Risk Warning: Your Capital is at Risk.

Contents

- Overview

- Pros & Cons Of Core Spreads

- Core Spreads Essential Information

- Where Does Core Spreads Operate?

- Core Spreads Trading Products

- Core Spreads Account Types

- Core Spreads’ Spreads and Fees

- Account Requirements

- Core Spreads CoreTrader Platform Review

- Core Spreads Demo Account

- Can I Trust Core Spreads?

- FAQs

Overview

Core Spreads is a derivative brokerage firm based in the United Kingdom. The broker emphasizes low-cost trading and strong customer service but has few other frills.

Core Spreads offers customers a platform for spread betting, forex trading, and Contracts-for-Difference (CFDs). CFDs allow traders to speculate on the price of assets without actually owning them in their accounts.

IMPORTANT: CFDs are not available in the USA due to local regulation, and regulated brokers do not accept US citizens or US residents as clients.

Core Spreads’ spread betting traders have access to the CoreTrader proprietary platform, while CFD traders have use of the industry-standard MetaTrader4 (MT4) platform.

Both provide traders mobile and desktop access to indices, forex, and commodities trading, while the CoreTrader platform provides traders with access to more than 950 UK equities, 500 US equities, and 100 European equities.

Core Spreads is regulated in the United Kingdom and serves clients across the globe.

This review of Core Spreads covers the important facts about the broker and discuss its strengths and weaknesses.

Pros & Cons Of Core Spreads

| What's Good About Core Spreads? | What Could Core Spreads Do Better? |

|---|---|

Core Spreads Essential Information

www.CoreSpreads.com |

|

|---|---|

| ✒️ Overview | Low-cost trading with a high-performance provider |

| ⭐ Our Overall Rating | |

| 🏆 Broker Trust Rating | 85/100 |

| 🏁 Founded | 2009 |

| 🛍️ Product | CFDs Forex Spread Betting |

| 📉 Markets | Indices Shares Bonds Commodities Forex |

| 🗺️ Countries Served | More than 150 |

| 💳 Minimum Deposit | None |

| 💰 Fees | Fees depend on the product being traded. There are no deposit or withdrawal fees. See here for full list of fees |

| 🛡️ Regulator(s) | Financial Conduct Authority (FCA) |

| 📞 Customer Support | 24/5 email, live chat and phone in English |

| 🎮 Demo Account | Yes - unlimited use |

Where Does Core Spreads Operate?

Core Spreads is regulated by the UK-based Financial Conduct Authority (FCA). The broker explicitly states that the information presented on their website is aimed at traders residing in the UK.

Here is a summary of what Core Spread’s license with the FCA entails:

| Regulator | Countries Covered | Protection Offered | Additional Protection Offered |

|---|---|---|---|

| Financial Conduct Authority (FCA) | Austria, Belgium, Bulgaria, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Germany, Gibraltar, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, The Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, UK | All client funds are held in segregated client accounts at Barclays Bank in London. | Financial Services Compensation Scheme (FSCS) may cover up to £50,000 if Finsa Europe Ltd. fails. |

IMPORTANT: CFDs are not available in the USA due to local regulation, and regulated brokers do not accept US citizens or US residents as clients.

The broker caters to international users, though it is the traders responsibility to determine whether they can legally trade with Core Spreads in .

The website and platform can only be viewed and used in English.

Core Spreads Trading Products

Core Spreads offers both CFDs and spread betting. Depending on the platform they are using – CoreTrader or MT4 – traders have access to markets in forex, indices (cash, futures, and differentials), shares, commodities, and bonds.

The CoreTrader platform, which is a spread betting platform, offers the most expansive list of product offerings:

Forex Currency Pairs

See all Core Spreads’ FX Rolling Cash products

- USD-JPY

- GBP-USD

- AUD-USD

- USD-ZAR

- USD-CHF

- EUR-ZAR

- EUR-JPY

- GBP-ZAR

- NZD-USD

- EUR-CAD

- EUR-CHF

- EUR-AUD

- CHF-JPY

- USD-CAD

- AUD-JPY

- GBP-CHF

- NZD-CHF

- AUD-CAD

- GBP-JPY

- CAD-JPY

- NZD-JPY

- AUD-CHF

- NZD-CAD

- GBP-AUD

- AUD-NZD

- GBP-CAD

- CAD-CHF

- EUR-NZD

- GBP-NZD

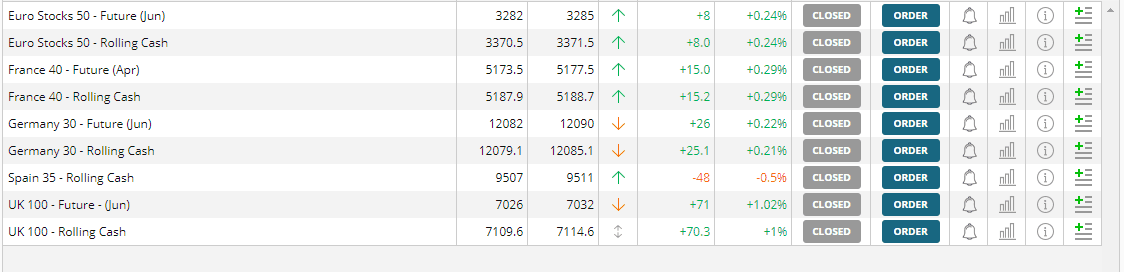

Indices – Rolling Cash

- FRANCE 40 CASH

- UK100 CASH

- WALL STREET 30 CASH

- GERMANY 30 CASH

- AUSTRALIA 200 CASH

- EURO STOCKS 50 CASH

- US TECH 100 CASH

- US 2000 CASH

- US 500 CASH

- SPAIN 35 CASH

- HONG KONG 50 CASH

- JAPAN 225 CASH

Equities – Cash Market

- UK Equities

- EU Equities

- US Equities

Energy – Futures Markets

- Brent Crude

- US Light Crude

- Brent / US Crude Differential

Metals – Rolling Cash

Bonds – Futures Market

- BOBL

- Bund

- UK Long Gilt

Core Spreads Account Types

Core Spreads offers two types of accounts, but the trading parameters are similar for both. Spread betting customers use the proprietary CoreTrader platform, while CFD traders use the MetaTrader 4 (MT4) platform.

Spread bettors have access to equities markets, while CFD traders do not. In addition, spread bettors simply pay a fixed spread on transactions, while CFD traders pay a variable spread and commissions.

Both the CoreTrader and MT4 platforms offer a demo account. Traders receive £10,000 in virtual trading funds with demo accounts.

| CoreTrader | MT4 | |

|---|---|---|

| Product | Spread Betting | CFDs |

| Spread Profile | Fixed | Variable |

| Commission | None | $1.50 per lot (or account currency equivalent) |

| Loyalty Rebates | On Spread | On Commission |

| Minimum Order | 0.50 £/$/€ | 0.01 lot |

| Indices | 16 | 13 |

| FX Pairs | 34 | 40 |

| Commodities | 5 | 13 |

| UK Equities | 950 + | - |

| US Equities | 500 + | - |

| European Equities | 100 + | - |

| Welcome Offer | ||

| Online Platform | ||

| Desktop Platform | ||

| Mobile Platform | ||

| One Click Demo | ||

| Sign-up Demo | ||

| 24/5 Support | ||

| Autotrade (EAs) | ||

| Customizable Charts | ||

| One Click Trading |

Core Spreads’ Spreads and Fees

Core Spreads receives its compensation either in the form of the market spread or commissions.

The spreads for trading vary by the particular financial instruments being traded and the platform for trading. Spread betting customers on the CoreTrader platform trade against Core Spreads and receive fixed spreads based on the particular market they are trading (see below).

On CoreTrader, Core Spreads receives its compensation in the form of the bid/ask spread. MT4 traders, on the other hand, trade in the interbank market, and the spreads they pay are based on prevailing market rates.

In the case of MT4 trades, Core Spreads receives its compensation in the form of commissions. MT4 traders pay $1.50 per lot (or account currency equivalent) for trades on this platform.

The following are the spreads on some of the more popular instruments on the CoreTrader platform:

Forex Spreads

See all Core Spreads’ Forex spreads

| Currency Pair | Spread |

|---|---|

| USD-JPY | 0.7 Points |

| GBP-USD | 0.8 Points |

| AUD-USD | 0.6 Points |

| USD-ZAR | 10 Points |

| USD-CHF | 1.4 Points |

| EUR-ZAR | 15 Points |

| EUR-JPY | 1 Point |

| GBP-ZAR | 20 Points |

| NZD-USD | 2 Points |

| EUR-CAD | 2 Points |

| EUR-CHF | 1.6 Points |

| EUR-AUD | 2 Points |

| CHF-JPY | 2 Points |

| USD-CAD | 1 Point |

| AUD-JPY | 2 Points |

| GBP-CHF | 3 Points |

| NZD-CHF | 3 Points |

| AUD-CAD | 3 Points |

| GBP-JPY | 2.6 Points |

| CAD-JPY | 3 Points |

| NZD-JPY | 3 Points |

| AUD-CHF | 3 Points |

| NZD-CAD | 3 Points |

| GBP-AUD | 3 Points |

| AUD-NZD | 4 Points |

| GBP-CAD | 3.4 Points |

| CAD-CHF | 4 Points |

| EUR-NZD | 4 Points |

| GBP-NZD | 4 Points |

Index Spreads

See all Core Spreads’ Indices spreads

| Index | Spread |

|---|---|

| FRANCE 40 CASH | 0.8 Points |

| UK100 CASH | 0.4 Points |

| WALL STREET 30 CASH | 1 Point |

| GERMANY 30 CASH | 1 Point |

| AUSTRALIA 200 CASH | 2 Points |

| EURO STOCKS 50 CASH | 1 Point |

| US TECH 100 CASH | 1 Point |

| US 2000 CASH | 0.14 Points |

| US 500 CASH | 0.14 Points |

| SPAIN 35 CASH | 4 Points |

| HONG KONG 50 CASH | 8 Points |

| JAPAN 225 CASH | 4 Point |

Equities – Cash Market

See all Core Spreads’ Equities spreads

| Market | Spread |

|---|---|

| UK Equities | |

| EU Equities | 0.2% (0.1% or 10 bps per side) |

| US Equities | 2 cents per side |

Commodity Spreads (Futures Included)

Bond – Futures Market

See all Core Spreads’ Bond spreads

| Market | Spread |

|---|---|

| BOBL | 0.50% |

| Bund | 0.50% |

| UK Long Gilt | 0.50% |

Account Requirements

When you click the red “Open Live Account” button on the Core Spreads’ website, the broker takes you to the sign-up page.

To begin the sign-up process, you simply enter your name, email, phone number and a username and password.

The system then takes you to the next page where you enter your address, your UK National Insurance number as well as basic information about your employment experience and financial status.

You also choose the platform you will be using – CoreTrader or MT4.

How To Verify Your Core Spreads Account

Core Spreads then takes you to two additional pages where they ask questions to assess your trading experience and knowledge. The broker then reviews your application, which usually takes less than five minutes.

To pass the Core Spreads’ identity verification, you will need to upload both an ID and proof of address. Before you are able to deposit funds you must complete the broker’s ID verification process:

| Document | Commentary |

|---|---|

| Identification Acceptable forms of ID include a colored copy of one of the following: Customers must send copies of the front and back of ID card. All documents must have at least three months left to expiry. | ID card must present the following details: |

| Proof of Address Acceptable forms of ID include the following: | All documents must be dated within the last three months. |

Traders can make deposits and withdrawals by major credit cards such as Visa, MasterCard, and American Express or by wire transfer.

Core Spreads does not charge deposit or withdrawal fees and has no minimum deposit amount. Core Spreads offers maximum leverage to traders of 1:200.

Margin Requirements

Each CFD also has specific Core Spreads margin requirements that traders must maintain. Traders should consult the Market Information section of the Core Spreads website for the specific margin requirements for each instrument.

Traders who fall below the Core Spreads margin requirements risk receiving a margin call and having their position closed prematurely.

Core Spreads CoreTrader Platform Review

The CoreTrader proprietary spread betting platform allows traders to access different markets and asset classes and execute trades quickly. The main screen layout has many tools you find on other CFD platforms:

On the left-hand side is a menu of different trading instruments organized by asset class.

When you click on a particular asset class, the instruments in that group populate the middle window.

From here you can see the daily change and percentage change for each instrument. You can set alerts from this panel and pull up charts for each instrument. You can also pull up trading information for each instrument and add it to a watch list.

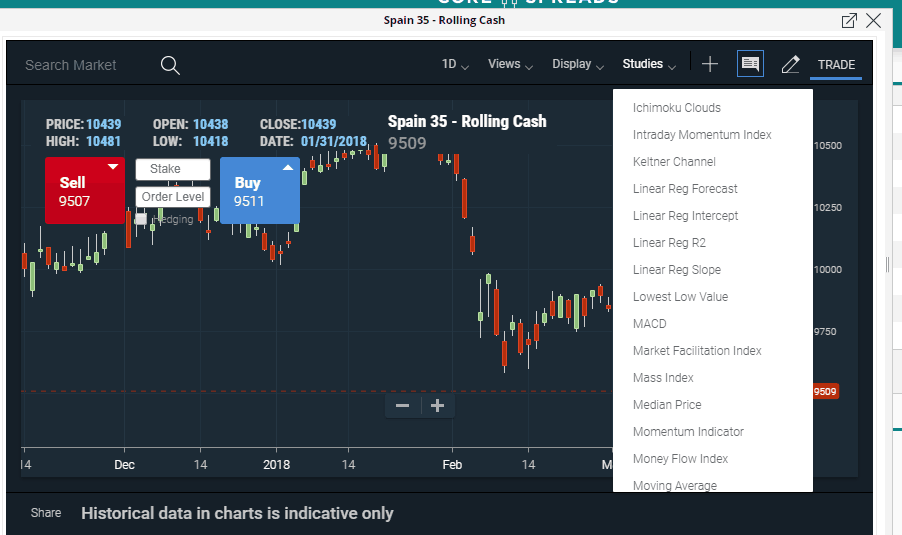

Core Spreads Technical Indicators

The charting icon in the main panel pulls up a chart with a range of technical indicators and studies:

Core Spreads allows you to execute an order via the chart window. This will appeal to technically-oriented traders.

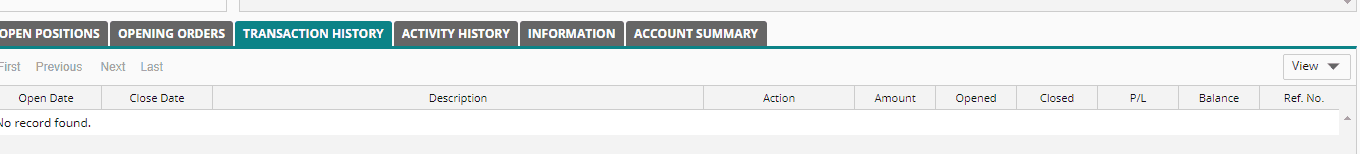

Trade Management With Core Spreads

The bottom of the main screen has the standard position window where you can access transactions including open positions, open orders, activity history and an account summary.

One significant weakness of this platform is the dearth of news and fundamental analysis. Combined with the lack of tools, such as economic calendars, expansive news feeds, and detailed news analyses, this comes across as a major flaw of this platform.

Core Spreads Demo Account

Traders can open demo accounts with Core Spreads for both the CoreTrader and MT4 platforms. Demo accounts are loaded with £10,000 in virtual trading funds.

The demo accounts look like live accounts, and traders get the same functionality.

Core Spreads doesn’t offer any educational materials on its website. For traders new to CFD trading and spread betting, this may be a disadvantage. However, there are plenty of free online resources on markets and trading topics.

Can I Trust Core Spreads?

Finsa Europe Ltd., the company that operates Core Spreads, is regulated by the Financial Conduct Authority (FCA), and the Markets in Financial Directive (MiFID) allows the company to operate as a regulated entity throughout the European Union.

The company has made some recent moves to strengthen its regulation, capital base and management team.

Core Spreads Company Info

Core Spreads is a trading name of Finsa Europe Limited, a company registered in England and Wales under number 07073413.

Finsa Europe began operating under the name The Trader Management Company Ltd. on November 11, 2009, and changed its name to Finsa Europe Limited on June 26, 2014.

Core Spreads has headquarters at the Tower Bridge Business Centre in London, United Kingdom. Finsa Europe is authorized and regulated by the Financial Conduct Authority (FCA) with license number 525164.

Core Spreads offers customers dedicated 24/5 customer support in English. Traders can contact customer service through its toll-free number in the United Kingdom, its local phone number for international users, email, or live chat.

Brief History Of Core Spreads

Between 2009 and 2014, The Trader Management Company Ltd. (the predecessor firm to Finsa Europe Ltd.) was simply a dormant operating company.

In 2014, Jasper White, the longtime CEO of sports betting consultancy Gambit Research, bought control of the company. White hired a management team with extensive management experience at other leading trading and betting firms including IG Group, Cantor, and William Hill.

White bootstrapped the company to £8 million in revenue with only a £192,000 investment. He then injected an additional £2.8 million in the company and upgraded its FCA license from a “125K” matched principal broker license to a “730K” principal license.

The new license, which requires the broker to hold a higher amount of capital, allows it to trade with its clients as a principal.

What Does The Financial Conduct Authority (FCA) Regulation Mean?

The UK’s Financial Conduct Agency (FCA) regulates the activities of Core Spreads in the United Kingdom.

The FCA is widely respected as a leader in financial regulation. In addition, the United Kingdom scores highly in Transparency International‘s rankings of countries based on their corruption perceptions index meaning the country is a pillar of anti-corruption.

Core Spreads customers in the United Kingdom are protected by the UK based Financial Services Compensation Scheme (FSCS), which was established to protect consumers when authorized financial services firms fail.

FSCS pays compensation up to £50,000 to customers in the United Kingdom if Core Spreads is unable to pay.

FAQs

Does Core Spreads offer any sign up promotions?

Core Spreads offers two types of sign-up promotions. New traders are offered half-price trading for the first month after signing up and need to contact customer support to claim this perk. Traders also get a total of 50% of the spread returned into their account after the first month, capped at £2,500. Core Spreads also has a loyalty points system where traders collect 1 ‘Core Point’ on every £1 spread traded.

ESMA regulations prohibit CFD brokers from offering bonuses to retail investors in Europe to encourage CFD trading (or a greater volume of trading), including signup bonuses or fee rebates.