take the high risk of losing your money.

Please Note: Availability subject to regulations. Cryptocurrency CFDs are not available to UK retail traders.

Alternatively, you can find IOTA available to exchange on some of these popular platforms:

Further Reading

We also have several other altcoin guides like: